“The DeLand Sport Aviation Showcase (DSAS), conducted from November 14-16, 2019 at the DeLand Municipal Airport in Florida, has completed a careful look at ticket sales, gate receipts, exhibitor numbers and other data… and is happy to report that the 2019 Showcase eclipsed the 2018 attendance by over 20%,” reported lead organizer, Jana Filip.

“Sport aviation is alive and well… and the truly dedicated flyers out there simply would not let some clouds and sporadic rain keep them from seeing and sharing in all that was new and interesting in the sport aviation universe,” explained Jana.

At the fourth running of Deland Showcase, organizers boasted 26 companies new to the event. They had earlier reported a sold-out exhibitor slate. Jana will study attendee and exhibitor reports and will then confirm dates for the 2020 edition of the DeLand Showcase. A decision is expected shortly.

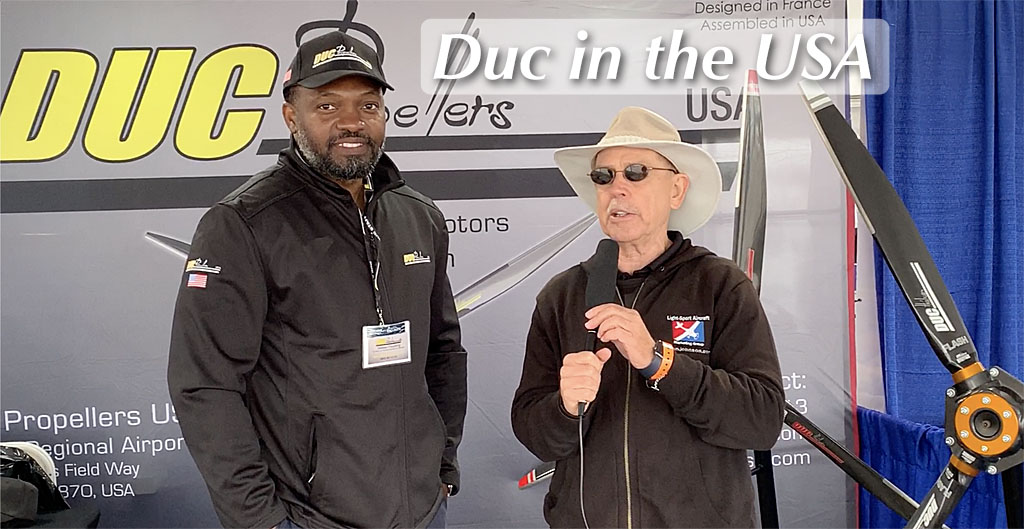

Duc Propellers USA Also a Success

“Designed in France.

“The DeLand Sport Aviation Showcase (DSAS), conducted from November 14-16, 2019 at the DeLand Municipal Airport in Florida, has completed a careful look at ticket sales, gate receipts, exhibitor numbers and other data… and is happy to report that the 2019 Showcase eclipsed the 2018 attendance by over 20%,” reported lead organizer, Jana Filip.

“Sport aviation is alive and well… and the truly dedicated flyers out there simply would not let some clouds and sporadic rain keep them from seeing and sharing in all that was new and interesting in the sport aviation universe,” explained Jana.

At the fourth running of Deland Showcase, organizers boasted 26 companies new to the event. They had earlier reported a sold-out exhibitor slate. Jana will study attendee and exhibitor reports and will then confirm dates for the 2020 edition of the DeLand Showcase. A decision is expected shortly.

Duc Propellers USA Also a Success

“Designed in France.Duc Propellers for Light-Sport Aircraft in the USA — Introducing 4-Blade Flash 2 Prop

“Sport aviation is alive and well… and the truly dedicated flyers out there simply would not let some clouds and sporadic rain keep them from seeing and sharing in all that was new and interesting in the sport aviation universe,” explained Jana.

At the fourth running of Deland Showcase, organizers boasted 26 companies new to the event. They had earlier reported a sold-out exhibitor slate. Jana will study attendee and exhibitor reports and will then confirm dates for the 2020 edition of the DeLand Showcase. A decision is expected shortly.

Duc Propellers USA Also a Success

“Designed in France. Assembled in the USA.” Hmmm, sounds rather like a certain product “Designed in California, Assembled in China” from a famous brand. The high-tech French prop maker established a base in the USA where they provide full support and service for the growing line of propellers for Light-Sport Aircraft and Sport Pilot kits.

“This is a four-blade, ground-adjustable prop developed expressly for the Rotax 915iS,” said Gaetan Fouozing, Duc’s new representative at their Sebring facility serving North America. Readers may recall the newest, most powerful engine from Rotax has only been available with props that can be adjusted in-flight. However, at AirVenture Oshkosh 2019, the Austrian company announced they would begin supplying the 915iS for fixed pitch props in fall 2019. Read more about Rotax 915iS here.

Gaetan said Duc engineers studied three and four blade combinations but settled on four blades to make use of the added power delivered by 915iS (up 40% from the Rotax 912iS). He confirmed the Flash 2 4-blade product is in stock at this time. “All Duc products are held in stock at our Sebring facility,” Gaetan observed.

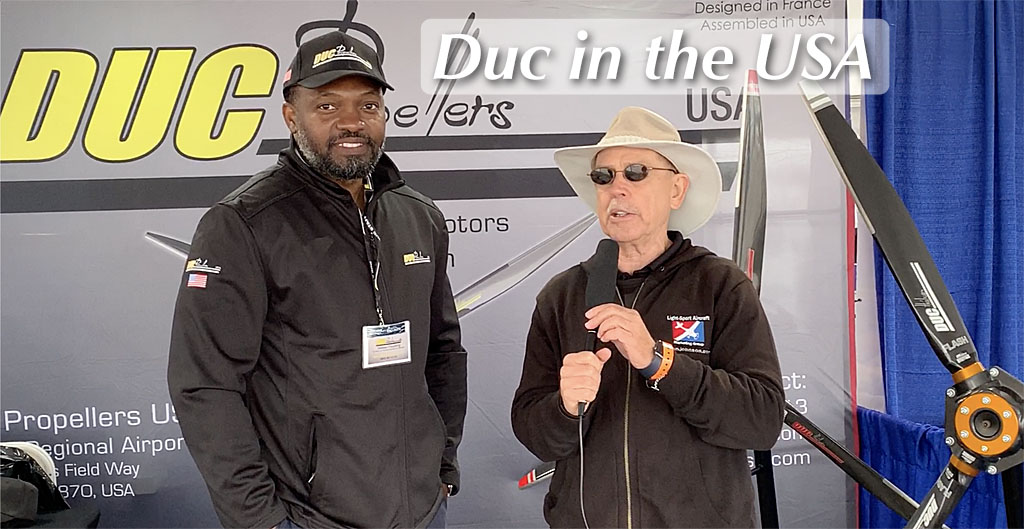

In addition to the ground adjustable capability, Duc said their new Flash 2 is “available in Hydro version for seaplanes.” The French prop manufacturer said the hydro version offers high water resistance and abrasion by adding an Inconel metal leading edge

Representing Duc at Deland Showcase 2019 (L-R): Isabelle Duqueine, Vincent Duqueine, Gaetan Fouozing, Michaël Derderian

The hydro prop development also includes a specific blade tip built of “structural monolithic carbon 40 millimeters (1.57 inches) thick” to “optimize cutting for splash.” The metal leading edge is available at no additional cost.

Priced at $4,589.50, Flash 2 four blade is fairly precious but it is designed to manage the power of the also more costly Rotax 915iS engine that outputs 141 horsepower. As the time-honored race car saying goes, “Speed costs money. How fast do you want to go?”

Engines are sometimes said to the be primary component that has driven aircraft development over the decades but engines demand propellers that can transmit engine power to moving an aircraft through the air. The folks at Duc continue to apply their expertise to this essential product.

“The DeLand Sport Aviation Showcase (DSAS), conducted from November 14-16, 2019 at the DeLand Municipal Airport in Florida, has completed a careful look at ticket sales, gate receipts, exhibitor numbers and other data… and is happy to report that the 2019 Showcase eclipsed the 2018 attendance by over 20%,” reported lead organizer, Jana Filip.

“Sport aviation is alive and well… and the truly dedicated flyers out there simply would not let some clouds and sporadic rain keep them from seeing and sharing in all that was new and interesting in the sport aviation universe,” explained Jana.

At the fourth running of Deland Showcase, organizers boasted 26 companies new to the event. They had earlier reported a sold-out exhibitor slate. Jana will study attendee and exhibitor reports and will then confirm dates for the 2020 edition of the DeLand Showcase. A decision is expected shortly.

Duc Propellers USA Also a Success

“Designed in France.

“The DeLand Sport Aviation Showcase (DSAS), conducted from November 14-16, 2019 at the DeLand Municipal Airport in Florida, has completed a careful look at ticket sales, gate receipts, exhibitor numbers and other data… and is happy to report that the 2019 Showcase eclipsed the 2018 attendance by over 20%,” reported lead organizer, Jana Filip.

“Sport aviation is alive and well… and the truly dedicated flyers out there simply would not let some clouds and sporadic rain keep them from seeing and sharing in all that was new and interesting in the sport aviation universe,” explained Jana.

At the fourth running of Deland Showcase, organizers boasted 26 companies new to the event. They had earlier reported a sold-out exhibitor slate. Jana will study attendee and exhibitor reports and will then confirm dates for the 2020 edition of the DeLand Showcase. A decision is expected shortly.

Duc Propellers USA Also a Success

“Designed in France.

Opening day at

Opening day at  SunDancer may be consider two airplanes in one, partly as it can be either a very efficient and surprising speedy cruiser or a motorglider capable of genuine soaring flight, but also because it comes with two wing extensions. SunDancer motorglider can exchange removable wing extensions boosting wingspan from 42 feet 8 inches (13 meters) to 49 feet 2 inches (15 meters). Glide goes from a respectable 26:1 to 30:1.

SunDancer may be consider two airplanes in one, partly as it can be either a very efficient and surprising speedy cruiser or a motorglider capable of genuine soaring flight, but also because it comes with two wing extensions. SunDancer motorglider can exchange removable wing extensions boosting wingspan from 42 feet 8 inches (13 meters) to 49 feet 2 inches (15 meters). Glide goes from a respectable 26:1 to 30:1. Clearly, cruising from the West Coast to East Coast shows SunDancer to be a serious travel machine for two occupants. Tomazin said you can range 800 miles and carry 100 pounds of baggage.

Clearly, cruising from the West Coast to East Coast shows SunDancer to be a serious travel machine for two occupants. Tomazin said you can range 800 miles and carry 100 pounds of baggage. According to FAA Part 61.23, “A person is not required to hold a medical certificate … when exercising the privileges of a Sport Pilot certificate with privileges in a glider or balloon,” with the definition of a glider being “…a heavier-than-air aircraft, that is supported in flight by the dynamic reaction of the air against its lifting surfaces and whose free flight does not depend principally on an engine.” SunDancer easily qualifies.

According to FAA Part 61.23, “A person is not required to hold a medical certificate … when exercising the privileges of a Sport Pilot certificate with privileges in a glider or balloon,” with the definition of a glider being “…a heavier-than-air aircraft, that is supported in flight by the dynamic reaction of the air against its lifting surfaces and whose free flight does not depend principally on an engine.” SunDancer easily qualifies. “With their large wing area, [motorgliders] offer low stall speeds, fast climb, and near-STOL capabilities. They usually employ glider-like spoilers or airbrakes for direct lift control and steep descents.” Speed brakes offer both dramatic and precise lift control despite their relatively small size; one secret is the exact placement on the wing’s chord. Their power and usefulness prompted Hanson to add, “Once you fly an aircraft with spoilers, you’ll wonder why every airplane doesn’t have them.”

“With their large wing area, [motorgliders] offer low stall speeds, fast climb, and near-STOL capabilities. They usually employ glider-like spoilers or airbrakes for direct lift control and steep descents.” Speed brakes offer both dramatic and precise lift control despite their relatively small size; one secret is the exact placement on the wing’s chord. Their power and usefulness prompted Hanson to add, “Once you fly an aircraft with spoilers, you’ll wonder why every airplane doesn’t have them.”

You can relax, though. It should warm up to more respectable temperatures as the show starts and continues. So this seems like a great time to attend the

You can relax, though. It should warm up to more respectable temperatures as the show starts and continues. So this seems like a great time to attend the  However, I have inquired on several occasions to learn an Aventura kit can get airborne for just over $50,000. The base airframe kit is less than $40,000 and you have several engine options including

However, I have inquired on several occasions to learn an Aventura kit can get airborne for just over $50,000. The base airframe kit is less than $40,000 and you have several engine options including

“Only basic shop tools are required and an assembly manual is provided with clear crisp details of each assembly,” added Walstrom. “The airframe is aluminum (the structural part of the aircraft) and the hull is made from fiberglass (which simply provides flotation). All hardware and everything required to assemble the kit is included. All of the aluminum is anodized (inside and out) to maximize corrosion protection from the elements.”

“Only basic shop tools are required and an assembly manual is provided with clear crisp details of each assembly,” added Walstrom. “The airframe is aluminum (the structural part of the aircraft) and the hull is made from fiberglass (which simply provides flotation). All hardware and everything required to assemble the kit is included. All of the aluminum is anodized (inside and out) to maximize corrosion protection from the elements.” Walstrom further glowed, “These aircraft are capable of taking off and landing in less than 250 feet!”

Walstrom further glowed, “These aircraft are capable of taking off and landing in less than 250 feet!”

In the previous runnings of the DeLand Showcase, weather has been not just good but spectacularly good. One late afternoon last year experienced rain and some wind — after a full day of decent weather. However, every other day of DeLand has enjoyed temperatures in the low 80s (close to 30° for you Centigrade users) under sunny skies and with plenty of vendors to keep you looking (list below).

In the previous runnings of the DeLand Showcase, weather has been not just good but spectacularly good. One late afternoon last year experienced rain and some wind — after a full day of decent weather. However, every other day of DeLand has enjoyed temperatures in the low 80s (close to 30° for you Centigrade users) under sunny skies and with plenty of vendors to keep you looking (list below). In addition to the Showcase event, DeLand is creating a

In addition to the Showcase event, DeLand is creating a  Follow this link to see all exhibitors

Follow this link to see all exhibitors

“No dice,” said FAA! With perspective, it turned out only a small group was opposed but so strong was their hand at the time that FAA leadership could not break the logjam. Now, that appears to be solved. I write “appears” as we won’t know for certain until FAA releases their NPRM on the program widely known as MOSAIC. Best guess, this won’t come for at least a couple more years but the plans inside FAA are maintaining support at the highest levels of the agency and that gyroplane logjam definitely appears to be loosening. Amen! That was a long time coming.

“No dice,” said FAA! With perspective, it turned out only a small group was opposed but so strong was their hand at the time that FAA leadership could not break the logjam. Now, that appears to be solved. I write “appears” as we won’t know for certain until FAA releases their NPRM on the program widely known as MOSAIC. Best guess, this won’t come for at least a couple more years but the plans inside FAA are maintaining support at the highest levels of the agency and that gyroplane logjam definitely appears to be loosening. Amen! That was a long time coming. Abid Farooqui‘s

Abid Farooqui‘s  Along came European developers like Italy’s Magni Gyro and Germany’s AutoGyro, followed by several others. They made numerous improvements but among them was the now-standard tailplane located further aft and with more vertical area. That and better pilot preparation resulted in a much better safety record and European pilots began to embrace these aircraft.

Along came European developers like Italy’s Magni Gyro and Germany’s AutoGyro, followed by several others. They made numerous improvements but among them was the now-standard tailplane located further aft and with more vertical area. That and better pilot preparation resulted in a much better safety record and European pilots began to embrace these aircraft. The video below conveys more information I learned in a training session with Greg in the fully enclosed

The video below conveys more information I learned in a training session with Greg in the fully enclosed  That said, FAA is to be commended for finally including fully built Special LSA gyroplanes in their proposed new regulation.

That said, FAA is to be commended for finally including fully built Special LSA gyroplanes in their proposed new regulation.

First, a caveat: While FAA is communicating some of the

First, a caveat: While FAA is communicating some of the

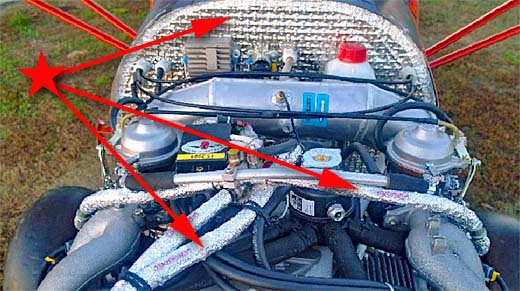

Michael Stock said, “In general, all propellers which are not in-flight adjustable are a compromise between take-off and climb performance (power) and cruise flight (speed, endurance). They cannot work at maximum efficiency in both flight regimes.”

Michael Stock said, “In general, all propellers which are not in-flight adjustable are a compromise between take-off and climb performance (power) and cruise flight (speed, endurance). They cannot work at maximum efficiency in both flight regimes.”

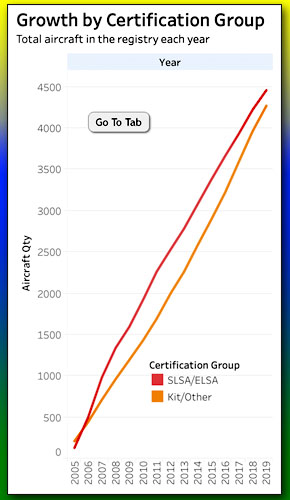

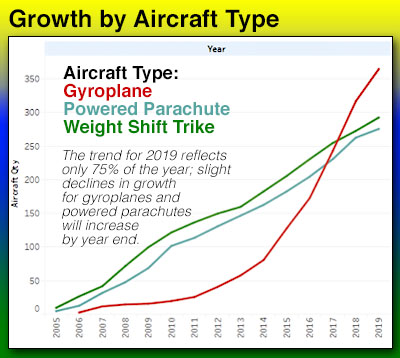

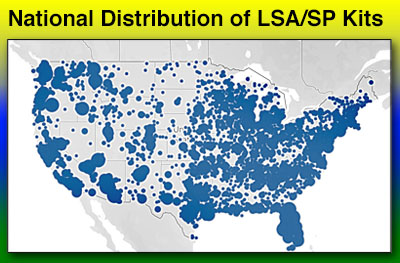

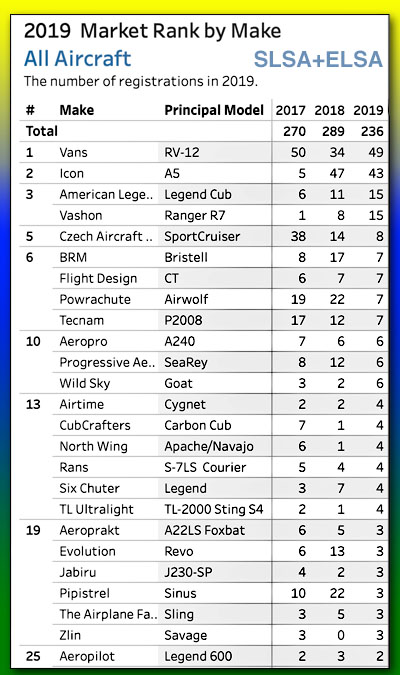

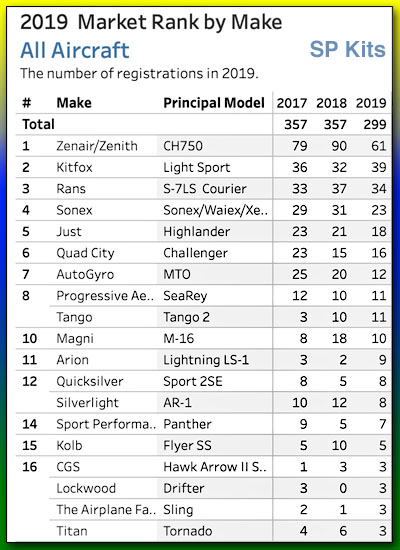

If you follow light aviation intently as many readers do, knowing what aircraft and subgroups (within LSA and SP kits

If you follow light aviation intently as many readers do, knowing what aircraft and subgroups (within LSA and SP kits Why? We don’t claim to have all the answers but regular surveying of exhibitors at airshows revealed that many sellers say, “The market is good. People are buying.” Of course, this is anecdotal not scientific but we heard it from enough vendors to believe they’re feeling good about their enterprises. Many pilots backed up this finding with their own, personal assessment.

Why? We don’t claim to have all the answers but regular surveying of exhibitors at airshows revealed that many sellers say, “The market is good. People are buying.” Of course, this is anecdotal not scientific but we heard it from enough vendors to believe they’re feeling good about their enterprises. Many pilots backed up this finding with their own, personal assessment. This is the first time you’ve seen this because earlier, we segmented SLSA from ELSA from SP kits. This made it appear kits were growing faster than the LSA groups. In fact, they are nearly matched with kit-built aircraft.

This is the first time you’ve seen this because earlier, we segmented SLSA from ELSA from SP kits. This made it appear kits were growing faster than the LSA groups. In fact, they are nearly matched with kit-built aircraft. Using

Using  However, fixed wing continue to be, by far, the biggest group of LSA (partly as very few kit-built aircraft are “alternative” types).

However, fixed wing continue to be, by far, the biggest group of LSA (partly as very few kit-built aircraft are “alternative” types). As we head into the final quarter of 2019 — and the final LSA show of the year, the

As we head into the final quarter of 2019 — and the final LSA show of the year, the

Referring to these flying machines is a way of showing the keen interest many pilots have in airplanes that somewhat resemble Piper’s 1940s-era Cub series. Into this enthusiasts’ heaven comes Shock Ultra, with its

Referring to these flying machines is a way of showing the keen interest many pilots have in airplanes that somewhat resemble Piper’s 1940s-era Cub series. Into this enthusiasts’ heaven comes Shock Ultra, with its  Shock Ultra has some features not found on all Zlin’s other models, including double slotted Fowler flaps that help lower stall speed to almost absurdly-slow levels (for proof with your own eyes, see our video below). In addition, Shock Ultra has leading edge wing slats though these, like the “Shock options” for the Titan-powered Shock Outback, are optional. The newest variation of this design uses the oversized outboard shock absorbers similar to those first seen on SuperSTOL and then Shock Outback. They are “to tame the landings,” said SportairUSA. All these design qualities combine to provide good visibility on approach thanks to a “flattened landing flare.”

Shock Ultra has some features not found on all Zlin’s other models, including double slotted Fowler flaps that help lower stall speed to almost absurdly-slow levels (for proof with your own eyes, see our video below). In addition, Shock Ultra has leading edge wing slats though these, like the “Shock options” for the Titan-powered Shock Outback, are optional. The newest variation of this design uses the oversized outboard shock absorbers similar to those first seen on SuperSTOL and then Shock Outback. They are “to tame the landings,” said SportairUSA. All these design qualities combine to provide good visibility on approach thanks to a “flattened landing flare.” Those low speeds are aided by a basic empty weight of 725 pounds. This is more than 100 pounds lighter than some Cub clones from CubCrafters and American Legend. As many experienced light aircraft pilots believe, the lighter the airframe the better it performs and handles and the more payload you can carry onboard.

Those low speeds are aided by a basic empty weight of 725 pounds. This is more than 100 pounds lighter than some Cub clones from CubCrafters and American Legend. As many experienced light aircraft pilots believe, the lighter the airframe the better it performs and handles and the more payload you can carry onboard. Cub-like models from Zlin include the very affordable

Cub-like models from Zlin include the very affordable

I toured the company’s aircraft production facilities in Hondo and found them able to match other strong operations I have visited. The company has wisely hired outside talent as needed, for example, to gain their Special airworthiness certificate. It was clear to me that, although a lot of paper documentation had to be correct, this Brazilian-founded but Texas-operated company would have no trouble proving their compliance to all applicable standards.

I toured the company’s aircraft production facilities in Hondo and found them able to match other strong operations I have visited. The company has wisely hired outside talent as needed, for example, to gain their Special airworthiness certificate. It was clear to me that, although a lot of paper documentation had to be correct, this Brazilian-founded but Texas-operated company would have no trouble proving their compliance to all applicable standards.

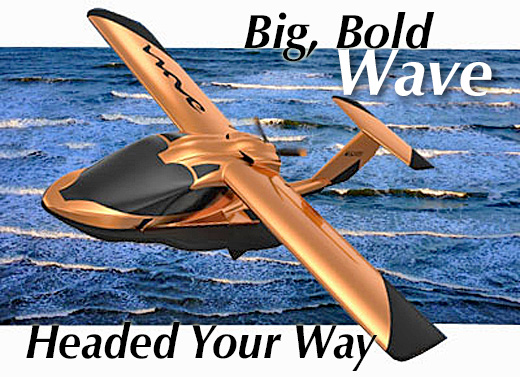

You might think those words don’t apply to many Light-Sport Aircraft. Certainly, “big” is not a word most pilots associate with LSA. A number are actually rather compact, though with standardized rules, aircraft parameters don’t differ as much as some might think.

You might think those words don’t apply to many Light-Sport Aircraft. Certainly, “big” is not a word most pilots associate with LSA. A number are actually rather compact, though with standardized rules, aircraft parameters don’t differ as much as some might think. “The aviation industry is known for its high barriers to entry,” said Paul. “While everyone sees the final product (the aircraft) flying, what they don’t see are the years of work that go into the company structure behind it.” Vickers related tasks to meet business regulations plus health and safety requirements, environmental considerations, design, flight and manufacturing criteria as well as aviation authority regulations prior to the first aircraft even operating.

“The aviation industry is known for its high barriers to entry,” said Paul. “While everyone sees the final product (the aircraft) flying, what they don’t see are the years of work that go into the company structure behind it.” Vickers related tasks to meet business regulations plus health and safety requirements, environmental considerations, design, flight and manufacturing criteria as well as aviation authority regulations prior to the first aircraft even operating. During this time, finishing touches put into the manuals and processes ensure that Vickers meets all of its regulatory requirements. “We are using technology to do it smarter and quicker,” said Paul. “Vickers is creating a paperless work environment from engineering to the manufacturing facility to customer support. Ensuring that all data is generated and stored electronically cuts down on development time and physical storage space while providing improved levels of control of the build of individual parts and aircraft.” Vickers notes use of portable electronic devices such as phones and tablets to allow staff to directly monitor the manufacturing equipment such as ovens and freezers. This technology also enables the approval of work and the ordering of parts and materials electronically.

During this time, finishing touches put into the manuals and processes ensure that Vickers meets all of its regulatory requirements. “We are using technology to do it smarter and quicker,” said Paul. “Vickers is creating a paperless work environment from engineering to the manufacturing facility to customer support. Ensuring that all data is generated and stored electronically cuts down on development time and physical storage space while providing improved levels of control of the build of individual parts and aircraft.” Vickers notes use of portable electronic devices such as phones and tablets to allow staff to directly monitor the manufacturing equipment such as ovens and freezers. This technology also enables the approval of work and the ordering of parts and materials electronically.

The idea is that since you could not go aloft in Colt I wanted to do what you’d have done had you been at Midwest LSA Expo (which I hope you will be next year; it is simply perfect for demonstration flights… the best of any airshow we attend). Through many years of experience, I have learned to start these Video Pilot Reports by asking the factory pilot to show me exactly what they’d show you if you were the one sitting in my seat.

The idea is that since you could not go aloft in Colt I wanted to do what you’d have done had you been at Midwest LSA Expo (which I hope you will be next year; it is simply perfect for demonstration flights… the best of any airshow we attend). Through many years of experience, I have learned to start these Video Pilot Reports by asking the factory pilot to show me exactly what they’d show you if you were the one sitting in my seat. Unlike most LSA, Colt uses a yoke rather than conventional or side stick. I’m a joystick lover but I acknowledge most pilots trained in the last few decades may be more comfortable with a yoke. Some prefer it so much they will tell you an airplane is easer to handle with a yoke. I think it’s a personal preference but if you prefer a yoke, Texas Aircraft’s Colt is one that may please you.

Unlike most LSA, Colt uses a yoke rather than conventional or side stick. I’m a joystick lover but I acknowledge most pilots trained in the last few decades may be more comfortable with a yoke. Some prefer it so much they will tell you an airplane is easer to handle with a yoke. I think it’s a personal preference but if you prefer a yoke, Texas Aircraft’s Colt is one that may please you. Colt’s aluminum skin — fuselage, wings, tail, and control surfaces — is supported by a welded chromoly steel safety cell. The construction techniques have been proven by designer Caio Jordão‘s model from a different company called Conquest 180. Jordão’s work has resulted in more than 300 planes that have amassed 150,000 flight hours. His son Diego assists him.

Colt’s aluminum skin — fuselage, wings, tail, and control surfaces — is supported by a welded chromoly steel safety cell. The construction techniques have been proven by designer Caio Jordão‘s model from a different company called Conquest 180. Jordão’s work has resulted in more than 300 planes that have amassed 150,000 flight hours. His son Diego assists him.

If SuperSport looks familiar to you, it should. It’s based on the CTSW but joins several elements of the newer CTLS. In Europe, Flight Design has continued to deliver a lighter model from the CT series to conform to the microlight or European ultralight parameters.

If SuperSport looks familiar to you, it should. It’s based on the CTSW but joins several elements of the newer CTLS. In Europe, Flight Design has continued to deliver a lighter model from the CT series to conform to the microlight or European ultralight parameters. CT SuperSport can be delivered with a 710 pound empty weight that puts it well below many Light-Sport Aircraft and more than 100 pounds lighter than the longer CTLS. “This weight reduction was accomplished by using simplified avionics and equipment plus some lighter parts from the European version of the CT,” said Flight Design.

CT SuperSport can be delivered with a 710 pound empty weight that puts it well below many Light-Sport Aircraft and more than 100 pounds lighter than the longer CTLS. “This weight reduction was accomplished by using simplified avionics and equipment plus some lighter parts from the European version of the CT,” said Flight Design. CT SuperSport is some 13 inches shorter than CTLS, Tom Jr. noted and it does not have the hat rack or aft cabin windows of CTLS. CT SuperSport also uses an electric trim for pitch only while CTLS has pitch, aileron, and rudder trim by wheels.

CT SuperSport is some 13 inches shorter than CTLS, Tom Jr. noted and it does not have the hat rack or aft cabin windows of CTLS. CT SuperSport also uses an electric trim for pitch only while CTLS has pitch, aileron, and rudder trim by wheels. Father and son Gutmanns run

Father and son Gutmanns run  You have two more days of

You have two more days of

Larry Mednick is a happily married man now but he remains a restless designer, always striving for a new variation on the exquisite theme he started with Revo ten years ago.

Larry Mednick is a happily married man now but he remains a restless designer, always striving for a new variation on the exquisite theme he started with Revo ten years ago. Finally comes RevX. Larry said about Rev that it is a delightful trike that he has thoroughly enjoyed since it was released four years ago. However, it is a calm weather flyer. I see nothing wrong with that but the lightweight airframe of Rev means it is somewhat more vulnerable should conditions pick up strength.

Finally comes RevX. Larry said about Rev that it is a delightful trike that he has thoroughly enjoyed since it was released four years ago. However, it is a calm weather flyer. I see nothing wrong with that but the lightweight airframe of Rev means it is somewhat more vulnerable should conditions pick up strength. However, in exchange for some building effort RevX buyers will get a quite capable trike with impressive performance.

However, in exchange for some building effort RevX buyers will get a quite capable trike with impressive performance. “The single surface RevX wing has a limited speed range,” Larry explained. “Pilots will see stall at 28 mph, normal cruise at 45 mph and the wing maxes out at 58 mph,” he noted but the handling of a single surface wing is superior.

“The single surface RevX wing has a limited speed range,” Larry explained. “Pilots will see stall at 28 mph, normal cruise at 45 mph and the wing maxes out at 58 mph,” he noted but the handling of a single surface wing is superior.

As I turn onto final James Milnes’ voice suddenly crackles in my headset, “Golf Oscar Kilo Uniform Bravo, don’t forget it’s a tailwheel today!” The reason for James’ timely reminder was that when I’d flown the same aircraft a few weeks previously it had been configured as a trike, but today it’s a taildragger! Like most things in life, sport flying isn’t getting any cheaper. Hangarage, insurance, maintenance and fuel are all getting more expensive. But what if you had an aeroplane that lived on a road-legal trailer and fitted in your garage? One you could fly from practically any friendly farmer’s field while burning only eight liters (about 2 gallons) of mogas an hour and that you could do all the maintenance on?

As I turn onto final James Milnes’ voice suddenly crackles in my headset, “Golf Oscar Kilo Uniform Bravo, don’t forget it’s a tailwheel today!” The reason for James’ timely reminder was that when I’d flown the same aircraft a few weeks previously it had been configured as a trike, but today it’s a taildragger! Like most things in life, sport flying isn’t getting any cheaper. Hangarage, insurance, maintenance and fuel are all getting more expensive. But what if you had an aeroplane that lived on a road-legal trailer and fitted in your garage? One you could fly from practically any friendly farmer’s field while burning only eight liters (about 2 gallons) of mogas an hour and that you could do all the maintenance on? Before going flying, a look around the TLAC facility reveals quite a few Kubs in various stages of construction, and the large lift (which wouldn’t look entirely out of place on an aircraft carrier) that conveys completed aircraft from the production line on the first floor down to the ground. Unlike some of the SSDRs that I’ve tested over the years, the Kub looks very well made, and also quite robust. TLAC boss Paul Hendry-Smith explained that although SSDR aircraft don’t need specific approvals from a national aviation authority or administration, as the Kub is descended from the Reality Aircraft Kid, it is built to British Civil Airworthiness Requirements, uses aircraft-quality materials and is “a proper aeroplane.”

Before going flying, a look around the TLAC facility reveals quite a few Kubs in various stages of construction, and the large lift (which wouldn’t look entirely out of place on an aircraft carrier) that conveys completed aircraft from the production line on the first floor down to the ground. Unlike some of the SSDRs that I’ve tested over the years, the Kub looks very well made, and also quite robust. TLAC boss Paul Hendry-Smith explained that although SSDR aircraft don’t need specific approvals from a national aviation authority or administration, as the Kub is descended from the Reality Aircraft Kid, it is built to British Civil Airworthiness Requirements, uses aircraft-quality materials and is “a proper aeroplane.” Currently offered by TLAC as either a basic kit, “Fast-Build” kit or as a RTF factory-built SSDR microlight, the Kub is of classic rag ‘n’ tube design. Construction is primarily of TIG-welded 4130-gauge aircraft grade steel tube that is then powder-coated. The fuselage has a triangular cross-section aft of the cockpit, while the wings use Avid Flyer/Kitfox-style tubular aluminium spars and plywood ribs. Oratex UL600 covers the fuselage, wings and tail, with composites used for the cowling, which half-covers the Hirth F23 engine.

Currently offered by TLAC as either a basic kit, “Fast-Build” kit or as a RTF factory-built SSDR microlight, the Kub is of classic rag ‘n’ tube design. Construction is primarily of TIG-welded 4130-gauge aircraft grade steel tube that is then powder-coated. The fuselage has a triangular cross-section aft of the cockpit, while the wings use Avid Flyer/Kitfox-style tubular aluminium spars and plywood ribs. Oratex UL600 covers the fuselage, wings and tail, with composites used for the cowling, which half-covers the Hirth F23 engine. Now, I’m not a huge fan of two-stroke aero-engines. In fact, even my lawnmower’s engine is a four-stroke, so I regard the F23 with a slightly jaundiced air. It’s quite an interesting, almost contradictory little engine, as despite Hirth having replaced the old-school magnetos with dual Capacitive Digital Ignition (CDI) units you still must mix the two-stroke oil into the petrol by hand. I believe automatic oil injection is an option, but even my Yamaha RD400 motorcycle had the oil automatically injected as standard in 1978. The Hirth does have an excellent power to weight ratio though – 50 horsepower from an aero-engine that only weighs 35 kilograms (77 pounds, including the electric starter and twin expansion-chamber exhaust) is not to be sniffed at. It’s fed from a pair of wing tanks with a combined capacity of 47 litres (12 gallons) via a fuselage-mounted four-litre (1 gallon) header tank.

Now, I’m not a huge fan of two-stroke aero-engines. In fact, even my lawnmower’s engine is a four-stroke, so I regard the F23 with a slightly jaundiced air. It’s quite an interesting, almost contradictory little engine, as despite Hirth having replaced the old-school magnetos with dual Capacitive Digital Ignition (CDI) units you still must mix the two-stroke oil into the petrol by hand. I believe automatic oil injection is an option, but even my Yamaha RD400 motorcycle had the oil automatically injected as standard in 1978. The Hirth does have an excellent power to weight ratio though – 50 horsepower from an aero-engine that only weighs 35 kilograms (77 pounds, including the electric starter and twin expansion-chamber exhaust) is not to be sniffed at. It’s fed from a pair of wing tanks with a combined capacity of 47 litres (12 gallons) via a fuselage-mounted four-litre (1 gallon) header tank. The constant-chord wings are braced by vee-struts and fold aft using a similar system to the Scout’s, but what really catches my eye are the large, single-slotted mechanically-actuated flaps. These have four positions, 0°, 10°, 25°, and 40° but are they really necessary? This thing has a MAUW of only 300 kilograms (661 pounds) and with a wing area of 10.5 square meters (113 square feet) the wing loading is very low, so why would it need flaps? It’s obvious that without some sort of hinged trailing edge it wouldn’t be possible to fold the wings, as they’d foul the fuselage. But does it really need lift-and-drag producing aerodynamic flaps? Only one way to find out: fly it!

The constant-chord wings are braced by vee-struts and fold aft using a similar system to the Scout’s, but what really catches my eye are the large, single-slotted mechanically-actuated flaps. These have four positions, 0°, 10°, 25°, and 40° but are they really necessary? This thing has a MAUW of only 300 kilograms (661 pounds) and with a wing area of 10.5 square meters (113 square feet) the wing loading is very low, so why would it need flaps? It’s obvious that without some sort of hinged trailing edge it wouldn’t be possible to fold the wings, as they’d foul the fuselage. But does it really need lift-and-drag producing aerodynamic flaps? Only one way to find out: fly it! There are only four circuit breakers and four toggle switches (for the master, avionics master and CDI units), plus a large button for the starter — and that’s pretty well it for the electrical services, as the handheld-type Icom transceiver doesn’t count as installed equipment.

There are only four circuit breakers and four toggle switches (for the master, avionics master and CDI units), plus a large button for the starter — and that’s pretty well it for the electrical services, as the handheld-type Icom transceiver doesn’t count as installed equipment. As you may readily appreciate, the pre-take checks continue the simple theme because the F23 is a two-stroke so it doesn’t need warming up and you can’t even check the oil temperature or pressure. Consequently, my generic SEP “flow check” is quickly completed but — as it always does when flying a two-stroke — the small “Master Caution” light in my brain flickers once or twice. “Have I missed something,” I wonder? To be certain, I waited until the CHTs rise slightly then run through the pre-takeoff checks again. Finally convinced I really haven’t forgotten anything, it’s time to fly.

As you may readily appreciate, the pre-take checks continue the simple theme because the F23 is a two-stroke so it doesn’t need warming up and you can’t even check the oil temperature or pressure. Consequently, my generic SEP “flow check” is quickly completed but — as it always does when flying a two-stroke — the small “Master Caution” light in my brain flickers once or twice. “Have I missed something,” I wonder? To be certain, I waited until the CHTs rise slightly then run through the pre-takeoff checks again. Finally convinced I really haven’t forgotten anything, it’s time to fly. Stalls — power on or off — are very benign. There is no artificial stall warner, but adequate natural pre-stall buffet. Furthermore, as you approach the stall a reasonable amount of backpressure on the stick is required. Recovery is quick and easy – just release the backpressure. Flaps up Kub stalls at around 28 knots, and although with full flap and some power you can get it down to around 22 knots it’s almost academic, as a sensible approach speed is well above stall. Trim is quite precise, although it did seem to run out of aft trim at my weight.

Stalls — power on or off — are very benign. There is no artificial stall warner, but adequate natural pre-stall buffet. Furthermore, as you approach the stall a reasonable amount of backpressure on the stick is required. Recovery is quick and easy – just release the backpressure. Flaps up Kub stalls at around 28 knots, and although with full flap and some power you can get it down to around 22 knots it’s almost academic, as a sensible approach speed is well above stall. Trim is quite precise, although it did seem to run out of aft trim at my weight. Cruise performance is also pretty well what you’d expect. A comfortable cruise speed is 50-55 knots, and although you can bump it up to 60 knots, the engine is buzzing quite frenetically and you’ll be burning (relatively) a lot more fuel. For example, at 50 knots you’re only burning around 10 liters an hour (2.6 gph), so the full 51 liters (13.5 gallons) provide a still-air range (including 30 minutes’ reserve fuel) of around 250 nautical miles. If you pull the power right back you can certainly improve the endurance; it’s just that if there’s any appreciable headwind at all then you won’t actually be going anywhere! However, when flying an aircraft like a Kub the journey is at least as important as the destination.

Cruise performance is also pretty well what you’d expect. A comfortable cruise speed is 50-55 knots, and although you can bump it up to 60 knots, the engine is buzzing quite frenetically and you’ll be burning (relatively) a lot more fuel. For example, at 50 knots you’re only burning around 10 liters an hour (2.6 gph), so the full 51 liters (13.5 gallons) provide a still-air range (including 30 minutes’ reserve fuel) of around 250 nautical miles. If you pull the power right back you can certainly improve the endurance; it’s just that if there’s any appreciable headwind at all then you won’t actually be going anywhere! However, when flying an aircraft like a Kub the journey is at least as important as the destination. I typically use about 45 knots on final, and although if it’s flat calm you could probably safely shave off another five knots, I’d advise against it. A Kub has plenty of drag and not much inertia; the speed soon washes off. Plus, it sideslips superbly. Furthermore, when landing into just a stiff breeze the speed at touchdown is very slow, possibly less than 10 knots. Brakes are only for taxiing.

I typically use about 45 knots on final, and although if it’s flat calm you could probably safely shave off another five knots, I’d advise against it. A Kub has plenty of drag and not much inertia; the speed soon washes off. Plus, it sideslips superbly. Furthermore, when landing into just a stiff breeze the speed at touchdown is very slow, possibly less than 10 knots. Brakes are only for taxiing. The air-to-airs with the C-152 carrying Keith and James were not easy as the Kub has practically no overtake, so I have to use a lot of geometric cut-off for the re-joins. With all the pictures recorded I briefly re-flew some of the items off the flight test card to see what — if any, changes in performance and handling had been produced by removing the nosewheel. Unsurprisingly, directional stability is stronger (less keel area in front of the center of pressure) but longitudinal stability weaker (more weight aft of the centre of gravity, exacerbating the limited aft trim). It also seems slightly faster (less drag). It’s also definitely better looking!

The air-to-airs with the C-152 carrying Keith and James were not easy as the Kub has practically no overtake, so I have to use a lot of geometric cut-off for the re-joins. With all the pictures recorded I briefly re-flew some of the items off the flight test card to see what — if any, changes in performance and handling had been produced by removing the nosewheel. Unsurprisingly, directional stability is stronger (less keel area in front of the center of pressure) but longitudinal stability weaker (more weight aft of the centre of gravity, exacerbating the limited aft trim). It also seems slightly faster (less drag). It’s also definitely better looking! Sky Arrow producer

Sky Arrow producer  Thanks to his work with more good folks at

Thanks to his work with more good folks at  No wonder Sky Arrow was able to win Part 23 approval for Sky Arrow. This achievement is unusual because — at least until the rewritten Part 23 becomes law — the process that put tens of thousands of GA airplanes in the air has been breathtakingly expensive. Cirrus claimed the effort took tens of millions of dollars after the design work was completed. That’s too expensive for LSA builders. If you think some LSA are too costly now, let me try assure you that they would have far higher prices if they had to meet Part 23.

No wonder Sky Arrow was able to win Part 23 approval for Sky Arrow. This achievement is unusual because — at least until the rewritten Part 23 becomes law — the process that put tens of thousands of GA airplanes in the air has been breathtakingly expensive. Cirrus claimed the effort took tens of millions of dollars after the design work was completed. That’s too expensive for LSA builders. If you think some LSA are too costly now, let me try assure you that they would have far higher prices if they had to meet Part 23. As most of the industry waits for FAA to complete their work, Sky Arrow USA has some luxury of time to plant their seeds.

As most of the industry waits for FAA to complete their work, Sky Arrow USA has some luxury of time to plant their seeds. The big difference here is that Sky Arrow may get in the business years ahead of other LSA players because Magnaghi already has Part 23 approval so they can perform commercial operations years before a manufacturer wanting to do so with a Light-Sport Aircraft model. “Also, because our airframe is tested to a 2x factor of safety, where most aircraft meet a 1.5x factor, we can carry the loads and do the work with greater assurance,” Marco explained.

The big difference here is that Sky Arrow may get in the business years ahead of other LSA players because Magnaghi already has Part 23 approval so they can perform commercial operations years before a manufacturer wanting to do so with a Light-Sport Aircraft model. “Also, because our airframe is tested to a 2x factor of safety, where most aircraft meet a 1.5x factor, we can carry the loads and do the work with greater assurance,” Marco explained.

If you are an ultralight enthusiast (as I certainly am!), then you are probably celebrating with me as FX1 joins the Special LSA fleet — which it does as Number 150 on our popular

If you are an ultralight enthusiast (as I certainly am!), then you are probably celebrating with me as FX1 joins the Special LSA fleet — which it does as Number 150 on our popular  The older JetFox models were more clearly ultralights. These were European ultralights, which are somewhere between a Part 103 ultralight vehicle and LSA of today.

The older JetFox models were more clearly ultralights. These were European ultralights, which are somewhere between a Part 103 ultralight vehicle and LSA of today. Chris created the

Chris created the  “At the controls were southern California-based reps for the aircraft, Pete Schutte and Deon Lombard. In the post-flight photograph are (from left to right) Deon Lombard,

“At the controls were southern California-based reps for the aircraft, Pete Schutte and Deon Lombard. In the post-flight photograph are (from left to right) Deon Lombard,  I’ve already bought my ticket and will be on hand all three days of the Midwest LSA Expo. I hope you can make it, as well.

I’ve already bought my ticket and will be on hand all three days of the Midwest LSA Expo. I hope you can make it, as well.

EAA announced attendance numbers identifying solid growth over last year, to 642,000 attendees

EAA announced attendance numbers identifying solid growth over last year, to 642,000 attendees True to form as you might expect,

True to form as you might expect,

What’s interesting here is that both companies have exclusively made low wing models in various configuration. Neither has made a high wing. One of these is also planning the new, powerful Rotax 915iS engine (though both producers are using that power plant in one of the low wing models.

What’s interesting here is that both companies have exclusively made low wing models in various configuration. Neither has made a high wing. One of these is also planning the new, powerful Rotax 915iS engine (though both producers are using that power plant in one of the low wing models.

I hope I didn’t drool on it as I looked it over.

I hope I didn’t drool on it as I looked it over.