I have followed Super Petrel since before it went to Brazil* more than 20 years ago. I mention this to make two points.

Super Petrel has a long history; some 400 are flying around the world. In addition, the current producer, Scoda Aeronautica, has continually made changes to the design. The video below identifies some of this history.

What’s new for 2023 is the Super Petrel XP and it’s boost to big Rotax power, the 915iS fuel injected, turbocharged, intercooled engine that seems to be steadily supplanting all prior models.

Smoother & More Powerful

Super Petrel XP

“Eight years ago, Rodrigo Scoda and his team of engineers at Scoda Aeronautica began a secret project to redesign the aircraft from the wheels up,” started the update explanation by Roger Helton president of Super Petrel USA. “About one year into the project, they and other OEM aircraft manufactures were invited by Rotax to attend a meeting and were informed of the new 915iS engine.”

The timing was perfect as Rodrigo has always said, “You begin with the engine and build the aircraft around it.”

Besides the more potent engine, Scoda engineers have been busy.

I have followed Super Petrel since before it went to Brazil* more than 20 years ago. I mention this to make two points.

Super Petrel has a long history; some 400 are flying around the world. In addition, the current producer, Scoda Aeronautica, has continually made changes to the design. The video below identifies some of this history.

What’s new for 2023 is the Super Petrel XP and it’s boost to big Rotax power, the 915iS fuel injected, turbocharged, intercooled engine that seems to be steadily supplanting all prior models.

Smoother & More Powerful

Super Petrel XP

“Eight years ago, Rodrigo Scoda and his team of engineers at Scoda Aeronautica began a secret project to redesign the aircraft from the wheels up,” started the update explanation by Roger Helton president of Super Petrel USA. “About one year into the project, they and other OEM aircraft manufactures were invited by Rotax to attend a meeting and were informed of the new 915iS engine.”

The timing was perfect as Rodrigo has always said, “You begin with the engine and build the aircraft around it.”

Besides the more potent engine, Scoda engineers have been busy.“Ultra Petrel?” How Do You Make Super Petrel Even Better? Add Power And Call It “XP”

I have followed Super Petrel since before it went to Brazil* more than 20 years ago. I mention this to make two points.

What’s new for 2023 is the Super Petrel XP and it’s boost to big Rotax power, the 915iS fuel injected, turbocharged, intercooled engine that seems to be steadily supplanting all prior models.

Smoother & More Powerful

Super Petrel XP

“Eight years ago, Rodrigo Scoda and his team of engineers at Scoda Aeronautica began a secret project to redesign the aircraft from the wheels up,” started the update explanation by Roger Helton president of Super Petrel USA. “About one year into the project, they and other OEM aircraft manufactures were invited by Rotax to attend a meeting and were informed of the new 915iS engine.”

Besides the more potent engine, Scoda engineers have been busy. The latest version shows several improvements.

- A longer hull enhances hydrodynamic efficiency.

- A new airfoil has been created using fully composite tapered wings, eliminating the Dacron fabric and resulting in improved speed, efficiency, and stability. Carbon fiber strut fairings and built-in landing and position lights are further features of the XP.

Larger tires with Beringer brakes offer improved operational performance on unprepared fields such as grass, soft sand, or rocky beaches. An electrically-actuated, hydraulically-operated landing gear retract system is optimized for ease of operation, low maintenance, and simplicity of design. The elimination of cables, arms and pulleys results in a 50% reduction of moving parts.

- A one-piece canopy improves visibility. It hinges aft for easier beach entry. A more structural nose area allows occupants to walk in and out when beaching.

- Fuel capacity has increased to 30 gallons.

- XP’s baggage area volume has been increased by 60% with special niches for Bose headsets (nearby image).

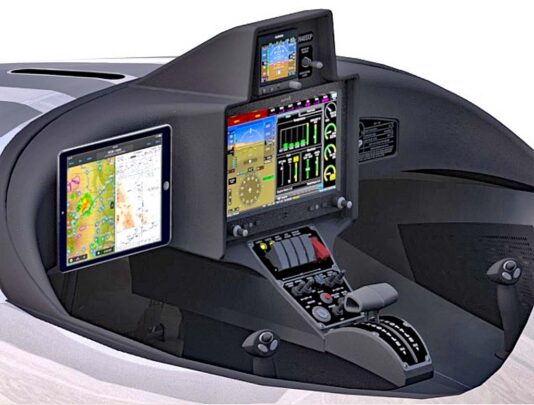

- Garmin avionics are standard: G3X Touch Screen augmented with Garmin G5 display, transponder, VHF radio, autopilot, angle of attack indicator, and ADSB in and out.

Super Petrel XP’s fuselage is longer by ten inches allowing for greater floatation providing the ability to go to the water at full maximum gross weight of 1,430 pounds.

“Remarkably, the aircraft empty weight is nearly the same as the current Super Petrel LS model with Rotax 914 at 870 pounds,” said Roger. “The ballast water system now has a gauge on the G3X along with a panel switch to add or remove water while while operating the aircraft on the water,” he added.

The landing gear is electrically actuated and hydraulically operated with a mechanical release behind the pilot seat. The doors are gone and replaced by the full canopy. The canopy can be completely operated by hand or, once unlocked, operated by a hydraulic assist. Visibility has been greatly improved with the new canopy design.

When Will XP Arrive?

“In July of this year, the first of the new Super Petrel XP, serial numbers 405 and 406, will arrive here in the U.S. at our Ormond airport facility,” said Roger. “At this time, we have firm orders for 12 aircraft.”

Roget observed several points. “Production time for an XP aircraft will be nearly 45 days less than the current LS version of the aircraft. The Super Petrel LS 400 series aircraft announced last year will no longer be offered; only the XP with Rotax 915iS engine will be offered and doing so will reduce production time. One aircraft and one engine type.”

He added, “There is only one option available for the aircraft, the colors of the graphics. Everything is standard equipment. We will deliver six aircraft in 2023 and an estimated 14 aircraft in 2024. The next available position is for June of 2024.” Prices in March 2023 suggest $289,000 when Super Petrel XP is powered by Rotax’s 915iS.

Super Petrel USA’s demonstration aircraft will be available in late July 2023 and they will begin scheduling demonstration flights soon afterward.

ARTICLE LINKS:

- Scoda Aeronautica, contact info and content on this website

- Super Petrel USA, U.S importer contact info including a link to their website

- New, “Dedicated” page for Super Petrel XP

- Rotax Aircraft Engines, contact info and content on this website

- Garmin Avionics, contact info and content on this website

This video provides additional information and visuals.

* The original design of what we now know as Super Petrel began with the Tisserand Hydroplum, a single-seat, wooden amphibian intended for kit building. It first flew in 1983. A two-seat, Rotax 532-powered Hydroplum II flew in 1986. After the French company closed, Brazilian company Edra Aeronautica (now Scoda) developed Super Petrel 100 in 2002.

I have followed Super Petrel since before it went to Brazil* more than 20 years ago. I mention this to make two points.

Super Petrel has a long history; some 400 are flying around the world. In addition, the current producer, Scoda Aeronautica, has continually made changes to the design. The video below identifies some of this history.

What’s new for 2023 is the Super Petrel XP and it’s boost to big Rotax power, the 915iS fuel injected, turbocharged, intercooled engine that seems to be steadily supplanting all prior models.

Smoother & More Powerful

Super Petrel XP

“Eight years ago, Rodrigo Scoda and his team of engineers at Scoda Aeronautica began a secret project to redesign the aircraft from the wheels up,” started the update explanation by Roger Helton president of Super Petrel USA. “About one year into the project, they and other OEM aircraft manufactures were invited by Rotax to attend a meeting and were informed of the new 915iS engine.”

The timing was perfect as Rodrigo has always said, “You begin with the engine and build the aircraft around it.”

Besides the more potent engine, Scoda engineers have been busy.

I have followed Super Petrel since before it went to Brazil* more than 20 years ago. I mention this to make two points.

Super Petrel has a long history; some 400 are flying around the world. In addition, the current producer, Scoda Aeronautica, has continually made changes to the design. The video below identifies some of this history.

What’s new for 2023 is the Super Petrel XP and it’s boost to big Rotax power, the 915iS fuel injected, turbocharged, intercooled engine that seems to be steadily supplanting all prior models.

Smoother & More Powerful

Super Petrel XP

“Eight years ago, Rodrigo Scoda and his team of engineers at Scoda Aeronautica began a secret project to redesign the aircraft from the wheels up,” started the update explanation by Roger Helton president of Super Petrel USA. “About one year into the project, they and other OEM aircraft manufactures were invited by Rotax to attend a meeting and were informed of the new 915iS engine.”

The timing was perfect as Rodrigo has always said, “You begin with the engine and build the aircraft around it.”

Besides the more potent engine, Scoda engineers have been busy.

Larger tires with

Larger tires with

How about if the aircraft was essentially free? And what if you could choose between two highly-desirable models? What if the only cost to get your “lottery” ticket was to subscribe to a popular magazine?

How about if the aircraft was essentially free? And what if you could choose between two highly-desirable models? What if the only cost to get your “lottery” ticket was to subscribe to a popular magazine? A couple years ago, the magazine — long headquartered in New York — relocated to Chattanooga, Tennessee. A new organization took it over under the banner of Flying Media. After this major move, Flying first went to quarterly while it boosted its presence online. After a year getting the electronic side running at full speed, Flying Media returned the print magazine to monthly even while keeping its thick, premium look and feel. The pages are smartly designed and full of great images and content.

A couple years ago, the magazine — long headquartered in New York — relocated to Chattanooga, Tennessee. A new organization took it over under the banner of Flying Media. After this major move, Flying first went to quarterly while it boosted its presence online. After a year getting the electronic side running at full speed, Flying Media returned the print magazine to monthly even while keeping its thick, premium look and feel. The pages are smartly designed and full of great images and content. How does that deal sound? You buy a subscription for $40 — which you should get anyway — and you are automatically entered in the prize drawing for an aircraft worth $200,000 or more. If you give a friend a gift subscription, you get an additional entry, and you can give up to 10 gifts. Somebody is going to win and the odds are fantastically better than any state lottery. You won’t be competing against millions of others. In my mind, winning a free airplane sounds like a great way to start a new year! Even if you don’t win, you’ll get a beautiful aviation magazine each month.

How does that deal sound? You buy a subscription for $40 — which you should get anyway — and you are automatically entered in the prize drawing for an aircraft worth $200,000 or more. If you give a friend a gift subscription, you get an additional entry, and you can give up to 10 gifts. Somebody is going to win and the odds are fantastically better than any state lottery. You won’t be competing against millions of others. In my mind, winning a free airplane sounds like a great way to start a new year! Even if you don’t win, you’ll get a beautiful aviation magazine each month. This year our favorite recreational flying area of the Lakeland show is sponsored by two leading names in aviation. Flying magazine is a sponsor of Paradise as is Junkers Aircraft.

This year our favorite recreational flying area of the Lakeland show is sponsored by two leading names in aviation. Flying magazine is a sponsor of Paradise as is Junkers Aircraft. Welcome to Junkers and their American importer and partner,

Welcome to Junkers and their American importer and partner,

Who cares about boats (or seaplanes) in the dead of winter? Well, what better way to endure icy streets and frigid temperatures than to go look at boats and dream of using them come summer — Plan Ahead!

Who cares about boats (or seaplanes) in the dead of winter? Well, what better way to endure icy streets and frigid temperatures than to go look at boats and dream of using them come summer — Plan Ahead! Aventura has been in operation for many years and has hundreds of their aircraft flying. These were produced by different business operations over the years but the company is in its most stable form today under the leadership of Alex Rolinski.

Aventura has been in operation for many years and has hundreds of their aircraft flying. These were produced by different business operations over the years but the company is in its most stable form today under the leadership of Alex Rolinski. The company’s Aventura II seaplane “is a versatile aircraft that is designed for recreational and commercial purposes, with safety requirements.” Alex listed several worthy reasons to consider their Aventura:

The company’s Aventura II seaplane “is a versatile aircraft that is designed for recreational and commercial purposes, with safety requirements.” Alex listed several worthy reasons to consider their Aventura: Durability and reliability: “Aventura is built with high-quality materials and is designed to withstand the rigors of operating in various environments.”

Durability and reliability: “Aventura is built with high-quality materials and is designed to withstand the rigors of operating in various environments.” Affordable: “Aventura II is fuel-efficient, keeping operating costs lower. The Kit is the most affordable seaplane in the market, and takes around 250 hours to build.”

Affordable: “Aventura II is fuel-efficient, keeping operating costs lower. The Kit is the most affordable seaplane in the market, and takes around 250 hours to build.” In early 2023, prices start at $60,000 for an Aventura II kit. The factory can walk you through numerous options or features you may want to provide a more specific price and time availability. However, Alex presently states that kits are available in four months.

In early 2023, prices start at $60,000 for an Aventura II kit. The factory can walk you through numerous options or features you may want to provide a more specific price and time availability. However, Alex presently states that kits are available in four months.

You truly need to see these performances to believe what determined pilots in suitable aircraft can do. I encourage all to come on down to sunny Florida for Sun ‘n Fun 2023 and check out the action in Paradise City (formerly the “Ultralight/Lightplane Area” and now badged as “

You truly need to see these performances to believe what determined pilots in suitable aircraft can do. I encourage all to come on down to sunny Florida for Sun ‘n Fun 2023 and check out the action in Paradise City (formerly the “Ultralight/Lightplane Area” and now badged as “ Like its counterpart at AirVenture in the Fun Fly Zone (also the former Ultralight Area), crowds can get close enough to see the STOL performances in great detail. Usually you have to arrive early enough to get a place at the fence. I’ve seen spectators 10-deep at both events.

Like its counterpart at AirVenture in the Fun Fly Zone (also the former Ultralight Area), crowds can get close enough to see the STOL performances in great detail. Usually you have to arrive early enough to get a place at the fence. I’ve seen spectators 10-deep at both events. Before

Before  Using his powerful Viking engines but also adding adding a super-special humongous landing gear arrangment to maximize rotation-for-takeoff performance Jan Eggenfellner created his Monster STOL.

Using his powerful Viking engines but also adding adding a super-special humongous landing gear arrangment to maximize rotation-for-takeoff performance Jan Eggenfellner created his Monster STOL. Fellow Zenith pilot Daniel Wright finished in second place flying his blue and white Zenith STOL (registration JRM) with a takeoff roll of just 19.0 meters (62.3 feet) and landing roll of 30.7 meters (100.7 feet), for a combined distance of just 49.7 meters (163.1 feet). Both pilots can be seen performing in the short video below.

Fellow Zenith pilot Daniel Wright finished in second place flying his blue and white Zenith STOL (registration JRM) with a takeoff roll of just 19.0 meters (62.3 feet) and landing roll of 30.7 meters (100.7 feet), for a combined distance of just 49.7 meters (163.1 feet). Both pilots can be seen performing in the short video below.

Maybe pilots are frustrated because FAA has delayed the release of Mosaic. This also happened almost 20 years ago with the Sport Pilot / Light-Sport Aircraft regulation. SP/LSA was anticipated for more than three years after the first announcement.

Maybe pilots are frustrated because FAA has delayed the release of Mosaic. This also happened almost 20 years ago with the Sport Pilot / Light-Sport Aircraft regulation. SP/LSA was anticipated for more than three years after the first announcement.

Jabiru

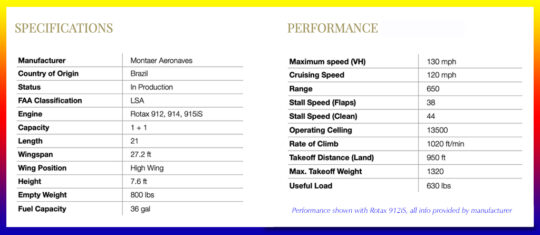

Jabiru Montaer

Montaer The Airplane Factory

The Airplane Factory

More Available

More Available *

* For FAA, this is somewhat new ground. It’s unusual for the agency to release this much information about a regulation before they issue it. These things change internally as different FAA departments weigh in, so they usually keep their cards close to the chest until the NPRM (Notice of Proposed Rule Making) is near final form. All this relates only to the airframe.

For FAA, this is somewhat new ground. It’s unusual for the agency to release this much information about a regulation before they issue it. These things change internally as different FAA departments weigh in, so they usually keep their cards close to the chest until the NPRM (Notice of Proposed Rule Making) is near final form. All this relates only to the airframe.

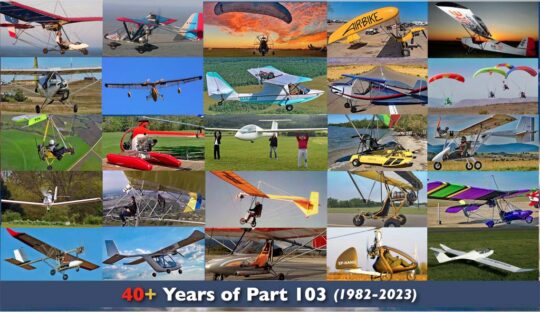

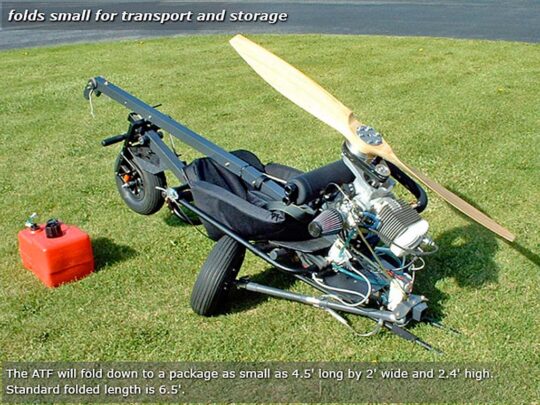

After Covid, so many things changed for so long that, today, it’s getting hard to remember how it was. EAA hosted (in-person) Ultralight Days for some years, with a wintery gathering of aviation’s lightest flying machines at their splendid facilities right behind the HQ building. Specifically I mean Pioneer Airport. Covid played a role in suspending that event.

After Covid, so many things changed for so long that, today, it’s getting hard to remember how it was. EAA hosted (in-person) Ultralight Days for some years, with a wintery gathering of aviation’s lightest flying machines at their splendid facilities right behind the HQ building. Specifically I mean Pioneer Airport. Covid played a role in suspending that event. Using their system that worked beautifully for homebuilders, EAA cooked up Virtual Ultralight Days.

Using their system that worked beautifully for homebuilders, EAA cooked up Virtual Ultralight Days. That covers a lot of ground. How could EAA gurus deliver all this useful information? One word: Webinars… and plenty of them. In about two weeks — over February 21-22-23, 2023 — EAA will present five seminars a day, a total of 15 highly information presentations. See all sessions referenced below.

That covers a lot of ground. How could EAA gurus deliver all this useful information? One word: Webinars… and plenty of them. In about two weeks — over February 21-22-23, 2023 — EAA will present five seminars a day, a total of 15 highly information presentations. See all sessions referenced below. Yet that’s not all the interaction you can have. During these talks, EAA can survey listeners. As one of the presenters, I am excited about this. When I give a talk in person, I often start out asking some questions of attendees so I can better suit my remarks to their interest and experience. On a webinar the presenter cannot see his or her audience so how do they know who is watching? Surveys will help plus give you a chance to interact.

Yet that’s not all the interaction you can have. During these talks, EAA can survey listeners. As one of the presenters, I am excited about this. When I give a talk in person, I often start out asking some questions of attendees so I can better suit my remarks to their interest and experience. On a webinar the presenter cannot see his or her audience so how do they know who is watching? Surveys will help plus give you a chance to interact. “Anyone can register for any presentation,” EAA said, “by going to their

“Anyone can register for any presentation,” EAA said, “by going to their

Tim and Helen Bridge are developing the ‘electric sky jeep,’ an all-electric

Tim and Helen Bridge are developing the ‘electric sky jeep,’ an all-electric  “The Bridges’ company plans to tap into ground-based networks of solar-powered energy grids in remote towns and villages,” said Zenith, “so that the aircraft can fly between villages delivering vital medical staff and supplies without relying on outside fuel that needs to be flown in to the location.”

“The Bridges’ company plans to tap into ground-based networks of solar-powered energy grids in remote towns and villages,” said Zenith, “so that the aircraft can fly between villages delivering vital medical staff and supplies without relying on outside fuel that needs to be flown in to the location.”

Sebring Expo accomplished its principal goal for the race-city airport: to put it on the aviation map in a definitive way. Led by longtime airport manager Mike Willingham, Sebring enjoyed a remarkable run and the young LSA industry benefitted greatly from their event. If you’re curious about how and why Sebring called it quits, check this

Sebring Expo accomplished its principal goal for the race-city airport: to put it on the aviation map in a definitive way. Led by longtime airport manager Mike Willingham, Sebring enjoyed a remarkable run and the young LSA industry benefitted greatly from their event. If you’re curious about how and why Sebring called it quits, check this

Held annually at the Mt. Vernon Outland Airport (KMVN), Midwest is focused on showcasing all things light aviation. Although the event serves the LSA, Sport Pilot-eligible kit-built aircraft and 103 ultralight communities, all segments of aviation are welcome.

Held annually at the Mt. Vernon Outland Airport (KMVN), Midwest is focused on showcasing all things light aviation. Although the event serves the LSA, Sport Pilot-eligible kit-built aircraft and 103 ultralight communities, all segments of aviation are welcome.

“Midwest Expo will feature the best of the best in the sport aircraft communities to include Light-Sport Aircraft, ultralights, kit planes, powered parachutes, powered paragliders, trikes, gyroplanes, amphibians and more,” said Chris.

“Midwest Expo will feature the best of the best in the sport aircraft communities to include Light-Sport Aircraft, ultralights, kit planes, powered parachutes, powered paragliders, trikes, gyroplanes, amphibians and more,” said Chris. If you live within range — people travel from all over the USA and even foreign countries — Midwest Expo offers free admission, free parking, and free camping. Based around the terminal building at KMVN, visitors will find a very popular restaurant (seriously, local residents regularly fill the place). In addition, forums are held indoors plus everyone appreciates clean, proper restrooms.

If you live within range — people travel from all over the USA and even foreign countries — Midwest Expo offers free admission, free parking, and free camping. Based around the terminal building at KMVN, visitors will find a very popular restaurant (seriously, local residents regularly fill the place). In addition, forums are held indoors plus everyone appreciates clean, proper restrooms.

In North America, Skyleader is represented by Michael Tomazin using the web domain

In North America, Skyleader is represented by Michael Tomazin using the web domain

“Skyleader 400 is designed for recreational flying and pilot training. It is distinguished by its … sports car-inspired looks and unique gull-wing-doors canopy,” said the U.S. representative. “It features a spacious interior with plenty of space for pilots and baggage (aft of the seats), and a 21-gallon fuel tank that gives the 400 a range of around 500 miles depending on engine selections and options.” Larger fuel options are available.

“Skyleader 400 is designed for recreational flying and pilot training. It is distinguished by its … sports car-inspired looks and unique gull-wing-doors canopy,” said the U.S. representative. “It features a spacious interior with plenty of space for pilots and baggage (aft of the seats), and a 21-gallon fuel tank that gives the 400 a range of around 500 miles depending on engine selections and options.” Larger fuel options are available.

Skyleader 400 follows the entire Skyleader line using Fowler-style flaps that work exceptionally hard when deployed and hide almost completely when retracted. It’s an elegant system, especially so on aircraft in the lighter range, and this yields stalls that happen well below what the LSA regulations require.

Skyleader 400 follows the entire Skyleader line using Fowler-style flaps that work exceptionally hard when deployed and hide almost completely when retracted. It’s an elegant system, especially so on aircraft in the lighter range, and this yields stalls that happen well below what the LSA regulations require. Worldwide, the company fleet is estimated at about 350 Skyleader 600s, Michael indicated. Counting all models, close to 600 of the company’s airplanes are flying. “This is their 23rd year,” Michael said. “They laid off nobody during Covid and they presently have many orders,” he added. “If we could get all the avionics we needed, we could deliver faster.”

Worldwide, the company fleet is estimated at about 350 Skyleader 600s, Michael indicated. Counting all models, close to 600 of the company’s airplanes are flying. “This is their 23rd year,” Michael said. “They laid off nobody during Covid and they presently have many orders,” he added. “If we could get all the avionics we needed, we could deliver faster.” Designer Antonín Píštěk also worked with Evektor — based in the same area as Jihlavan — on the five-seat VUT 100 Cobra aircraft designed for approval under conventional certification.

Designer Antonín Píštěk also worked with Evektor — based in the same area as Jihlavan — on the five-seat VUT 100 Cobra aircraft designed for approval under conventional certification.

Most commonly, you hear “drone.”

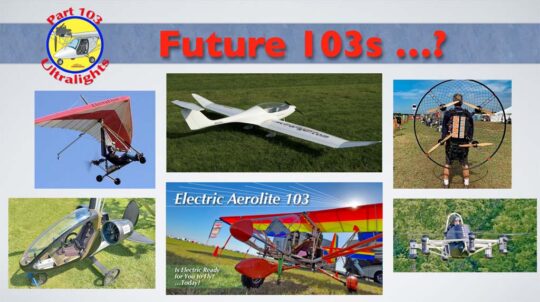

Most commonly, you hear “drone.” The Spectrum article refers to 350 aircraft developments in the eVTOL field, spanning 48 countries. How many will make it to market and succeed? When will public acceptance allow executives to zip over urban congestion in their buzzing contraptions? Will FAA ever finish regulating them? All these questions are unknown.

The Spectrum article refers to 350 aircraft developments in the eVTOL field, spanning 48 countries. How many will make it to market and succeed? When will public acceptance allow executives to zip over urban congestion in their buzzing contraptions? Will FAA ever finish regulating them? All these questions are unknown. All models featured here are single-seat aircraft that may possibly qualify for Part 103 regulations. Two of these companies, Lift Aircraft and Opener, have engaged

All models featured here are single-seat aircraft that may possibly qualify for Part 103 regulations. Two of these companies, Lift Aircraft and Opener, have engaged  Recon is compact (like all of these), only 15.5 feet long, 7.5 feet wide, and just under five feet tall. It weighs a reported 286 pounds, though more detail was not available.

Recon is compact (like all of these), only 15.5 feet long, 7.5 feet wide, and just under five feet tall. It weighs a reported 286 pounds, though more detail was not available. “It’s easier to operate a flying ATV than you think — or, at least it was for me. That’s not a humblebrag either. It was designed so any idiot like me — who backs up into his recycling bin every time he pulls out of the driveway — can jump in and use it,” wrote Tony Ho Tran for the Daily Beast. Is it a good thing that a complete newbie can get in and fly one of these?

“It’s easier to operate a flying ATV than you think — or, at least it was for me. That’s not a humblebrag either. It was designed so any idiot like me — who backs up into his recycling bin every time he pulls out of the driveway — can jump in and use it,” wrote Tony Ho Tran for the Daily Beast. Is it a good thing that a complete newbie can get in and fly one of these? Based in Australia, Alauda Aeronautics said, “[We are] building performance electric flying cars” and “racing to deliver a revolution in personal air mobility so everyone will own a flying car.” On their website, information is very sparse but they quickly introduce the reader to Airspeeder, the “world’s first series for electric flying cars.” While their website suggests Alauda also has more orthodox goals, they appear focused on air racing vehicles. Alauda supports Airspeeder developer Mike Pearson as he forms a new league.

Based in Australia, Alauda Aeronautics said, “[We are] building performance electric flying cars” and “racing to deliver a revolution in personal air mobility so everyone will own a flying car.” On their website, information is very sparse but they quickly introduce the reader to Airspeeder, the “world’s first series for electric flying cars.” While their website suggests Alauda also has more orthodox goals, they appear focused on air racing vehicles. Alauda supports Airspeeder developer Mike Pearson as he forms a new league. Alauda’s all-electric aircraft, which is expected to have a range of 25 miles and a Part 103-compliant top speed of 63 mph, could be used for tasks such as inspecting crops and rounding up livestock, goals similar to those expressed by Ryse Aero.

Alauda’s all-electric aircraft, which is expected to have a range of 25 miles and a Part 103-compliant top speed of 63 mph, could be used for tasks such as inspecting crops and rounding up livestock, goals similar to those expressed by Ryse Aero. Jetson reported their Jetson One is “built to comply with existing FAA regulations,” though they don’t state which rule. We presume Part 103 as anything higher on the certification scheme is not yet ready for market. However, unlike Lift and Opener, they have not reached out to LAMA for TSC confirmation.

Jetson reported their Jetson One is “built to comply with existing FAA regulations,” though they don’t state which rule. We presume Part 103 as anything higher on the certification scheme is not yet ready for market. However, unlike Lift and Opener, they have not reached out to LAMA for TSC confirmation. What will one of these machines set you back? “A down payment of $22,000 is required [at the time of ordering]. A final payment of $70,000 when your Jetson One is ready for delivery at the factory.” Does $92,000 sound affordable to you?

What will one of these machines set you back? “A down payment of $22,000 is required [at the time of ordering]. A final payment of $70,000 when your Jetson One is ready for delivery at the factory.” Does $92,000 sound affordable to you? Distance and location are also computer controlled and that’s perfect for Lift’s initial plan.

Distance and location are also computer controlled and that’s perfect for Lift’s initial plan. “Traffic congestion and long commutes are two leading causes of stress and reduction in quality of life,” believes Opener. “Countless hours are wasted on roads each day, idling in traffic, time that could be better spent with family and friends.” Who can argue yet range anxiety and a lack of experience flying this unorthodox aircraft may hold back buyers. That’s OK as it is often “early adopters” that start the trend.

“Traffic congestion and long commutes are two leading causes of stress and reduction in quality of life,” believes Opener. “Countless hours are wasted on roads each day, idling in traffic, time that could be better spent with family and friends.” Who can argue yet range anxiety and a lack of experience flying this unorthodox aircraft may hold back buyers. That’s OK as it is often “early adopters” that start the trend.

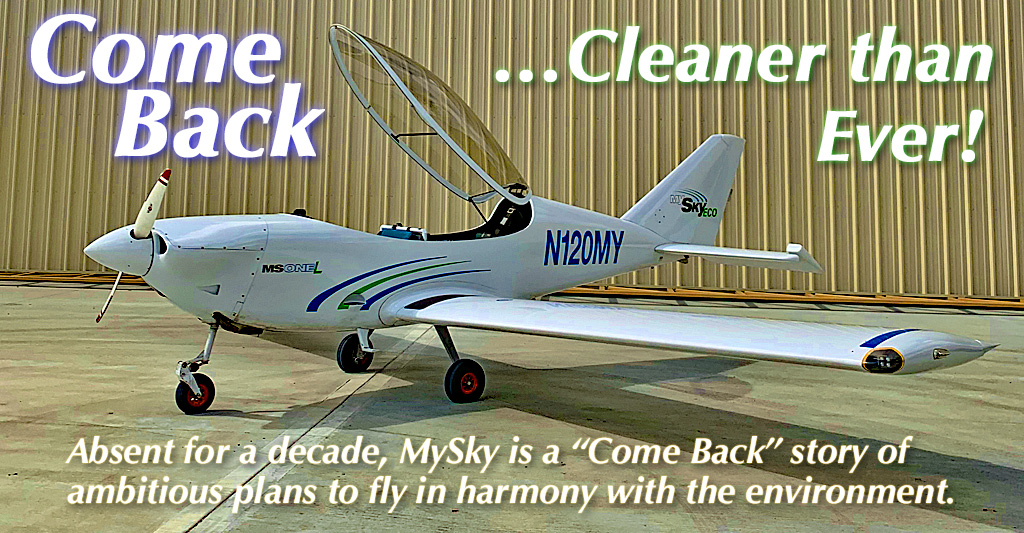

For the past few years that torrid pace slowed… just as it has in every other industry I’ve examined. However, in aviation it is uncommon for a good airplane to actually disappear forever. Designs worth their avgas often manage a come-back, a term meant to show a return to market for a flying machine some may have written off earlier.

For the past few years that torrid pace slowed… just as it has in every other industry I’ve examined. However, in aviation it is uncommon for a good airplane to actually disappear forever. Designs worth their avgas often manage a come-back, a term meant to show a return to market for a flying machine some may have written off earlier. One thing MS-1 did not have going for it: the design arrived to the party amidst so many other new designs that it was easy to get lost in the crowd. Proprietor and principal investor Dieter Canje wisely set the project aside while the dust cleared.

One thing MS-1 did not have going for it: the design arrived to the party amidst so many other new designs that it was easy to get lost in the crowd. Proprietor and principal investor Dieter Canje wisely set the project aside while the dust cleared. “MySky MS-1 is making a comeback, with an ecological twist,” said Dieter. “We believed our MySky MS-1 was a promising light aircraft project about 10, 12 years ago. Unfortunately, MySky Aircraft never made any efforts to put the model into production.”

“MySky MS-1 is making a comeback, with an ecological twist,” said Dieter. “We believed our MySky MS-1 was a promising light aircraft project about 10, 12 years ago. Unfortunately, MySky Aircraft never made any efforts to put the model into production.” Why did you not put MySky MS-1 in production in 2010?

Why did you not put MySky MS-1 in production in 2010? “In 2015, we formed MySky Eco with the intent to modify MS-1 into an electric aircraft,” Dieter said. “But we found that the time was not ready yet. Even now, endurance and range limits its use to flight training. However, there is strong demand in this market segment.”

“In 2015, we formed MySky Eco with the intent to modify MS-1 into an electric aircraft,” Dieter said. “But we found that the time was not ready yet. Even now, endurance and range limits its use to flight training. However, there is strong demand in this market segment.” What is MySkyECO MS-1L?

What is MySkyECO MS-1L? Can a tandem aircraft be used for flight training?

Can a tandem aircraft be used for flight training?

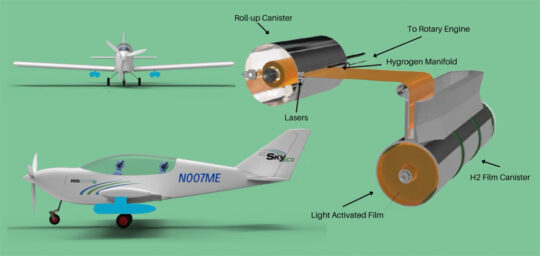

Electric has appeal but a method of extending range on an electric airplane would be useful for longer missions than flight training. “We are working on a range extender based on the rotary engine concept, using Jet-A,” said MySky.

Electric has appeal but a method of extending range on an electric airplane would be useful for longer missions than flight training. “We are working on a range extender based on the rotary engine concept, using Jet-A,” said MySky.

Aircraft seen in nearby images is the VL3, a plane formerly designed by Vanessa Air and produced by Aveko. Americans first came to know a variation of this model as the

Aircraft seen in nearby images is the VL3, a plane formerly designed by Vanessa Air and produced by Aveko. Americans first came to know a variation of this model as the  Add another three years taking us to 2015 and JMB began fully producing the fuselage and wings, work that had previously been subcontracted. Today, JMB Aircraft is in full production at their Chocen, Czech Republic facility.

Add another three years taking us to 2015 and JMB began fully producing the fuselage and wings, work that had previously been subcontracted. Today, JMB Aircraft is in full production at their Chocen, Czech Republic facility. CEO Jean Marie Guisset gathered and addressed all JMB Aircraft employees (nearby image) and said, “This is another unique landmark for JMB. We are improving our product every single day, and the biggest thank you goes to all of you who are standing here, because you are the ones who make it happen.”

CEO Jean Marie Guisset gathered and addressed all JMB Aircraft employees (nearby image) and said, “This is another unique landmark for JMB. We are improving our product every single day, and the biggest thank you goes to all of you who are standing here, because you are the ones who make it happen.” A well-evolved design, Evolution is a 250-knot-cruise aircraft that can climb 4,000 feet per minute powered by its Pratt & Whitney turbine powerplant. About 100 of these cabin-class speedsters are flying around the world.

A well-evolved design, Evolution is a 250-knot-cruise aircraft that can climb 4,000 feet per minute powered by its Pratt & Whitney turbine powerplant. About 100 of these cabin-class speedsters are flying around the world. At this year’s AirVenture Oshkosh, the two companies exhibited together (image), giving them a good venue to launch their fresh collaboration. Officially, JMB will take over the production of the Evolution at their facility in Czech Republic, as well as help with the sales and marketing. The part of Evolution Aircraft based in the United States will handle research & development and provide services and maintenance.

At this year’s AirVenture Oshkosh, the two companies exhibited together (image), giving them a good venue to launch their fresh collaboration. Officially, JMB will take over the production of the Evolution at their facility in Czech Republic, as well as help with the sales and marketing. The part of Evolution Aircraft based in the United States will handle research & development and provide services and maintenance. Both companies are passionate about their aircraft, each extreme speedsters in their class. It would appear a well-considered and sound collaboration.

Both companies are passionate about their aircraft, each extreme speedsters in their class. It would appear a well-considered and sound collaboration.

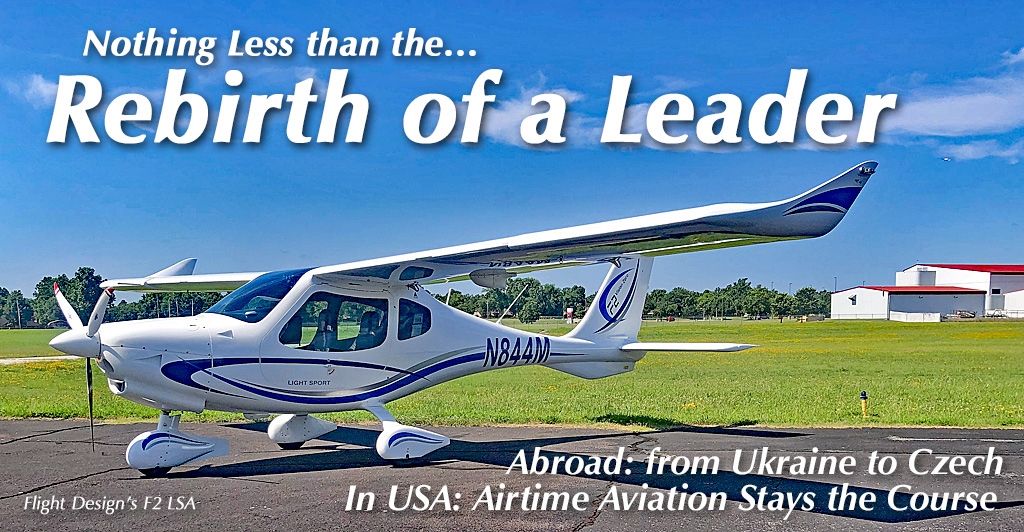

In the middle of the last decade, long before Putin’s aggression, LSA market leader Flight Design went through a German-imposed reorganization. While difficult, the company emerged stronger and more stable.

In the middle of the last decade, long before Putin’s aggression, LSA market leader Flight Design went through a German-imposed reorganization. While difficult, the company emerged stronger and more stable.

Despite such hardships, Flight Design’s German leaders and team closed ranks and moved production to Šumperk, Czech Republic, near the country’s northern border with Poland, about 100 miles east of Prague.

Despite such hardships, Flight Design’s German leaders and team closed ranks and moved production to Šumperk, Czech Republic, near the country’s northern border with Poland, about 100 miles east of Prague.

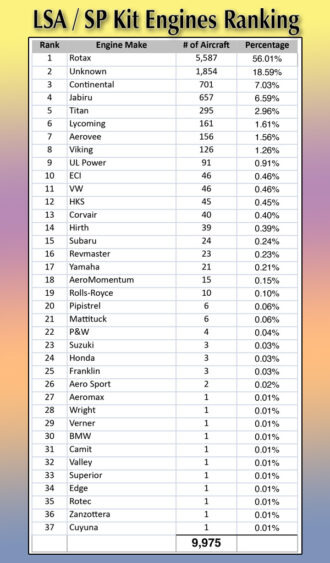

In light aviation, we have a roughly similar situation. Rotax provides somewhere around 70-80% of all engines for aircraft in the light aircraft space globally. The remaining 20-30% is divided between Continental or Titan, Jabiru, ULPower, and a growing collection of converted auto engines (though the latter, without ASTM approval, are used only on kit aircraft or ELSAs).

In light aviation, we have a roughly similar situation. Rotax provides somewhere around 70-80% of all engines for aircraft in the light aircraft space globally. The remaining 20-30% is divided between Continental or Titan, Jabiru, ULPower, and a growing collection of converted auto engines (though the latter, without ASTM approval, are used only on kit aircraft or ELSAs). So, Jabiru may not be #1, but the “down-under” company achieved a significant benchmark when they shipped number 4,000 of the 2200 series. Jabiru’s 3300 six-cylinder 120-horsepower model is well past 3,000 engines shipped. Therefore, almost 8,000 airplane owners are carried into the sky by Jabiru. Contrasted to the entire American LSA, ELSA, Sport Pilot kit-built aircraft fleet of almost 10,000 aircraft (see

So, Jabiru may not be #1, but the “down-under” company achieved a significant benchmark when they shipped number 4,000 of the 2200 series. Jabiru’s 3300 six-cylinder 120-horsepower model is well past 3,000 engines shipped. Therefore, almost 8,000 airplane owners are carried into the sky by Jabiru. Contrasted to the entire American LSA, ELSA, Sport Pilot kit-built aircraft fleet of almost 10,000 aircraft (see

“These Pipistrel powerplant entries are for electric-powered aircraft as the

“These Pipistrel powerplant entries are for electric-powered aircraft as the

Other powerful engines are available, for example, the even-higher-horsepower Titan from

Other powerful engines are available, for example, the even-higher-horsepower Titan from  Although no one is saying it today, I perceive that his is a smart play to prepare for Mosaic LSA. Given a cabin that has already accommodated four seats and three doors to serve all those seats, adding an engine powerful enough to carry four makes Montaer a shoe-in to offer such a model in 2025 after the new regulation should emerge.

Although no one is saying it today, I perceive that his is a smart play to prepare for Mosaic LSA. Given a cabin that has already accommodated four seats and three doors to serve all those seats, adding an engine powerful enough to carry four makes Montaer a shoe-in to offer such a model in 2025 after the new regulation should emerge. Montaer wrote, “[We have] the roomiest cockpit in the entire LSA category. Montaer MC-01 was originally designed as a four-seater aircraft in Brazil (when different regulations applied), therefore, the removal of the two back seats, with an existing third door, produces impressive room for cargo. Also [we offer plenty of] legroom for pilot and passenger.” The company added a line that should work for lots of pilots: “No challenge for the big guys.”

Montaer wrote, “[We have] the roomiest cockpit in the entire LSA category. Montaer MC-01 was originally designed as a four-seater aircraft in Brazil (when different regulations applied), therefore, the removal of the two back seats, with an existing third door, produces impressive room for cargo. Also [we offer plenty of] legroom for pilot and passenger.” The company added a line that should work for lots of pilots: “No challenge for the big guys.” However, with the 915iS engine on a present-day LSA two seater, this bird is going to soar. Climb rate shown in the specification box nearby is for a 912iS-powered MC01. With another 41 horsepower, the “Monster Montaer” should shoot upwards like a homesick angel. If someone in a MC01 915 challenges your Skyhawk to a climb contest, don’t take the bait. You’ll lose… by a wide margin.

However, with the 915iS engine on a present-day LSA two seater, this bird is going to soar. Climb rate shown in the specification box nearby is for a 912iS-powered MC01. With another 41 horsepower, the “Monster Montaer” should shoot upwards like a homesick angel. If someone in a MC01 915 challenges your Skyhawk to a climb contest, don’t take the bait. You’ll lose… by a wide margin. Before the Covid panic hit worldwide, Montaer was accepted by FAA as a Special LSA after the company verified that it had met all ASTM Standards for Light-Sport Aircraft. Shortly afterward, in 2021, Montaer established a presence at DeLand Municipal Airport, Florida airport by partnering with Shalom Confessor of the

Before the Covid panic hit worldwide, Montaer was accepted by FAA as a Special LSA after the company verified that it had met all ASTM Standards for Light-Sport Aircraft. Shortly afterward, in 2021, Montaer established a presence at DeLand Municipal Airport, Florida airport by partnering with Shalom Confessor of the  The reference is to an additional control added to allow pilots without the use of their legs to operate the MC01 (nearby image). Such pilots have a few choices but Montaer’s entry is modern and handsome.

The reference is to an additional control added to allow pilots without the use of their legs to operate the MC01 (nearby image). Such pilots have a few choices but Montaer’s entry is modern and handsome.

Is is even possible to fly an aircraft without all these advanced devices and services? Who would want such a simple aircraft?

Is is even possible to fly an aircraft without all these advanced devices and services? Who would want such a simple aircraft?

North Wing carefully prices everything they sell — from full-sized aircraft to small accessories — on their website. All shoppers can applaud such full disclosure while budget-conscious buyers especially appreciate the forthright way North Wing does business.

North Wing carefully prices everything they sell — from full-sized aircraft to small accessories — on their website. All shoppers can applaud such full disclosure while budget-conscious buyers especially appreciate the forthright way North Wing does business.

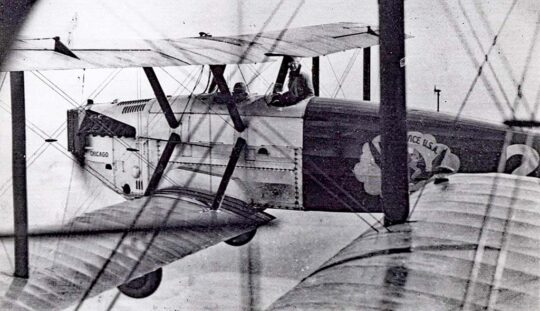

However, very long flights in an open cockpit airplane are rare. The very first such involved four open cockpit Douglas World Cruiser aircraft, which Donald Douglas modified from his DT-2 torpedo bomber.

However, very long flights in an open cockpit airplane are rare. The very first such involved four open cockpit Douglas World Cruiser aircraft, which Donald Douglas modified from his DT-2 torpedo bomber.

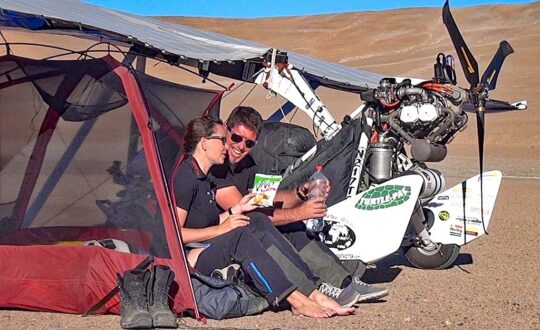

“Born in Berlin,” Rotax continued, “Andreas Zmuda has been an adventurer since he was a young lad. He hitchhiked all over Europe with a backpack when he was 15, before he emigrated to Venezuela in the early 1990s and gained a fascination for other cultures, traditions, and ways of life.”

“Born in Berlin,” Rotax continued, “Andreas Zmuda has been an adventurer since he was a young lad. He hitchhiked all over Europe with a backpack when he was 15, before he emigrated to Venezuela in the early 1990s and gained a fascination for other cultures, traditions, and ways of life.” In November 2010, Andreas met Doreen during an Amazon expedition through Peru, Bolivia and Brazil, where he was the expedition leader and Doreen was a tourist.

In November 2010, Andreas met Doreen during an Amazon expedition through Peru, Bolivia and Brazil, where he was the expedition leader and Doreen was a tourist. For a short time both Andreas and Doreen returned to freezing-cold Germany, but this only lasted a few months. They were much too motivated to experience new adventures, so they decided in summer 2012 to sell everything they had and take off for a 160,000 kilometer-long (100,000 mile) world record flight through 101 countries, which would last for the next few years.

For a short time both Andreas and Doreen returned to freezing-cold Germany, but this only lasted a few months. They were much too motivated to experience new adventures, so they decided in summer 2012 to sell everything they had and take off for a 160,000 kilometer-long (100,000 mile) world record flight through 101 countries, which would last for the next few years. Beyond that, flights across Central and South America included their own special perils

Beyond that, flights across Central and South America included their own special perils

Full Disclosure — Andreas and Doreen did not fly the entire route shown on the nearby map. Remember, this flight took place during some of low points of the global Covid panic. As Andreas wrote earlier on Facebook, “These are really crazy times at the moment and we will fly from Madrid to Portugal in February, but then [we will] transport the trike in a container to South Africa. Flying along the west coast [of Africa] is just not possible right now.” This was also a time of supply line constraints and container shipping expenses that quadrupled. Shipment of the trike involved considerable delays.

Full Disclosure — Andreas and Doreen did not fly the entire route shown on the nearby map. Remember, this flight took place during some of low points of the global Covid panic. As Andreas wrote earlier on Facebook, “These are really crazy times at the moment and we will fly from Madrid to Portugal in February, but then [we will] transport the trike in a container to South Africa. Flying along the west coast [of Africa] is just not possible right now.” This was also a time of supply line constraints and container shipping expenses that quadrupled. Shipment of the trike involved considerable delays.

Yes, those of us in countries where private aviation is well-established take for granted the privilege of flying cross country. In fact, it’s one of the great joys we love to experience. It’s a fantastic way to see the country. That’s simply doesn’t happen in China. …Or, it didn’t. Things are changing and one company has forged ahead despite the challenges.

Yes, those of us in countries where private aviation is well-established take for granted the privilege of flying cross country. In fact, it’s one of the great joys we love to experience. It’s a fantastic way to see the country. That’s simply doesn’t happen in China. …Or, it didn’t. Things are changing and one company has forged ahead despite the challenges.