You can call modern gyroplanes “wanna-be” helicopters if you want but that might miss a few important points. First, a gyroplane can be flown by a Sport Pilot. Other than Part 103 ultralight version, a helicopter requires a higher certificate and that means a medical, at least BasicMed. LAMA believes gyroplanes will be included in FAA’s revised LSA regulation from what is known at this time. That means they’ll be available ready-to-fly and prices are so much less than conventional helicopters that it’s not even comparable. Comparing the most deluxe fully-built gyroplane to even a used helicopter is a world apart. Finally, maintenance of a gyroplane is dramatically less than any helicopter. Despite those differences, gyroplanes enjoy some of the same performance capabilities of a helicopter — other than vertical launch. Gyroplanes also work unusually well in wind conditions that might ground most other aircraft. No wonder gyroplanes have enjoyed a huge run in space-tight European countries and have been growing steadily in the USA.

First, a gyroplane can be flown by a Sport Pilot. Other than

First, a gyroplane can be flown by a Sport Pilot. Other than

Company leader, Abid Farooqui, notes that Rotax's newest powerplant requires use of an EFIS (Electronic Flight Information System, or digital screen avionics) for engine monitoring that can interface with 915's electronic engine monitoring. Analog gauges are not an option with use of this engine. The lowest cost and simplest EFIS is

Company leader, Abid Farooqui, notes that Rotax's newest powerplant requires use of an EFIS (Electronic Flight Information System, or digital screen avionics) for engine monitoring that can interface with 915's electronic engine monitoring. Analog gauges are not an option with use of this engine. The lowest cost and simplest EFIS is  I will link to a video with much more detail but as one example, Rotax's powerful engine has a turbocharger. Those air boosters make air hotter so an intercooler is needed. The trouble with these components is they have to be securely mounted and a gyroplane like AR-1 is slim, so Abid did not want a big intercooler sticking out and upsetting the lines and low drag of his design. As the video below shows, he went to considerable effort to clean up the 915 installation.

To learn all about the many actions Abid took to install Rotax 915s into his aircraft, see

I will link to a video with much more detail but as one example, Rotax's powerful engine has a turbocharger. Those air boosters make air hotter so an intercooler is needed. The trouble with these components is they have to be securely mounted and a gyroplane like AR-1 is slim, so Abid did not want a big intercooler sticking out and upsetting the lines and low drag of his design. As the video below shows, he went to considerable effort to clean up the 915 installation.

To learn all about the many actions Abid took to install Rotax 915s into his aircraft, see  Yes, you read that right and that figure includes everything needed although you may elect added-cost options such as glass avionics or a specialized paint job. While some models of LSA seaplanes appeal to the wealthy class at prices approaching $400,000, Aero Adventure makes …seaplanes for the rest of us.

Two years ago, Aero Adventure was focused on their

Yes, you read that right and that figure includes everything needed although you may elect added-cost options such as glass avionics or a specialized paint job. While some models of LSA seaplanes appeal to the wealthy class at prices approaching $400,000, Aero Adventure makes …seaplanes for the rest of us.

Two years ago, Aero Adventure was focused on their  While Alex and team previously hoped to debut the new model at

While Alex and team previously hoped to debut the new model at  Meanwhile, in my visit at the end of March 2020, I reviewed several items of the long work list required to achieve Special LSA status and it appears to me that Aero Adventure has nearly finished all work. They hired outside talent to assist them in assuring they fully meet the ASTM standards FAA requires before accepting a new model into the fleet. They've also completed the numerous manuals required before they can declare their compliance to standards.

Building the case for FAA acceptance has absorbed a lot of time and money, but Alex and crew have worked the rest of the effort, too. A major decision was made about representation of the enhanced line.

Meanwhile, in my visit at the end of March 2020, I reviewed several items of the long work list required to achieve Special LSA status and it appears to me that Aero Adventure has nearly finished all work. They hired outside talent to assist them in assuring they fully meet the ASTM standards FAA requires before accepting a new model into the fleet. They've also completed the numerous manuals required before they can declare their compliance to standards.

Building the case for FAA acceptance has absorbed a lot of time and money, but Alex and crew have worked the rest of the effort, too. A major decision was made about representation of the enhanced line.

Bristell USA importer, Lou Mancuso, will represent the Aventura SLSA 912. He has already dipped his toe into the water (literally …ask him about it at an airshow) by offering the S-17 version of Aventura but he is stoked about the potential for the fully-built seaplane with a modest price. Aventura SLSA 912 will be north of $100,000 but significantly less than all other Special LSA seaplanes and far, far less than Icon's A5.

Lou has carefully built a solid reputation in the Light-Sport Aircraft world (see here

Bristell USA importer, Lou Mancuso, will represent the Aventura SLSA 912. He has already dipped his toe into the water (literally …ask him about it at an airshow) by offering the S-17 version of Aventura but he is stoked about the potential for the fully-built seaplane with a modest price. Aventura SLSA 912 will be north of $100,000 but significantly less than all other Special LSA seaplanes and far, far less than Icon's A5.

Lou has carefully built a solid reputation in the Light-Sport Aircraft world (see here

No, of course not. Admittedly, though, a nosedragger is certainly not what most pilots think when they envision a Cub.

No, of course not. Admittedly, though, a nosedragger is certainly not what most pilots think when they envision a Cub.

“Putting a nosewheel on a modern Cub type aircraft certainly surprised some people," noted CubCrafters' VP of Sales & Marketing, Brad Damm. "The overwhelming public response has been positive, especially among more than 300 pilots that had the opportunity to fly the airplane during the market survey phase."

“A nosewheel equipped XCub is a very easy airplane to fly that takes off shorter, lands shorter, and cruises faster than the tailwheel version," Brad added. "Once a pilot is in the airplane and experiences it, the advantages are obvious.”

“Engaging our customers has been hugely important,” said Patrick Horgan, President of CubCrafters. “We went into this process not entirely sure if the market wanted to accept a nosewheel-type personal adventure Cub." He reported the question has been resolved. "We’ve had people wanting to place deposits for this aircraft from day one. Our customers have made it very clear that they want us to build this airplane.”

“Putting a nosewheel on a modern Cub type aircraft certainly surprised some people," noted CubCrafters' VP of Sales & Marketing, Brad Damm. "The overwhelming public response has been positive, especially among more than 300 pilots that had the opportunity to fly the airplane during the market survey phase."

“A nosewheel equipped XCub is a very easy airplane to fly that takes off shorter, lands shorter, and cruises faster than the tailwheel version," Brad added. "Once a pilot is in the airplane and experiences it, the advantages are obvious.”

“Engaging our customers has been hugely important,” said Patrick Horgan, President of CubCrafters. “We went into this process not entirely sure if the market wanted to accept a nosewheel-type personal adventure Cub." He reported the question has been resolved. "We’ve had people wanting to place deposits for this aircraft from day one. Our customers have made it very clear that they want us to build this airplane.”

CubCrafters said that a variety of pilots with varying skill levels invested hundreds of hours of real-world use during the market survey phase. The Yakima company said this experience led to many design improvements that might not have happened solely from company engineers.

CubCrafters said that a variety of pilots with varying skill levels invested hundreds of hours of real-world use during the market survey phase. The Yakima company said this experience led to many design improvements that might not have happened solely from company engineers.

Regarding retrofit, the nosewheel assembly "is a bolt-on effort that can be removed should the owner want to convert the airplane to a tailwheel configuration." XCub's tricycle gear option is available now on experimental XCubs through the company’s Builder Assist program

Following the company's also-Part 23 Cub, the nosedragger has been badged as “NX Cub” for aircraft delivered from the factory in nosewheel configuration. CubCrafters expects to achieve FAA Part 23 certification for NX Cub in early 2021.

Regarding retrofit, the nosewheel assembly "is a bolt-on effort that can be removed should the owner want to convert the airplane to a tailwheel configuration." XCub's tricycle gear option is available now on experimental XCubs through the company’s Builder Assist program

Following the company's also-Part 23 Cub, the nosedragger has been badged as “NX Cub” for aircraft delivered from the factory in nosewheel configuration. CubCrafters expects to achieve FAA Part 23 certification for NX Cub in early 2021.

In April, lots of readers were clearly pleased with the "Vintage Ultralights" series. Thanks to our cooperation with Videoman Dave and his popular

In April, lots of readers were clearly pleased with the "Vintage Ultralights" series. Thanks to our cooperation with Videoman Dave and his popular  "The UltraCruiser was designed as the first all-metal ultralight in 1998," reported

"The UltraCruiser was designed as the first all-metal ultralight in 1998," reported

"

"

In our strongest month ever, April 2020,

In our strongest month ever, April 2020,

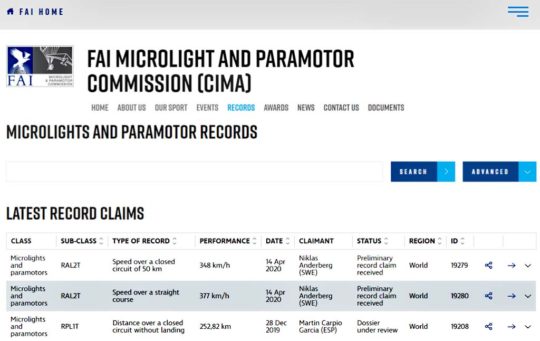

"Things are even more confusing for the [second record for a] 50-kilometer closed-circuit course," said Stéphan. "In every record we attempt, our motivation is to show that our marketing brochure is very accurate without inflated numbers. Because nobody could believe the performance of the fixed-gear Siren with [100 horsepower] 912ULS, we decided to set a new record. The result was an astonishing 288 kilometers per hour (corrected for ISA). We could fly the Risen 914T and set a much faster record, because of retractable gear and an extra 15 horsepower of the

"Things are even more confusing for the [second record for a] 50-kilometer closed-circuit course," said Stéphan. "In every record we attempt, our motivation is to show that our marketing brochure is very accurate without inflated numbers. Because nobody could believe the performance of the fixed-gear Siren with [100 horsepower] 912ULS, we decided to set a new record. The result was an astonishing 288 kilometers per hour (corrected for ISA). We could fly the Risen 914T and set a much faster record, because of retractable gear and an extra 15 horsepower of the

Stéphan observed that I had written (in my

Stéphan observed that I had written (in my

I was told by several builders that Crystal puts out a good food spread and generally these two make you feel at home, even providing bedrooms so you can stay on the job as long as your schedule allows. "Most spend time, return home, and come back to finish the task," explained Greg.

Building a Lightning — Greg observed, "All the primary fiberglass assemblies are preformed and fully fabricated including fuselage halves already bonded together with bulkheads installed; wings are substantially finished with fuel tanks installed; and all flight controls are installed." The kit also includes cowls, the prop spinner, cockpit canopy frame, seats, and baggage floors.

I was told by several builders that Crystal puts out a good food spread and generally these two make you feel at home, even providing bedrooms so you can stay on the job as long as your schedule allows. "Most spend time, return home, and come back to finish the task," explained Greg.

Building a Lightning — Greg observed, "All the primary fiberglass assemblies are preformed and fully fabricated including fuselage halves already bonded together with bulkheads installed; wings are substantially finished with fuel tanks installed; and all flight controls are installed." The kit also includes cowls, the prop spinner, cockpit canopy frame, seats, and baggage floors.

Welded structures, such as the motor mount, spar box assembly, gear leg sockets, and various brackets, are finished and epoxy painted at the factory making them ready to install. Lightning's landing gear is machined from 7075T6 aluminum and ready to fit.

An airplane like Lightning "goes together pretty fast," said Greg, continuing to say that the process takes only about three weeks. If you try this at home, plan on more time, other builders told me. The help the Build Center gives is invaluable plus it's more social than many projects.

The Experimental Aircraft Build Center Arizona also helps builders create the

Welded structures, such as the motor mount, spar box assembly, gear leg sockets, and various brackets, are finished and epoxy painted at the factory making them ready to install. Lightning's landing gear is machined from 7075T6 aluminum and ready to fit.

An airplane like Lightning "goes together pretty fast," said Greg, continuing to say that the process takes only about three weeks. If you try this at home, plan on more time, other builders told me. The help the Build Center gives is invaluable plus it's more social than many projects.

The Experimental Aircraft Build Center Arizona also helps builders create the

What pilot doesn't want more power? Or speed?

The trouble with more power allowing more speed is that old auto racing line: "Speed costs money! How fast do you want to go?"

How about a not-so-expensive option?

U.S. importer

What pilot doesn't want more power? Or speed?

The trouble with more power allowing more speed is that old auto racing line: "Speed costs money! How fast do you want to go?"

How about a not-so-expensive option?

U.S. importer

However, as power went up, so did prices. The 915, 340 and 170 mentioned above carry significantly higher price tags, and honestly, not all light aircraft need that much power. Plus, bigger engines are heavier so some of the added power is used to lift the extra engine weight.

Zlin develop Pasquale Russo and U.S. importer Bill Canino think the familiar and proven Rotax 914 Turbo offered a "best of both worlds" proposition.

For 2020, Zlin introduced the Norden concepts.

However, as power went up, so did prices. The 915, 340 and 170 mentioned above carry significantly higher price tags, and honestly, not all light aircraft need that much power. Plus, bigger engines are heavier so some of the added power is used to lift the extra engine weight.

Zlin develop Pasquale Russo and U.S. importer Bill Canino think the familiar and proven Rotax 914 Turbo offered a "best of both worlds" proposition.

For 2020, Zlin introduced the Norden concepts.

"This required a long, meticulous revision and optimization of the whole airframe," said Pasquale, including fuselage, empennage, landing gear, nose cowl, fuselage skin, the cockpit interior, brakes and control surfaces. It became a reconfigured airplane from spinner to tailwheel.

Careful weight reduction dropped the weight while keep their "hyper STOL" wing performance that can sustain speeds of barely more than 30 mph. "This is more typical for a powered paraglider than for a robust three-axis aircraft while maintaining interesting cruise speeds" Pasquale observed.

"This required a long, meticulous revision and optimization of the whole airframe," said Pasquale, including fuselage, empennage, landing gear, nose cowl, fuselage skin, the cockpit interior, brakes and control surfaces. It became a reconfigured airplane from spinner to tailwheel.

Careful weight reduction dropped the weight while keep their "hyper STOL" wing performance that can sustain speeds of barely more than 30 mph. "This is more typical for a powered paraglider than for a robust three-axis aircraft while maintaining interesting cruise speeds" Pasquale observed.

Around the world outside the U.S., aviation fuels like 100LL are not widely available.

Around the world outside the U.S., aviation fuels like 100LL are not widely available.

What's Up!?

To learn more, we reached out to one of the most Light-Sport Aircraft, Sport Pilot kit aircraft-friendly insurance agencies, AIR, a fun abbreviation for

What's Up!?

To learn more, we reached out to one of the most Light-Sport Aircraft, Sport Pilot kit aircraft-friendly insurance agencies, AIR, a fun abbreviation for  "With quoting becoming almost automated for many aircraft, insurance underwriters found themselves having to find new ways to stay competitive," she added. "This meant broader policies, more flexible training requirements, and of course, a lower rate."

These changes lead insurance companies to what is called a “soft market.” Pilots and aviation business owners often benefited from flexible underwriting and record low premiums.

"With quoting becoming almost automated for many aircraft, insurance underwriters found themselves having to find new ways to stay competitive," she added. "This meant broader policies, more flexible training requirements, and of course, a lower rate."

These changes lead insurance companies to what is called a “soft market.” Pilots and aviation business owners often benefited from flexible underwriting and record low premiums.

"Senior pilots have been greatly impacted in this hardening market," Victoria continued, "specifically those in retractable gear and multi-engine aircraft. If a single engine piston fixed tricycle-gear aircraft can fit your aircraft needs, this will often result in a better rate and insurability on your aircraft insurance." Her advice seems nearly written to boost the LSA industry.

"Senior pilots have been greatly impacted in this hardening market," Victoria continued, "specifically those in retractable gear and multi-engine aircraft. If a single engine piston fixed tricycle-gear aircraft can fit your aircraft needs, this will often result in a better rate and insurability on your aircraft insurance." Her advice seems nearly written to boost the LSA industry.

I can think of three worthy methods to fly what you want: 1️⃣ Buy a used LSA, either Special or Experimental — many great choices are available and a growing number of professional sellers can help you connect to an especially good used model and then provide back-up after the sale. 2️⃣ Shared purchase or expenses — where you help an aircraft-owning friend with his cost of ownership in return for access (this is what I do). 3️⃣ Kit-built Sport Pilot certificate-eligible aircraft — especially if you are handy and have space, but even if you are inexperienced or don’t want to invest the time, many kits demand less hours and lots of them have Quick-Build options that sharply reduce the hours you must expend.

On the other hand, "new is nice" is a common expression for a reason. That new airplane smell and knowing you are the first owner is as satisfying as being able to customize the aircraft to your liking.

I can think of three worthy methods to fly what you want: 1️⃣ Buy a used LSA, either Special or Experimental — many great choices are available and a growing number of professional sellers can help you connect to an especially good used model and then provide back-up after the sale. 2️⃣ Shared purchase or expenses — where you help an aircraft-owning friend with his cost of ownership in return for access (this is what I do). 3️⃣ Kit-built Sport Pilot certificate-eligible aircraft — especially if you are handy and have space, but even if you are inexperienced or don’t want to invest the time, many kits demand less hours and lots of them have Quick-Build options that sharply reduce the hours you must expend.

On the other hand, "new is nice" is a common expression for a reason. That new airplane smell and knowing you are the first owner is as satisfying as being able to customize the aircraft to your liking.

To make their aircraft affordable to more pilots, Texas Aircraft Manufacturing said it has arranged "a new financing program for its Colt-S and Colt-SL Special LSA." Fly-Away Financing is the result of a partnership between Texas Aircraft and Hondo, Texas-based Community National Bank. According to the company, "Prospective aircraft buyers can now access an online form to calculate their down payment, loan terms and total monthly payments." Contact

To make their aircraft affordable to more pilots, Texas Aircraft Manufacturing said it has arranged "a new financing program for its Colt-S and Colt-SL Special LSA." Fly-Away Financing is the result of a partnership between Texas Aircraft and Hondo, Texas-based Community National Bank. According to the company, "Prospective aircraft buyers can now access an online form to calculate their down payment, loan terms and total monthly payments." Contact  “Imagine owning a brand-new, fully-equipped Colt-SL for about the same cost as a much older, less advanced, pre-owned aircraft,” says Texas Aircraft CEO Matheus Grande. “Our Fly-Away Financing offer doesn’t just make it affordable; Community National Bank has streamlined the loan approval process to make it as easy as possible.”

I have written about Colt and you can

“Imagine owning a brand-new, fully-equipped Colt-SL for about the same cost as a much older, less advanced, pre-owned aircraft,” says Texas Aircraft CEO Matheus Grande. “Our Fly-Away Financing offer doesn’t just make it affordable; Community National Bank has streamlined the loan approval process to make it as easy as possible.”

I have written about Colt and you can

"With the variety of special Fly-Away Financing rates we can offer," said

"With the variety of special Fly-Away Financing rates we can offer," said

This long, slender, cantilevered wings draws me in like a bees to honey. If it does the same for you, this is one sleek choice. Surprisingly, it won't cost an arm and leg. In fact, the kit KR-010 is base priced at $39,000 plus a shipping fee(2). Elf is quite complete for this price tag but you can bid it up into the $40,000s by adding an airframe parachute and com radio.

As Kris describes the single seater: "KR-01A Elf is a full composite single seat SLSA that operates like a motorglider. It uses Parabeam® vinyl-ester resins composite material resulting in an amazing empty weight of 264 pounds, to qualify for the German 120-KG Class."

This long, slender, cantilevered wings draws me in like a bees to honey. If it does the same for you, this is one sleek choice. Surprisingly, it won't cost an arm and leg. In fact, the kit KR-010 is base priced at $39,000 plus a shipping fee(2). Elf is quite complete for this price tag but you can bid it up into the $40,000s by adding an airframe parachute and com radio.

As Kris describes the single seater: "KR-01A Elf is a full composite single seat SLSA that operates like a motorglider. It uses Parabeam® vinyl-ester resins composite material resulting in an amazing empty weight of 264 pounds, to qualify for the German 120-KG Class."

"Elf was designed by Jerzy Krawcyk of Ekolot by utilizing the early work of Slovenian-American Alex Strojnikun," explained Kris. "Elf features removable cantilever wings, cockpit under bubble canopy with tricycle fixed landing gear. The power-plant is a two-stroke engine with aft-folding composite propeller blades and can be equipped with ballistic parachute."

The producer of Elf and the also-very-handsome Topaz plus another model named Junior comes from PPHU Ekolot, a Polish manufacturer based in the city of Krosno. Formed in 1995 by director Henryk Slowik, a successful Polish business man, the chief designer is Jerzy Krawczyk, an aeronautical engineer who graduated from Warsaw Polytechnics – Aircraft Design and has 35 years of experience in designing aircraft.

Headquartered in DeKalb, Illinois, Kris operates NIU Group doing business as Ekolot America,

the distributor and importer for Ekolot.

"Elf was designed by Jerzy Krawcyk of Ekolot by utilizing the early work of Slovenian-American Alex Strojnikun," explained Kris. "Elf features removable cantilever wings, cockpit under bubble canopy with tricycle fixed landing gear. The power-plant is a two-stroke engine with aft-folding composite propeller blades and can be equipped with ballistic parachute."

The producer of Elf and the also-very-handsome Topaz plus another model named Junior comes from PPHU Ekolot, a Polish manufacturer based in the city of Krosno. Formed in 1995 by director Henryk Slowik, a successful Polish business man, the chief designer is Jerzy Krawczyk, an aeronautical engineer who graduated from Warsaw Polytechnics – Aircraft Design and has 35 years of experience in designing aircraft.

Headquartered in DeKalb, Illinois, Kris operates NIU Group doing business as Ekolot America,

the distributor and importer for Ekolot.

Wing Span — 35.2 feet

Wing Span — 35.2 feet

"Following a recent certification process with extensive inspection of its new factory," the company reported, "Seamax's R&D team have worked to raise the bar bringing state-of-the-art technologies to the M-22. The company has heard customers' requests and accepted the challenge to add new capabilities to the Seamax M-22." One of those requests was from an experienced pilot seeking equipment to file for flight in the IFR system.

The newest buyer is Todd Lang, a Captain for a major U.S. airline and a combat veteran fighter pilot with 40 years of aviation experience. With more than 11,000 hours logged and a logbook full of ratings including a CFII (Certified Flight Instructor Instrument) certificate, Lang is ready to enjoy his Seamax but he also wants to do instruction with it.

"Following a recent certification process with extensive inspection of its new factory," the company reported, "Seamax's R&D team have worked to raise the bar bringing state-of-the-art technologies to the M-22. The company has heard customers' requests and accepted the challenge to add new capabilities to the Seamax M-22." One of those requests was from an experienced pilot seeking equipment to file for flight in the IFR system.

The newest buyer is Todd Lang, a Captain for a major U.S. airline and a combat veteran fighter pilot with 40 years of aviation experience. With more than 11,000 hours logged and a logbook full of ratings including a CFII (Certified Flight Instructor Instrument) certificate, Lang is ready to enjoy his Seamax but he also wants to do instruction with it.

"But as these pilots gain experience, don’t we want them to keep learning? In my case, I’m a CFII, and my daughter has her Private Pilot certificate. She would like to have an instrument rating, but she doesn’t want to go rent an airplane if we are going to purchase an airplane. When I made the decision to purchase the Seamax, I probably would not have spent the money strictly for water fun. With the IFR option, we can go to the lake and have fun then shoot an approach when we come back." (See Captain Lang's impressive bio at the end.)

"I have been flying for 40 years," Lang continued, "and I’ve always wanted to own my own airplane. Over the years I have looked at a lot of airplanes, but I never reached a motivation level to actually write a check. The older airplanes and flying from A to B just never inspired me and with a family of four, I was always looking at four-seaters." Then the situation changed.

"But as these pilots gain experience, don’t we want them to keep learning? In my case, I’m a CFII, and my daughter has her Private Pilot certificate. She would like to have an instrument rating, but she doesn’t want to go rent an airplane if we are going to purchase an airplane. When I made the decision to purchase the Seamax, I probably would not have spent the money strictly for water fun. With the IFR option, we can go to the lake and have fun then shoot an approach when we come back." (See Captain Lang's impressive bio at the end.)

"I have been flying for 40 years," Lang continued, "and I’ve always wanted to own my own airplane. Over the years I have looked at a lot of airplanes, but I never reached a motivation level to actually write a check. The older airplanes and flying from A to B just never inspired me and with a family of four, I was always looking at four-seaters." Then the situation changed.

"I had a paradigm shift when I saw a Light-Sport seaplane with [the latest] avionics," Lang noted. Since his children are now adults, he doesn’t need four seats. "In fact, some one-on-one time with my family members sounded nice," he added.

While he acknowledged "several very nice amphibious airplanes are available in the market, but [the others were not] for me. Seamax stood out with its clean, polished look and very light weight. We also wanted the folding wing option and that one feature eliminated some other choices.

"We plan to do most of our operations on freshwater lakes," Lang explained, "but occasionally take a trip to the Bahamas or the Keys and Seamax seems like it would stand up to the saltwater a little better with very few metal parts exposed.

I’m embracing the whole “low and slow” concept. Going to the lake is a blast." That's not all that motivated Todd.

"I had a paradigm shift when I saw a Light-Sport seaplane with [the latest] avionics," Lang noted. Since his children are now adults, he doesn’t need four seats. "In fact, some one-on-one time with my family members sounded nice," he added.

While he acknowledged "several very nice amphibious airplanes are available in the market, but [the others were not] for me. Seamax stood out with its clean, polished look and very light weight. We also wanted the folding wing option and that one feature eliminated some other choices.

"We plan to do most of our operations on freshwater lakes," Lang explained, "but occasionally take a trip to the Bahamas or the Keys and Seamax seems like it would stand up to the saltwater a little better with very few metal parts exposed.

I’m embracing the whole “low and slow” concept. Going to the lake is a blast." That's not all that motivated Todd.

"As a history fan," Lang went on, "I’m also thinking about following Lewis and Clark’s trail, or the Oregon trail." He sees the Seamax as about perfect for this kind of adventure. "It may have taken me 40 years but I think I have found my dream plane!"

Let's get back to that part of the announcement that speaks about IFR flying.

"As a history fan," Lang went on, "I’m also thinking about following Lewis and Clark’s trail, or the Oregon trail." He sees the Seamax as about perfect for this kind of adventure. "It may have taken me 40 years but I think I have found my dream plane!"

Let's get back to that part of the announcement that speaks about IFR flying.

He is right in that LSA are not "certified." They are "accepted" by FAA as complying to the ASTM standards. Speaking of which…

A longtime expert with years of experience working on ASTM committees wrote, "Please refer to F37 standards on SLSA. [F37 is the committee designation for ASTM people working on standards for Light-Sport Aircraft.] The aircraft can fly in IFR but not into IMC. This limitation allows for instrument training. FAA has no opinion on it as this is part of the standards that the OEM states in the 8130-15 document [the FAA form used by manufacturers to declare their aircraft complies with all ASTM standards]. If the person wants to build the aircraft, assuming it can be an Experimental Amateur-Built aircraft, they [must fly with] a Private Pilot [or higher] certificate with instrument rating and a correctly-equipped plane. Then it can be flown IFR with no restrictions."

He is right in that LSA are not "certified." They are "accepted" by FAA as complying to the ASTM standards. Speaking of which…

A longtime expert with years of experience working on ASTM committees wrote, "Please refer to F37 standards on SLSA. [F37 is the committee designation for ASTM people working on standards for Light-Sport Aircraft.] The aircraft can fly in IFR but not into IMC. This limitation allows for instrument training. FAA has no opinion on it as this is part of the standards that the OEM states in the 8130-15 document [the FAA form used by manufacturers to declare their aircraft complies with all ASTM standards]. If the person wants to build the aircraft, assuming it can be an Experimental Amateur-Built aircraft, they [must fly with] a Private Pilot [or higher] certificate with instrument rating and a correctly-equipped plane. Then it can be flown IFR with no restrictions."

Another correct response, yet all these accurate comments still don't reveal the whole story.

A further conundrum about IFR in LSA is that no express prohibition is stated in the regulations. The restriction comes from ASTM in a standard document that FAA subsequently accepted, giving it the weight of regulation. However, the ELSA option (as used by

Another correct response, yet all these accurate comments still don't reveal the whole story.

A further conundrum about IFR in LSA is that no express prohibition is stated in the regulations. The restriction comes from ASTM in a standard document that FAA subsequently accepted, giving it the weight of regulation. However, the ELSA option (as used by

Most western nations have kit programs of some kind but since their regulations have longer allowed fully-built aircraft, the European brands tend to slightly lead in SLSA deliveries while American producers thoroughly dominate kit-built aircraft sales.

Two other reasons also account for this situation.

A kit-built aircraft can lower the total cost of acquisition in trade for you investing your time. Many find those hours highly enjoyable and educational so kits may always be popular. In addition, a kit-built aircraft builder can do his or her own maintenance although a ELSA can qualify for this advantage as well.

Most western nations have kit programs of some kind but since their regulations have longer allowed fully-built aircraft, the European brands tend to slightly lead in SLSA deliveries while American producers thoroughly dominate kit-built aircraft sales.

Two other reasons also account for this situation.

A kit-built aircraft can lower the total cost of acquisition in trade for you investing your time. Many find those hours highly enjoyable and educational so kits may always be popular. In addition, a kit-built aircraft builder can do his or her own maintenance although a ELSA can qualify for this advantage as well.

"It's an interesting year for Jabiru," Scott declared!

During the Coronavirus panic, Jabiru Australia designed and began 3D printing face shields, collaborating with other businesses in Australia using 3D printers to increase production volumes. This has been well received as it has kept employment up plus fulfilled a need in the country.

Here in America, Scott enthused, "In the U.S., 2020 started out flying high and fast! While activity slowed a little with the pandemic, even with the major aviation shows cancelling, the market is returning to a vibrant pace."

"It's an interesting year for Jabiru," Scott declared!

During the Coronavirus panic, Jabiru Australia designed and began 3D printing face shields, collaborating with other businesses in Australia using 3D printers to increase production volumes. This has been well received as it has kept employment up plus fulfilled a need in the country.

Here in America, Scott enthused, "In the U.S., 2020 started out flying high and fast! While activity slowed a little with the pandemic, even with the major aviation shows cancelling, the market is returning to a vibrant pace."

"We are now offering all three kits," Scott noted. He referred to the J170-D two door; the 230-D three door, and 430-D four place aircraft. "The kits are suitable for home assembly or with builder assistance in Tennessee," Scott added.

To learn more, visit the

"We are now offering all three kits," Scott noted. He referred to the J170-D two door; the 230-D three door, and 430-D four place aircraft. "The kits are suitable for home assembly or with builder assistance in Tennessee," Scott added.

To learn more, visit the

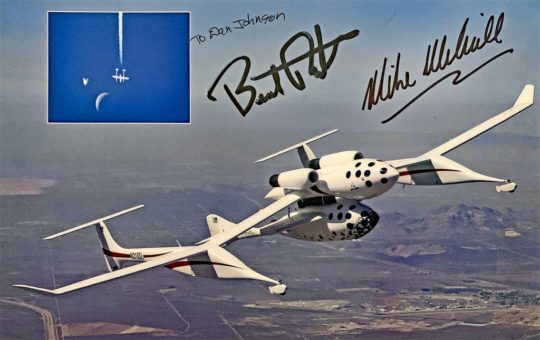

You can call the title "clickbait" if you want, but I've long had a strong interest in space flight and SpaceShipOne certainly was far lighter than any manned spacecraft NASA has launched.

Still, even this light and relatively simple spacecraft is about as far from Part 103 ultralights as you can get.

It's the main man behind this space adventure that may be of greater interest to pilots of any certificate.

I was initially captured by the video below. When I realized it was an interview with Burt Rutan, I was drawn to see what this tell-it-like-it-is fellow had to say.

I'll keep this short as it doesn't relate to Light-Sport Aircraft, kit-build aircraft Sport Pilots may fly or ultralight aircraft. For you true believers — don't worry. I don't plan to repeat this.

You can call the title "clickbait" if you want, but I've long had a strong interest in space flight and SpaceShipOne certainly was far lighter than any manned spacecraft NASA has launched.

Still, even this light and relatively simple spacecraft is about as far from Part 103 ultralights as you can get.

It's the main man behind this space adventure that may be of greater interest to pilots of any certificate.

I was initially captured by the video below. When I realized it was an interview with Burt Rutan, I was drawn to see what this tell-it-like-it-is fellow had to say.

I'll keep this short as it doesn't relate to Light-Sport Aircraft, kit-build aircraft Sport Pilots may fly or ultralight aircraft. For you true believers — don't worry. I don't plan to repeat this.

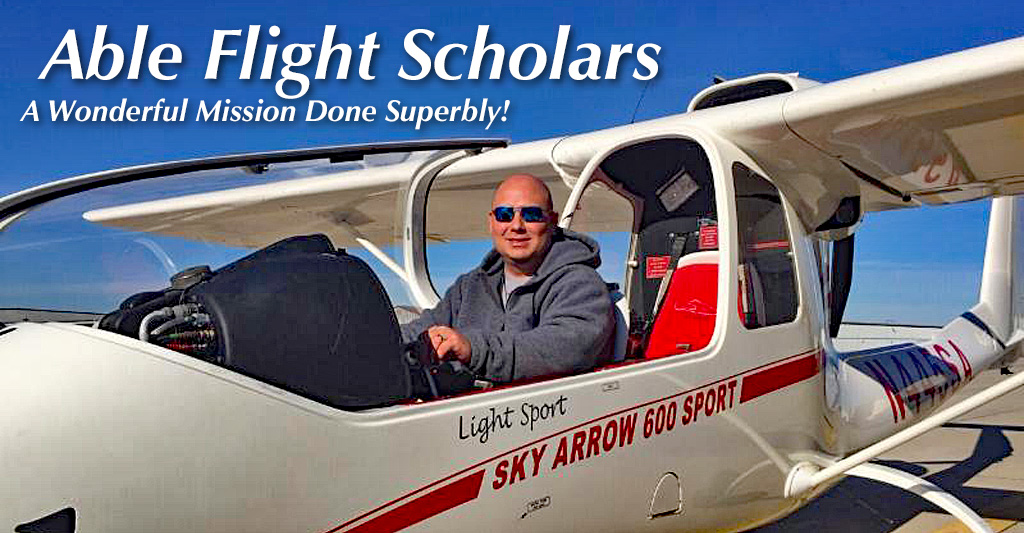

The members of the Able Flight “Class of 2020” are as follows (numbered according to photo, not in any order of importance):

Chris Murad (1) of Georgia. Chris recently graduated from Georgia Tech with an aerospace degree. He became paralyzed in 2016 when shot during a robbery as he was leaving work. Chris will train at Purdue University.

Joshua Martin (2) of Texas. Joshua is a graduate of West Point who trained and served as a Special Operations helicopter pilot before losing his lower left leg due to a motor vehicle accident in 2018. With his scholarship, Joshua will return to flying by earning his fixed-wing pilot certificate. Joshua will train at Purdue University.

Michael Price (3) of North Dakota. Michael is a graduate of Penn Foster University in Fargo, ND, and had his first flight as part of an introductory program in 1997. That same day he became paralyzed due to injuries from a car accident. Michael will train at Purdue University.

The members of the Able Flight “Class of 2020” are as follows (numbered according to photo, not in any order of importance):

Chris Murad (1) of Georgia. Chris recently graduated from Georgia Tech with an aerospace degree. He became paralyzed in 2016 when shot during a robbery as he was leaving work. Chris will train at Purdue University.

Joshua Martin (2) of Texas. Joshua is a graduate of West Point who trained and served as a Special Operations helicopter pilot before losing his lower left leg due to a motor vehicle accident in 2018. With his scholarship, Joshua will return to flying by earning his fixed-wing pilot certificate. Joshua will train at Purdue University.

Michael Price (3) of North Dakota. Michael is a graduate of Penn Foster University in Fargo, ND, and had his first flight as part of an introductory program in 1997. That same day he became paralyzed due to injuries from a car accident. Michael will train at Purdue University.

Steven Curry (9) of Virginia. Steven served in the U.S. Army in both Afghanistan and Iraq. His plans to secure a Warrant Officer training slot to become a helicopter pilot ended when injuries from an IED required the amputation of his left leg below the knee. Steven with train at Aviation Adventures in Virginia.

David Snypes, Jr. (10) of New York. David is a veteran of the U.S. Army having served from 2009 to 2016, including tours in Afghanistan. In 2016, he lost the use of his left arm due to injuries sustained in a motorcycle accident. David will train at Purdue University.

The preceding list is only for this year.

Steven Curry (9) of Virginia. Steven served in the U.S. Army in both Afghanistan and Iraq. His plans to secure a Warrant Officer training slot to become a helicopter pilot ended when injuries from an IED required the amputation of his left leg below the knee. Steven with train at Aviation Adventures in Virginia.

David Snypes, Jr. (10) of New York. David is a veteran of the U.S. Army having served from 2009 to 2016, including tours in Afghanistan. In 2016, he lost the use of his left arm due to injuries sustained in a motorcycle accident. David will train at Purdue University.

The preceding list is only for this year.

Instead, I want to take you back in time, way back to January …a whole four months ago. What a different world we lived in then. Coronavirus was not on the minds of many Americans — nor, at that time, even on the minds of Chinese citizens, though leaders might have had some inkling.

In January 2020, the aviation community, certainly the Light-Sport Aircraft and Sport Pilot kit aircraft sector, was stunned by the

Instead, I want to take you back in time, way back to January …a whole four months ago. What a different world we lived in then. Coronavirus was not on the minds of many Americans — nor, at that time, even on the minds of Chinese citizens, though leaders might have had some inkling.

In January 2020, the aviation community, certainly the Light-Sport Aircraft and Sport Pilot kit aircraft sector, was stunned by the

Other than the pure thrill of logging a high groundspeed, going fast is only useful when you're going somewhere. If perhaps your goal is aerial sightseeing then slow (and probably low) is the way to go. If you have to go fast, remember that old saying from auto racing: "Speed cost money; how fast do you want to go?" This equally applies to aviation.

FAA actually drew a speed line back in the early 2000s when the SP/LSA rule was being written (just as now with the LSA 2023 rule in the works). No, I don't refer to the 120-knot speed limit we'll discuss below. I refer to a slower speed, the one implied in the minimum 20 hours required for a Sport Pilot certificate.

Other than the pure thrill of logging a high groundspeed, going fast is only useful when you're going somewhere. If perhaps your goal is aerial sightseeing then slow (and probably low) is the way to go. If you have to go fast, remember that old saying from auto racing: "Speed cost money; how fast do you want to go?" This equally applies to aviation.

FAA actually drew a speed line back in the early 2000s when the SP/LSA rule was being written (just as now with the LSA 2023 rule in the works). No, I don't refer to the 120-knot speed limit we'll discuss below. I refer to a slower speed, the one implied in the minimum 20 hours required for a Sport Pilot certificate.

Rule writers separated Light-Sport Aircraft as sub-87 knot and faster. At the time the rule was released, this made sense. America was still flying lots of what we now loosely call "ultralights." These aircraft were simply built, half the empty weight of most LSA today, and flew slower, usually under 100 mph …87 knots.

Then LSA got glass cockpits, leather interiors, high performance engines, autopilots, and more. Prices went up accordingly and today we have a bifurcated market — just like FAA once envisioned, with simpler sub-87 knot airplanes and faster but more costly models.

Rule writers separated Light-Sport Aircraft as sub-87 knot and faster. At the time the rule was released, this made sense. America was still flying lots of what we now loosely call "ultralights." These aircraft were simply built, half the empty weight of most LSA today, and flew slower, usually under 100 mph …87 knots.

Then LSA got glass cockpits, leather interiors, high performance engines, autopilots, and more. Prices went up accordingly and today we have a bifurcated market — just like FAA once envisioned, with simpler sub-87 knot airplanes and faster but more costly models.

For plenty of pilots, 100 mph is fine for most of their flying including regional travel. Those who yearn for speed or want to travel interstate or cross country want the fastest machine they can afford.

The aircraft I've written about recently —

For plenty of pilots, 100 mph is fine for most of their flying including regional travel. Those who yearn for speed or want to travel interstate or cross country want the fastest machine they can afford.

The aircraft I've written about recently —  BRM Aero was early to begin work with Rotax's new

BRM Aero was early to begin work with Rotax's new  "Vne, Velocity Never Exceed, is an indicated air speed," Lou started in a reply to a Facebook audience. "For example, When the 915iS powered Bristell Speedster is flying at 12,500 feet with a true airspeed of 170 miles per hour or 147 knots, the indicated airspeed is only 118 knots. The Bristell has a 157 knots Vne." A good

"Vne, Velocity Never Exceed, is an indicated air speed," Lou started in a reply to a Facebook audience. "For example, When the 915iS powered Bristell Speedster is flying at 12,500 feet with a true airspeed of 170 miles per hour or 147 knots, the indicated airspeed is only 118 knots. The Bristell has a 157 knots Vne." A good

"A few weeks earlier," he continued, "we started high-speed taxi tests. We noticed immediately that this aircraft is something special. The turbo-charged engine (

"A few weeks earlier," he continued, "we started high-speed taxi tests. We noticed immediately that this aircraft is something special. The turbo-charged engine ( "On Tuesday the weather conditions were perfect. We decided to fly at 10,000 feet. The [FAI] criteria that the course could only be flown once made it even more intense. At the first turn, I climbed some 300 feet, and returning to altitude she accelerated to 219 knots (405 km/h). I felt extremely tense and had a hard time keeping the ball in the center. Overall I am happy that I managed to fly a pretty good course. On the straight course, we got 212 knots average speed. It was great to celebrate the success with my co-pilot Fredrik Lanz, and the rest of the Blackwing team.

"On Tuesday the weather conditions were perfect. We decided to fly at 10,000 feet. The [FAI] criteria that the course could only be flown once made it even more intense. At the first turn, I climbed some 300 feet, and returning to altitude she accelerated to 219 knots (405 km/h). I felt extremely tense and had a hard time keeping the ball in the center. Overall I am happy that I managed to fly a pretty good course. On the straight course, we got 212 knots average speed. It was great to celebrate the success with my co-pilot Fredrik Lanz, and the rest of the Blackwing team.

"The flight testing will continue in spring and summer. After 50 hours of flight testing, we can start taking passengers.

"The aircraft used for the record is a standard BW600RG with the Rotax 915iS engine. In order to optimize the drag, we only had one outside antenna and sealed some of the gaps."

Once again, my heartiest congratutions to Niklas, Fredrik, and Team Blackwing, for a job well done!

"The flight testing will continue in spring and summer. After 50 hours of flight testing, we can start taking passengers.

"The aircraft used for the record is a standard BW600RG with the Rotax 915iS engine. In order to optimize the drag, we only had one outside antenna and sealed some of the gaps."

Once again, my heartiest congratutions to Niklas, Fredrik, and Team Blackwing, for a job well done!

"JMB Aircraft is proud to announce some achievements from the past few months," the company wrote recently. "After more than 100 hours of flight test with two planes, we manage with success to perform a V-dive test reaching an indicated 381 kilometers per hour and 425 km/h (229 knots) true air speed. This enable us to safely increase our VNE up to an indicated 340 kilometers per hour (184 knots)."

On April 25th JMB added, "With all nominal operating parameters, we climbed to FL180 in 13 minutes with one short level off due to a too-fast climb reported by ATC. The conditions were ISO +7 degrees Celsius (45°F) and 600 kilogram MTOW. Our test pilots performed a level flight of several minutes at maximum continuous power and reached 380 km/h (205 knots) true airspeed, breaking the mythical 200 knot barrier."

"JMB Aircraft is proud to announce some achievements from the past few months," the company wrote recently. "After more than 100 hours of flight test with two planes, we manage with success to perform a V-dive test reaching an indicated 381 kilometers per hour and 425 km/h (229 knots) true air speed. This enable us to safely increase our VNE up to an indicated 340 kilometers per hour (184 knots)."

On April 25th JMB added, "With all nominal operating parameters, we climbed to FL180 in 13 minutes with one short level off due to a too-fast climb reported by ATC. The conditions were ISO +7 degrees Celsius (45°F) and 600 kilogram MTOW. Our test pilots performed a level flight of several minutes at maximum continuous power and reached 380 km/h (205 knots) true airspeed, breaking the mythical 200 knot barrier."

I suspect the LSA-like airspeed race isn't over yet, especially given the previous record holder — Risen, from a formerly Swiss, now Italian company renamed as

I suspect the LSA-like airspeed race isn't over yet, especially given the previous record holder — Risen, from a formerly Swiss, now Italian company renamed as

I am pleased to serve a need for news during a month when we should have been covering

I am pleased to serve a need for news during a month when we should have been covering  Several sources close to EAA leadership have said a decision will come in early May, however, it doesn't take a genius to figure that. EAA is grappling with matters such as when hundreds of tents or thousands of portable bathrooms must be ordered, or finalizing the call to a not-small army of volunteers to begin the trek to Wisconsin. Such major plans must be started well in advance of the event slated for July 20-26th.

If you back-calendar from when EAA needs those tents and so much more to be ready I think you get to a date that is fast approaching.

Cancelling a show is frightening stuff for show producers (EAA, Sun ‘n Fun, Aero, etc.), especially when the event represents a substantial share of their annual budget (a lot for Sun ‘n Fun and Aero; somewhat less so for EAA). Other than their accountants and top leadership, few know the hard facts but it is clear these events bring in plenty of the dough needed to run the enterprises that organize the shows. I have heard all sorts of comments, such as "AirVenture accounts for upwards of 60% of the EAA's annual income." Honestly, I doubt that for EAA but for Sun 'n Fun and Aero, the percentage could even be higher. Oh, my!

I hope for the best for all these vital events but I’m concerned.

Several sources close to EAA leadership have said a decision will come in early May, however, it doesn't take a genius to figure that. EAA is grappling with matters such as when hundreds of tents or thousands of portable bathrooms must be ordered, or finalizing the call to a not-small army of volunteers to begin the trek to Wisconsin. Such major plans must be started well in advance of the event slated for July 20-26th.

If you back-calendar from when EAA needs those tents and so much more to be ready I think you get to a date that is fast approaching.

Cancelling a show is frightening stuff for show producers (EAA, Sun ‘n Fun, Aero, etc.), especially when the event represents a substantial share of their annual budget (a lot for Sun ‘n Fun and Aero; somewhat less so for EAA). Other than their accountants and top leadership, few know the hard facts but it is clear these events bring in plenty of the dough needed to run the enterprises that organize the shows. I have heard all sorts of comments, such as "AirVenture accounts for upwards of 60% of the EAA's annual income." Honestly, I doubt that for EAA but for Sun 'n Fun and Aero, the percentage could even be higher. Oh, my!

I hope for the best for all these vital events but I’m concerned.

A prime motivator for E-Fan is Grazia Vittadini, Airbus' Chief Technology Officer. She wrote, "When I first started my career at Airbus, the notion of electric flight was considered a far-off pipedream. Today, it’s a reality." Yet that future may not involve their much-promoted E-Fan.

A prime motivator for E-Fan is Grazia Vittadini, Airbus' Chief Technology Officer. She wrote, "When I first started my career at Airbus, the notion of electric flight was considered a far-off pipedream. Today, it’s a reality." Yet that future may not involve their much-promoted E-Fan.

Now, a

Now, a  Even during the lockdown,

Even during the lockdown,  While the following information covers only one quarter of the year and while it does not reflect much of the pandemic effects, we nonetheless found a few tidbits of interest. For the data hounds among you, we invite you to visit our market share and airplane registration database website called

While the following information covers only one quarter of the year and while it does not reflect much of the pandemic effects, we nonetheless found a few tidbits of interest. For the data hounds among you, we invite you to visit our market share and airplane registration database website called  Among Special (fully-built) LSA registrations,

Among Special (fully-built) LSA registrations,

Ernie was the man behind Carlson Aircraft along with his wife, Mary. This pair introduced Sparrow, a Part 103-capable single-place ultralight plus larger models like Sparrow II and XTC.

I won't say they've been lost to pilots but they've been hiding. Now, out of the history books will return the Sparrow, thanks to David Cooper, the man behind

Ernie was the man behind Carlson Aircraft along with his wife, Mary. This pair introduced Sparrow, a Part 103-capable single-place ultralight plus larger models like Sparrow II and XTC.

I won't say they've been lost to pilots but they've been hiding. Now, out of the history books will return the Sparrow, thanks to David Cooper, the man behind  "In the next couple weeks, we will get our website up and running," he forecast, but until then David invites a call or text to 574-214-3660 or theecoop@comcast.net.

I asked about plans on the table at this early stage.

"Plan One," David said, "is to carry on the legacy of Ernie Carlson's designs. Production will be in kit form."

"All welded parts will be done at the factory," he assured. "Other fast-build kits with factory-built ribs will be part of the offering."

"In the next couple weeks, we will get our website up and running," he forecast, but until then David invites a call or text to 574-214-3660 or theecoop@comcast.net.

I asked about plans on the table at this early stage.

"Plan One," David said, "is to carry on the legacy of Ernie Carlson's designs. Production will be in kit form."

"All welded parts will be done at the factory," he assured. "Other fast-build kits with factory-built ribs will be part of the offering."

In addition, for Carlson airplanes already built and flying, David and partners' new operation will offer replacement parts. I'm sure that will be most welcome by those flying Carlson aircraft.

"We hope to keep costs low to make the price of kits affordable," David added …music to the ears of this website that maintains a focus on affordable aviation.

To further support and build on the Carlson line, David will seek both American and overseas sales.

When Will Sparrow Debut (Again)?

"We plan to have a first kit available before Oshkosh this year," stated David.

As I have understood, EAA is planning a go/no-go decision for Oshkosh fairly soon. Given the huge amount of effort to put on a show like AirVenture and including the gargantuan task of building the army of volunteers it takes to put on the event, a decision simply has to be made in the next couple weeks or so.

I don't know about you, but I have all my fingers crossed for a "Go!" decision. Hope springs eternal!

Learn more about Sparrow in my

In addition, for Carlson airplanes already built and flying, David and partners' new operation will offer replacement parts. I'm sure that will be most welcome by those flying Carlson aircraft.

"We hope to keep costs low to make the price of kits affordable," David added …music to the ears of this website that maintains a focus on affordable aviation.

To further support and build on the Carlson line, David will seek both American and overseas sales.

When Will Sparrow Debut (Again)?

"We plan to have a first kit available before Oshkosh this year," stated David.

As I have understood, EAA is planning a go/no-go decision for Oshkosh fairly soon. Given the huge amount of effort to put on a show like AirVenture and including the gargantuan task of building the army of volunteers it takes to put on the event, a decision simply has to be made in the next couple weeks or so.

I don't know about you, but I have all my fingers crossed for a "Go!" decision. Hope springs eternal!

Learn more about Sparrow in my