Coronavirus or not, departures from the Golden State of California continue unabated. Before this novel virus “plague” brought isolation around the world, one of our top Light-Sport Aircraft service companies picked up sticks and moved more than halfway across this big country to Kingsville, Missouri (about one hour southeast of Kansas City).

Years ago at the very beginning of Light-Sport Aircraft and Sport Pilot, Rainbow Aviation entrepreneurs Brian and Carol Carpenter started what would become the nation’s largest and most productive repairman training courseware provider.

I recall this husband and wife team coming to EAA headquarters in Oshkosh, Wisconsin. At the time I was consulting to the organization as they prepared for the arrival of the new regulation. Brian and Carol showed up at EAA to brief them on their plans. That was 16 years ago and today Rainbow is the leading supplier of repairman classes.

As the new rule was announced back in 2004, one aspect was the Light Sport Repairmen section, including LSR-Inspection and LSR-Maintenance privileges.

Coronavirus or not, departures from the Golden State of California continue unabated. Before this novel virus “plague” brought isolation around the world, one of our top Light-Sport Aircraft service companies picked up sticks and moved more than halfway across this big country to Kingsville, Missouri (about one hour southeast of Kansas City).

Years ago at the very beginning of Light-Sport Aircraft and Sport Pilot, Rainbow Aviation entrepreneurs Brian and Carol Carpenter started what would become the nation’s largest and most productive repairman training courseware provider.

I recall this husband and wife team coming to EAA headquarters in Oshkosh, Wisconsin. At the time I was consulting to the organization as they prepared for the arrival of the new regulation. Brian and Carol showed up at EAA to brief them on their plans. That was 16 years ago and today Rainbow is the leading supplier of repairman classes.

As the new rule was announced back in 2004, one aspect was the Light Sport Repairmen section, including LSR-Inspection and LSR-Maintenance privileges.Mechanically-Minded — Rainbow Starts Light-Sport Repairman Training in Missouri

Coronavirus or not, departures from the Golden State of California continue unabated. Before this novel virus “plague” brought isolation around the world, one of our top Light-Sport Aircraft service companies picked up sticks and moved more than halfway across this big country to Kingsville, Missouri (about one hour southeast of Kansas City).

I recall this husband and wife team coming to EAA headquarters in Oshkosh, Wisconsin. At the time I was consulting to the organization as they prepared for the arrival of the new regulation. Brian and Carol showed up at EAA to brief them on their plans. That was 16 years ago and today Rainbow is the leading supplier of repairman classes.

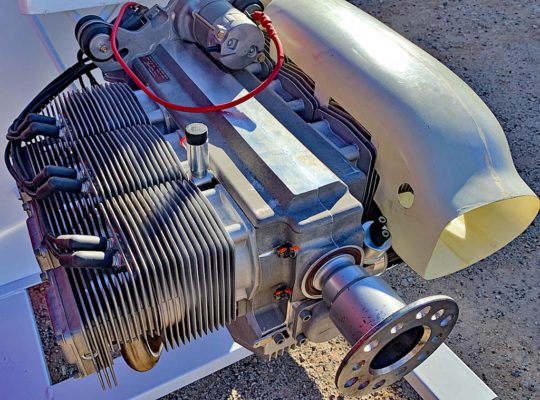

As the new rule was announced back in 2004, one aspect was the Light Sport Repairmen section, including LSR-Inspection and LSR-Maintenance privileges. The former, covered in a two-day weekend class, helps an owner perform an annual condition inspection on an LSA they own. To perform more involved work or to work on other people’s LSA for hire, a more intensive class was needed.

Centrally-Based Rainbow Aviation

After training more than 5,000 students from nearly every U.S. state and from more than 20 different countries, Rainbow Aviation’s Light Sport Maintenance training programs have become internationally known as the premier light sport aviation maintenance training programs.

Fifteen students took Rainbow Aviation’s first class at their new home in Kingsville, Missouri.

Their two principal offerings include the two-day Light Sport Repairman Inspection (LSR-I) course and the Light Sport Repairman Maintenance Certificate (LSR-M) course. If you aren’t sure which is right for you, read Carol Carpenter’s explanation.

The LSR-I classes are taught across the entire country as well as internationally and allow students to obtain an FAA-approved Light Sport Repairman Certificate to complete an annual condition inspection on a Experimental Light-Sport Aircraft that they own. Once you have this certificate, it does not need to be renewed. The typically weekend class provides a lot of great information to an aircraft owner. Learn what this short course involves (scroll down slightly).

Unlike the simpler, shorter LSR-I course, a person completing the longer, more involved LSR-M course may perform maintenance and inspections on anyone’s Special LSA or Experimental LSA and may charge for their services.

All images provided by Rainbow Aviation Services.

No prerequisites are needed for the LSR-M course. A Repairman with a Maintenance rating does not need to be a pilot and the Repairman may also keep a portfolio of his work and apply for authorization to take the A&P written and practical exams for general aviation after working in the field for 30+ months under his or her own supervision. That represents a significant privilege and opportunity for LSR-M certificate holders.

In addition, the LSR-M certificate may also serve as a stepping-stone to the DAR (Designated Airworthiness Representative). This FAA designation covers those who go inspect new SLSA to provide them the certificate every Special LSA needs before it enters the aircraft fleet. Therefore, demand is good and this can provide earnings for the certificate holder while serving the consumer by making this essential service easier to obtain.

What can you do if you take the 120-hour (15-day) LSRM Maintenance Program?

- Operate commercially, earn money for providing maintenance and repair services.

- Work on Special Light-Sport Aircraft

- Work on Experimental Light-Sport Aircraft

- Perform annual inspections

- Perform 100-hour inspections

- Perform routine maintenance on SLSA and ELSA

- Perform major repairs on SLSA and ELSA

- Do avionics installations

- Gain a pathway to an FAA-issued A&P Certificate

Where are the Rainbow mechanics located? Rainbow graduates are all over the USA. See the nearby map.

Classes before June this year are full, so the next opportunities are June 15 to June 30, 2020 and August 31 to September 15, 2020

What can you gain from the 16-hour (2-day) LSR-I Inspection Course intended for LSA owners?

- Work on Experimental Light-Sport Aircraft

- Annual your own aircraft

- Improve your safety

- Reduce your maintenance problems

- Gain a greater awareness of your aircraft

Classes for the LSR-I course are offered across the country featuring top-notch instructors. Contact Rainbow Aviation for more details or to sign up for classes,

Coronavirus or not, departures from the Golden State of California continue unabated. Before this novel virus “plague” brought isolation around the world, one of our top Light-Sport Aircraft service companies picked up sticks and moved more than halfway across this big country to Kingsville, Missouri (about one hour southeast of Kansas City).

Years ago at the very beginning of Light-Sport Aircraft and Sport Pilot, Rainbow Aviation entrepreneurs Brian and Carol Carpenter started what would become the nation’s largest and most productive repairman training courseware provider.

I recall this husband and wife team coming to EAA headquarters in Oshkosh, Wisconsin. At the time I was consulting to the organization as they prepared for the arrival of the new regulation. Brian and Carol showed up at EAA to brief them on their plans. That was 16 years ago and today Rainbow is the leading supplier of repairman classes.

As the new rule was announced back in 2004, one aspect was the Light Sport Repairmen section, including LSR-Inspection and LSR-Maintenance privileges.

Coronavirus or not, departures from the Golden State of California continue unabated. Before this novel virus “plague” brought isolation around the world, one of our top Light-Sport Aircraft service companies picked up sticks and moved more than halfway across this big country to Kingsville, Missouri (about one hour southeast of Kansas City).

Years ago at the very beginning of Light-Sport Aircraft and Sport Pilot, Rainbow Aviation entrepreneurs Brian and Carol Carpenter started what would become the nation’s largest and most productive repairman training courseware provider.

I recall this husband and wife team coming to EAA headquarters in Oshkosh, Wisconsin. At the time I was consulting to the organization as they prepared for the arrival of the new regulation. Brian and Carol showed up at EAA to brief them on their plans. That was 16 years ago and today Rainbow is the leading supplier of repairman classes.

As the new rule was announced back in 2004, one aspect was the Light Sport Repairmen section, including LSR-Inspection and LSR-Maintenance privileges.

“This, too, shall pass…” said my neighbor, Bill Chernish, who flies for Southwest Airlines. His industry is unusually battered by the coronavirus pandemic. His calm and forward-looking view is refreshing amidst the fear seen, well… everywhere.

“This, too, shall pass…” said my neighbor, Bill Chernish, who flies for Southwest Airlines. His industry is unusually battered by the coronavirus pandemic. His calm and forward-looking view is refreshing amidst the fear seen, well… everywhere.

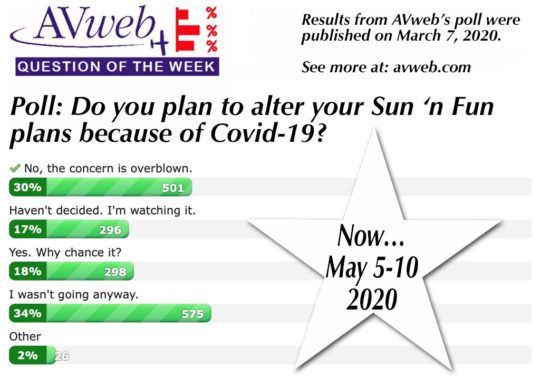

Delay, postpone, or cancel — that seems to be the question organizers of events faced in the current pandemic scare.

Delay, postpone, or cancel — that seems to be the question organizers of events faced in the current pandemic scare. “Nevertheless,” he continued, “it is still imperative for Messe Friedrichshafen (the exhibit operator’s business name) to look to the future.

“Nevertheless,” he continued, “it is still imperative for Messe Friedrichshafen (the exhibit operator’s business name) to look to the future. Like tens of thousands of others, I so enjoy this event and was looking forward to the show that was to begin in just a couple weeks. I was able to back out of most booked travel and will start planning for the 2021 event.

Like tens of thousands of others, I so enjoy this event and was looking forward to the show that was to begin in just a couple weeks. I was able to back out of most booked travel and will start planning for the 2021 event.

Relax, folks. We’re not going anywhere fast. Across all industries, shows and events have been “falling like dominos,” as publisher Ben Sclair put it when I called to discuss

Relax, folks. We’re not going anywhere fast. Across all industries, shows and events have been “falling like dominos,” as publisher Ben Sclair put it when I called to discuss  Later yesterday both the giant Florida theme parks Disney and Universal announced they will close Sunday through the end of the month. These Orlando-area businesses along with other theme parks draw 75 million visitors annually with a $75 billion economic impact, said officials, so even a few weeks of closure is a serious decision.

Later yesterday both the giant Florida theme parks Disney and Universal announced they will close Sunday through the end of the month. These Orlando-area businesses along with other theme parks draw 75 million visitors annually with a $75 billion economic impact, said officials, so even a few weeks of closure is a serious decision. The organization said, “With the full support of Polk County, the City of Lakeland, Lakeland Linder International Airport, and the FAA, at this time we are planning to postpone the 2020 Sun ‘n Fun Aerospace Expo until May 5-10. We appreciate the unwavering support of our airport and community and hope everyone will make plans to join us here this May.”

The organization said, “With the full support of Polk County, the City of Lakeland, Lakeland Linder International Airport, and the FAA, at this time we are planning to postpone the 2020 Sun ‘n Fun Aerospace Expo until May 5-10. We appreciate the unwavering support of our airport and community and hope everyone will make plans to join us here this May.”

“The best practices of scientific and health resources are being followed as we prepare for our 2020 event. At

“The best practices of scientific and health resources are being followed as we prepare for our 2020 event. At

How does one LSA brand rise and stay above others?

How does one LSA brand rise and stay above others? My tongue-in-cheek subtitle comes from the perspective of an average-sized pilot talking to the father and son team of Tom Sr. and Tom Jr. Gutmann. These gentle giants stand so tall above me that even Tom Cruise’s acting box would not let me look this pair eye-to-eye.

My tongue-in-cheek subtitle comes from the perspective of an average-sized pilot talking to the father and son team of Tom Sr. and Tom Jr. Gutmann. These gentle giants stand so tall above me that even Tom Cruise’s acting box would not let me look this pair eye-to-eye. Tom and I flew Super Sport at the

Tom and I flew Super Sport at the  What you don’t get with CT Super Sport is the back window and hat rack cabin space of CTLS. The slight enlargement of the longer, fancier LS does indeed make the cabin feel roomier and you have less space for things you need in the cockpit — though the floor compartments in front of both seats will suffice for most things you may want to access during flight. Both models keep the ample storage area aft of the cabin but you cannot access that while flying.

What you don’t get with CT Super Sport is the back window and hat rack cabin space of CTLS. The slight enlargement of the longer, fancier LS does indeed make the cabin feel roomier and you have less space for things you need in the cockpit — though the floor compartments in front of both seats will suffice for most things you may want to access during flight. Both models keep the ample storage area aft of the cabin but you cannot access that while flying. Coordinating closely with

Coordinating closely with

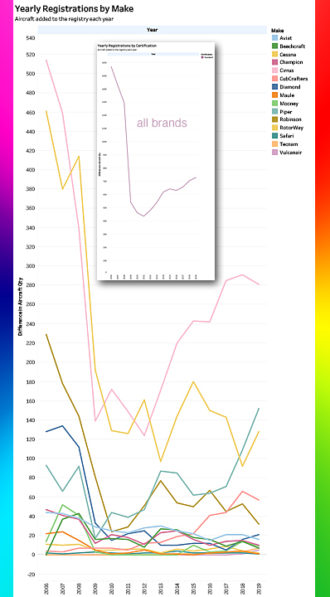

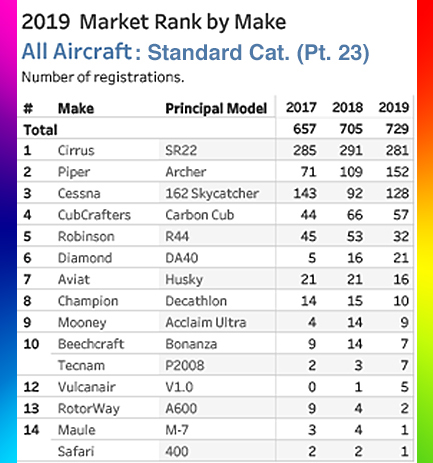

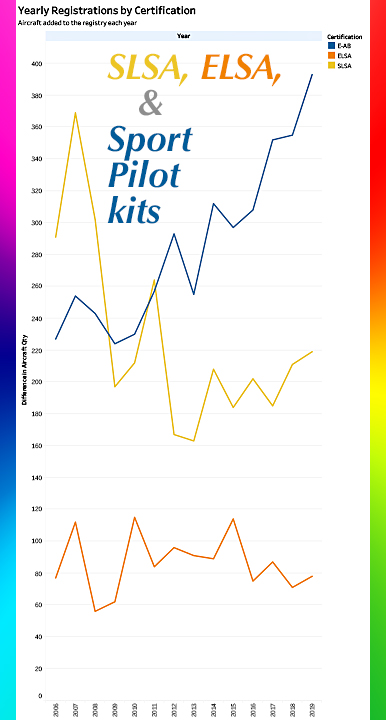

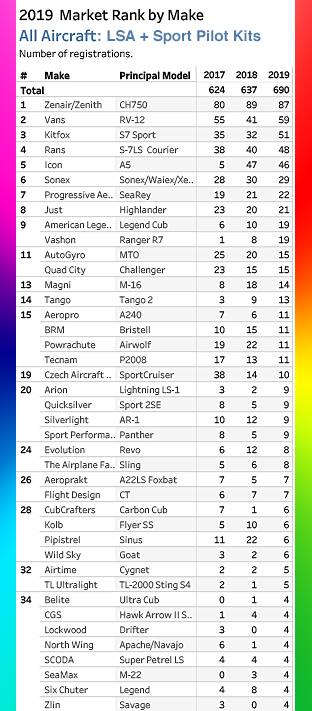

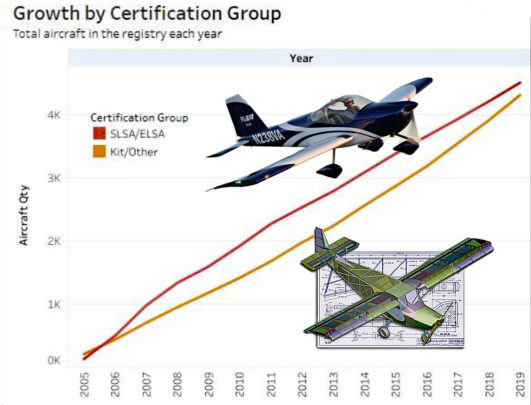

If you like airplane statistics and facts, this article may interest you. Some pilots don’t follow such things while others eat it up (you know who you are). For these readers, we have a new perspective that many may find intriguing.

If you like airplane statistics and facts, this article may interest you. Some pilots don’t follow such things while others eat it up (you know who you are). For these readers, we have a new perspective that many may find intriguing.

When you go global with these two aviation sectors, you find the USA has 80% of the GA fleet with the entire rest of the globe flying the other 20%.

When you go global with these two aviation sectors, you find the USA has 80% of the GA fleet with the entire rest of the globe flying the other 20%. Take Cirrus out of the count and GA registered 448 aircraft from 15 producers, only 65% as many as all LSA/SP kit producers registered.

Take Cirrus out of the count and GA registered 448 aircraft from 15 producers, only 65% as many as all LSA/SP kit producers registered.

FAA permits two place hang glider for instructional purposes, and believe me, every one going for a flight is going to learn plenty. Still, an instructor needs to know his or her student and preflight coaching is essential. To achieve a perfect safety record, Mike has clearly set some proper techniques to work for him.

FAA permits two place hang glider for instructional purposes, and believe me, every one going for a flight is going to learn plenty. Still, an instructor needs to know his or her student and preflight coaching is essential. To achieve a perfect safety record, Mike has clearly set some proper techniques to work for him. Each of Mike’s tandem flights isn’t walking out on the airport ramp and hopping in a plane for an hour. Coaching, driving up to the launch site, setting up the glider, launching into flight, and retrieving from landing consumes much more than an hour even if the flight itself may be short. Doing this thousands of times with excellent success speaks to using best practices.

Each of Mike’s tandem flights isn’t walking out on the airport ramp and hopping in a plane for an hour. Coaching, driving up to the launch site, setting up the glider, launching into flight, and retrieving from landing consumes much more than an hour even if the flight itself may be short. Doing this thousands of times with excellent success speaks to using best practices. Look at that cockpit view (a different angle shows in the video). What more could you need?

Look at that cockpit view (a different angle shows in the video). What more could you need?

Just one year ago, I flew Tucano for the first time. The small-scale fighter-like aircraft was dashing with its modified Rotax 912 producing 140 horsepower.

Just one year ago, I flew Tucano for the first time. The small-scale fighter-like aircraft was dashing with its modified Rotax 912 producing 140 horsepower. In a phrase: Tucano 915 climbs enthusiastically from take off to 10,000 feet without a decaying rate of climb.

In a phrase: Tucano 915 climbs enthusiastically from take off to 10,000 feet without a decaying rate of climb.

One of the reasons why Videoman Dave and I attend smaller events is because we can do a particular kind of work while visiting: Video Pilot Reports. We’ve now done many dozens of these (among some 700 total videos on Light-Sport Aircraft, Sport Pilot kit aircraft, and ultralights).

One of the reasons why Videoman Dave and I attend smaller events is because we can do a particular kind of work while visiting: Video Pilot Reports. We’ve now done many dozens of these (among some 700 total videos on Light-Sport Aircraft, Sport Pilot kit aircraft, and ultralights). Strapping six or seven cameras all over the airplane, discussing what we want to accomplish aloft, video recording takeoffs and landing, sometimes shooting video and stills from a second airplane, and then doing what we call a “stand up” near the airplane where we review the flight qualities discovered during an hour or so of flying. VPRs are a fun and a learning experience. Viewers appear to love them. Yet they drink up lots of time and trying to do these at a jam-packed major show is difficult or impossible. Hence, our love of events like

Strapping six or seven cameras all over the airplane, discussing what we want to accomplish aloft, video recording takeoffs and landing, sometimes shooting video and stills from a second airplane, and then doing what we call a “stand up” near the airplane where we review the flight qualities discovered during an hour or so of flying. VPRs are a fun and a learning experience. Viewers appear to love them. Yet they drink up lots of time and trying to do these at a jam-packed major show is difficult or impossible. Hence, our love of events like  After discovering the model a year ago, we did a interview with Garret Komm at last year’s Copperstate. We followed up with more at EAA AirVenture Oshklosh last year as well. The two interviews have been seen some 70,000 times (both videos) and have introduced his Mule experimental amateur built kit to the many who enjoyed watching.

After discovering the model a year ago, we did a interview with Garret Komm at last year’s Copperstate. We followed up with more at EAA AirVenture Oshklosh last year as well. The two interviews have been seen some 70,000 times (both videos) and have introduced his Mule experimental amateur built kit to the many who enjoyed watching.

To start this year’s event,

To start this year’s event,

It started with a seemingly simple product. Since long before recreational aircraft arrived, the invention that launched the Rotax brand was a “rotary axle,” a freewheeling hub that advanced the then-state-of-the-art in bicycles.

It started with a seemingly simple product. Since long before recreational aircraft arrived, the invention that launched the Rotax brand was a “rotary axle,” a freewheeling hub that advanced the then-state-of-the-art in bicycles.

“

“ To aviators, the company’s compact and light weight engines are seen on many kinds of aircraft, supplied by more than 250 OEMs (Original Equipment Manufacturers).

To aviators, the company’s compact and light weight engines are seen on many kinds of aircraft, supplied by more than 250 OEMs (Original Equipment Manufacturers). All Rotax aircraft engines “are approved for operation with Ethanol 10, automobile gasoline, and aviation-grade fuels.” In many countries where avgas is hard to find or unavailable, premium auto gas can be used — in fact, expert repair stations often report engines run on auto gas look even cleaner when brought in for inspection or maintenance.

All Rotax aircraft engines “are approved for operation with Ethanol 10, automobile gasoline, and aviation-grade fuels.” In many countries where avgas is hard to find or unavailable, premium auto gas can be used — in fact, expert repair stations often report engines run on auto gas look even cleaner when brought in for inspection or maintenance.

A handsome high-wing, side-by-side two seater, Scout’s lineage goes back to 1983, when Dean Wilson’s trendsetter-to-be Avid Flyer was first introduced.

A handsome high-wing, side-by-side two seater, Scout’s lineage goes back to 1983, when Dean Wilson’s trendsetter-to-be Avid Flyer was first introduced. Of course, the folding mechanism adds both weight and complexity (two things that light aircraft designers generally try to avoid), but the trade-off in this instance is worth it; the wing-fold mechanism does not add much weight or complexity.

Of course, the folding mechanism adds both weight and complexity (two things that light aircraft designers generally try to avoid), but the trade-off in this instance is worth it; the wing-fold mechanism does not add much weight or complexity. The tail consists of a very slightly swept-back fin and large rudder, a tailplane braced by a combination of struts and wires, and separate elevators. Primary controls are actuated by a mixture of pushrods, bellcranks, and cables. Longitudinal trim is provided by a large tab set into the trailing edge of the left elevator.

The tail consists of a very slightly swept-back fin and large rudder, a tailplane braced by a combination of struts and wires, and separate elevators. Primary controls are actuated by a mixture of pushrods, bellcranks, and cables. Longitudinal trim is provided by a large tab set into the trailing edge of the left elevator. With a maximum width of 44 inches Scout’s cockpit and the extensive glazing gives it a very airy feel. The baggage bay behind the seats has an impressive volume of 17 cubic feet, and its open floor area can take up to 77 pounds. Unusually for an aircraft in this class the seats adjust, secured in position with a positive locking pin.

With a maximum width of 44 inches Scout’s cockpit and the extensive glazing gives it a very airy feel. The baggage bay behind the seats has an impressive volume of 17 cubic feet, and its open floor area can take up to 77 pounds. Unusually for an aircraft in this class the seats adjust, secured in position with a positive locking pin. Flight and engine instruments are a mixture of analog and digital — an

Flight and engine instruments are a mixture of analog and digital — an  Ambient conditions are slightly above standard atmospheric, with an airfield elevation of 196 feet and an outside air temperature of 66°F. We had about ten knots on the nose, the grass is short and the acceleration excellent. I doubt we used even the first 300 feet of the 2,700 available. Scout’s climb rate was equally impressive, the best rate of climb of 55 knots produced around 900 fpm.

Ambient conditions are slightly above standard atmospheric, with an airfield elevation of 196 feet and an outside air temperature of 66°F. We had about ten knots on the nose, the grass is short and the acceleration excellent. I doubt we used even the first 300 feet of the 2,700 available. Scout’s climb rate was equally impressive, the best rate of climb of 55 knots produced around 900 fpm. Visibility in the turn — and indeed every phase of flight — was very good for a high-wing aircraft. An exploration of the stick-free stability around all three axes revealed it to be strongly positive longitudinally, weakly positive directionally and positive laterally. Slowing down to examine the stall confirms what I already suspected: this is a very well-mannered flying machine.

Visibility in the turn — and indeed every phase of flight — was very good for a high-wing aircraft. An exploration of the stick-free stability around all three axes revealed it to be strongly positive longitudinally, weakly positive directionally and positive laterally. Slowing down to examine the stall confirms what I already suspected: this is a very well-mannered flying machine. At the other side of the speed scale I got the distinct impression that it would probably exceed Vne in straight and level flight, though we didn’t try due to some turblence.

At the other side of the speed scale I got the distinct impression that it would probably exceed Vne in straight and level flight, though we didn’t try due to some turblence. I honestly feel that TLAC has got a winner here! Obviously care needs to be taken with the weight and balance of the lightest version, but with a typical useful load in excess of 517 pounds the larger Scout is a very practical machine, with good numbers for speed, range and endurance, and the ability to carry a good load into and out of rather short strips. The folding wings are a big plus, while the ability to reconfigure from a nosewheel to a tailwheel quickly and easily could also be very useful. I liked it, a lot.

I honestly feel that TLAC has got a winner here! Obviously care needs to be taken with the weight and balance of the lightest version, but with a typical useful load in excess of 517 pounds the larger Scout is a very practical machine, with good numbers for speed, range and endurance, and the ability to carry a good load into and out of rather short strips. The folding wings are a big plus, while the ability to reconfigure from a nosewheel to a tailwheel quickly and easily could also be very useful. I liked it, a lot.

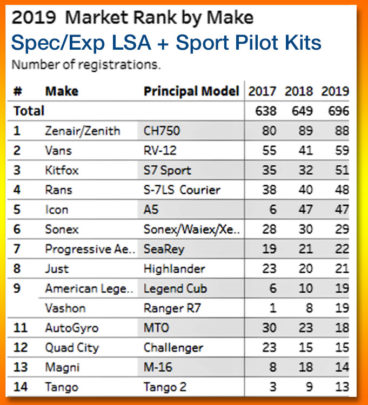

A huge thanks to our supreme “datastician,” Steve Beste for making such swift and accurate reporting possible. I assure you that I’ve looked high and low for every year LSA have existed to find no comparable information.

A huge thanks to our supreme “datastician,” Steve Beste for making such swift and accurate reporting possible. I assure you that I’ve looked high and low for every year LSA have existed to find no comparable information. Overview

Overview However, as he added, “All did not have the same experience. Kitfox registrations increased by 60% (as the Idaho company appeared to lose some momentum in 2018). Van’s Aircraft grew by 44% and Rans by 20% but Zenair/Zenith and Sonex were modestly off their previous pace (see chart below).”

However, as he added, “All did not have the same experience. Kitfox registrations increased by 60% (as the Idaho company appeared to lose some momentum in 2018). Van’s Aircraft grew by 44% and Rans by 20% but Zenair/Zenith and Sonex were modestly off their previous pace (see chart below).” Steve wrote, “Regarding Icon’s numbers, note that historical figures often differ from what was previously reported,” in this case with Icon and its A5. He continued, “This happens because FAA continues to perfect its data. For example, for 2018 the agency reported 57 Icon A5s as ‘2018’ aircraft but FAA data clerks switched 11 of those to ‘2019’ once their late-in-the-year paperwork was done. Thus, we now report fewer than 57 Icons for 2018.”

Steve wrote, “Regarding Icon’s numbers, note that historical figures often differ from what was previously reported,” in this case with Icon and its A5. He continued, “This happens because FAA continues to perfect its data. For example, for 2018 the agency reported 57 Icon A5s as ‘2018’ aircraft but FAA data clerks switched 11 of those to ‘2019’ once their late-in-the-year paperwork was done. Thus, we now report fewer than 57 Icons for 2018.” In general terms, Steve noted, “Alternate aircraft offer a mixed picture.”

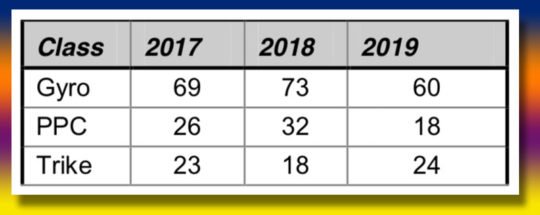

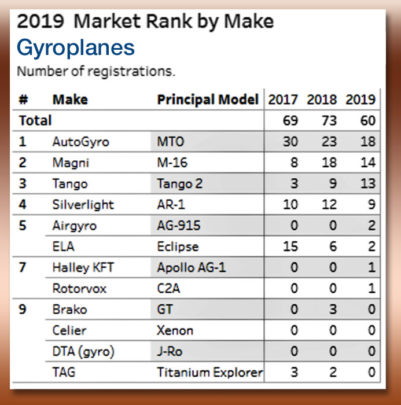

In general terms, Steve noted, “Alternate aircraft offer a mixed picture.” Gyroplanes

Gyroplanes Weight Shift Trikes

Weight Shift Trikes About this Report — “SP Kits” means Sport Pilot kit aircraft referring to amateur-built aircraft that can be flown by a pilot possessing a Sport Pilot certificate, or a pilot holding a Private Pilot certificate or higher who is exercising the privileges of Sport Pilot — meaning no aviation medical is required. Since Sport Pilot, as a form of pilot license, only arrived in late 2004, we collect information from FAA’s Aircraft Registration database for all applicable kit-built aircraft that can be flown by a Sport Pilot plus, of course, all Special or Experimental LSA. Although some of the same kit aircraft existed before January 1, 2005, we omit them as it cannot be said those older aircraft could be flown by someone with a Sport Pilot certificate. This also evenly and fairly compares SP Kits with SLSA and ELSA.

About this Report — “SP Kits” means Sport Pilot kit aircraft referring to amateur-built aircraft that can be flown by a pilot possessing a Sport Pilot certificate, or a pilot holding a Private Pilot certificate or higher who is exercising the privileges of Sport Pilot — meaning no aviation medical is required. Since Sport Pilot, as a form of pilot license, only arrived in late 2004, we collect information from FAA’s Aircraft Registration database for all applicable kit-built aircraft that can be flown by a Sport Pilot plus, of course, all Special or Experimental LSA. Although some of the same kit aircraft existed before January 1, 2005, we omit them as it cannot be said those older aircraft could be flown by someone with a Sport Pilot certificate. This also evenly and fairly compares SP Kits with SLSA and ELSA.

How about this for a great way to start off the new year — a brand-new airplane? Both pilot and manufacturer are smiling and with good reason: both are winners in this transaction, as it should be.

How about this for a great way to start off the new year — a brand-new airplane? Both pilot and manufacturer are smiling and with good reason: both are winners in this transaction, as it should be.

“

“

As we kick off a new year and a new decade, it feels like the starter’s timer has just been clicked into action. The next four years should prove to be highly interesting — and for all of aviation, not only Light-Sport Aircraft, Sport Pilot kit aircraft, and ultralights. Change can be difficult, but it’s coming. For the most part, I feel this is heading in a great direction even if some may struggle with elements of the new rule.

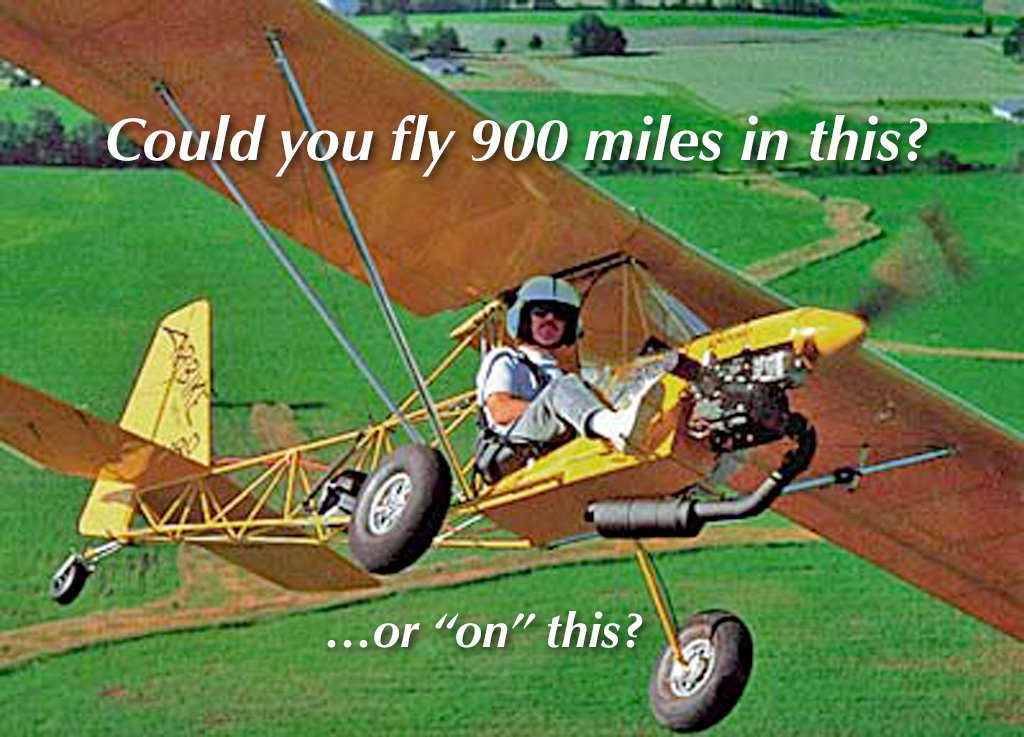

As we kick off a new year and a new decade, it feels like the starter’s timer has just been clicked into action. The next four years should prove to be highly interesting — and for all of aviation, not only Light-Sport Aircraft, Sport Pilot kit aircraft, and ultralights. Change can be difficult, but it’s coming. For the most part, I feel this is heading in a great direction even if some may struggle with elements of the new rule. In this article, I will answer some common questions. The goal is not to repeat the earlier info but to provide clarification. Call this an FAQ (Frequently Asked Questions) review.

In this article, I will answer some common questions. The goal is not to repeat the earlier info but to provide clarification. Call this an FAQ (Frequently Asked Questions) review.

Higher speeds

Higher speeds

Perhaps more to the point, will FAA allow you to fly a 2,500-pound GA airplane with a Sport Pilot certificate …without getting a Class 1-2-3 medical? Alternatively, can a Sport Pilot fly a 3,000-pound new LSA? We don’t know this either.

Perhaps more to the point, will FAA allow you to fly a 2,500-pound GA airplane with a Sport Pilot certificate …without getting a Class 1-2-3 medical? Alternatively, can a Sport Pilot fly a 3,000-pound new LSA? We don’t know this either.

The last airshow (

The last airshow ( One of the most anticipated of these new Light-Sport Aircraft seaplanes is the

One of the most anticipated of these new Light-Sport Aircraft seaplanes is the  “As 2019 draws to a close, we are pleased to announce a new strategic partnership with

“As 2019 draws to a close, we are pleased to announce a new strategic partnership with  Earlier, as Vickers’ team anticipated a higher weight — as did

Earlier, as Vickers’ team anticipated a higher weight — as did

We begin a new year shortly and will keep our focus on the many enjoyable light airplanes. This industry and the pilots it serves have an exciting four years ahead as

We begin a new year shortly and will keep our focus on the many enjoyable light airplanes. This industry and the pilots it serves have an exciting four years ahead as  How about

How about  Until that rule arrives — probably in late 2023 — “Whisper can be a nice step up in airspeed and weight limits within the Experimental Amateur Built class.” Deon’s now-Florida-based operation will offer Whisper in kit form or quick-built kit. It can be completed as a taildragger or tricycle gear (nearby photos).

Until that rule arrives — probably in late 2023 — “Whisper can be a nice step up in airspeed and weight limits within the Experimental Amateur Built class.” Deon’s now-Florida-based operation will offer Whisper in kit form or quick-built kit. It can be completed as a taildragger or tricycle gear (nearby photos). One is already approved and flying in the USA, Deon reported, using a slightly smaller Lycoming engine at present. Some 25 are presently flying in South Africa.

One is already approved and flying in the USA, Deon reported, using a slightly smaller Lycoming engine at present. Some 25 are presently flying in South Africa.

Fortunately, you can stay where it’s warm and just watch — thanks to new videos from DeLand. While I missed my

Fortunately, you can stay where it’s warm and just watch — thanks to new videos from DeLand. While I missed my  The following information and quotes come from a

The following information and quotes come from a

Learn about all TQ products at

Learn about all TQ products at