Icon Informs Customers Longtime Icon PR guy Brian Manning wrote recently. He informed me he would leaving Icon at the end of this year, adding, “I’ve experienced all the ups and downs of a startup aircraft company over the years, and I’m very proud of the accomplishments along the way. I’m still yet to meet anybody who’s been up in the A5 who came away disappointed in the experience. It’s an incredible airplane that’s been a passion project for so many talented people over the years.” Brian has been a dependable contact at the company for nine years. His talents will readily transfer elsewhere but his departure signals more than his own situation. He continued, “I would like to share a note that Jason Huang, the current but outbound president, wrote to some of our owners recently.” “Icon Aircraft will be transitioning a portion of its manufacturing to a new, state-of-the-art facility in China,” wrote Jason Huang.

Big Changes for Major LSA Producers, Icon Aircraft and Flight Design

Icon Informs Customers

Longtime Icon PR guy Brian Manning wrote recently. He informed me he would leaving Icon at the end of this year, adding, "I’ve experienced all the ups and downs of a startup aircraft company over the years, and I'm very proud of the accomplishments along the way. I’m still yet to meet anybody who’s been up in the A5 who came away disappointed in the experience. It’s an incredible airplane that’s been a passion project for so many talented people over the years."Flight Design Reorganizes… Again.

Two months ago, I reported that production was rising for Flight Design's impressive F-2 that will quickly adapt to Mosaic. Despite that advance, the massive upheaval triggered by the Russia-Ukraine war is still taking its toll on the German designer. Flight Design operates at multiple sites. Currently most manufacturing operations occur in the Czech Republic. The company and many personnel were forced to move after Russia invaded Ukraine. The earliest military operations were in Kherson, where Flight Design fabricated CT-series aircraft and began development of the F-2 line.

In a recent announcement the company, headquartered and owned in Germany, reported they had filed for what Germans call insolvency.

"The managing director of Flight Design general aviation filed for insolvency at the Meiningen district court on December 3, 2024," the company wrote. "Outstanding debts in the mid-six-figure range and unpaid undisputed claims led to a liquidity bottleneck."

Flight Design operates at multiple sites. Currently most manufacturing operations occur in the Czech Republic. The company and many personnel were forced to move after Russia invaded Ukraine. The earliest military operations were in Kherson, where Flight Design fabricated CT-series aircraft and began development of the F-2 line.

In a recent announcement the company, headquartered and owned in Germany, reported they had filed for what Germans call insolvency.

"The managing director of Flight Design general aviation filed for insolvency at the Meiningen district court on December 3, 2024," the company wrote. "Outstanding debts in the mid-six-figure range and unpaid undisputed claims led to a liquidity bottleneck."

After proceedings were initiated with the responsible district court in Meiningen, Germany on Tuesday, December 3rd, 2024, the court appointed lawyer Marcello Di Stefano as provisional insolvency administrator.

According to an initial assessment, Di Stefano wrote, "After Flight Design general aviation GmbH filed for insolvency… [we see] good restructuring opportunities for one of the world market leaders in the construction of light aircraft." He added, "The company's order situation is good and the products have a very good reputation on the international market, and the outstanding debts are manageable."

After proceedings were initiated with the responsible district court in Meiningen, Germany on Tuesday, December 3rd, 2024, the court appointed lawyer Marcello Di Stefano as provisional insolvency administrator.

According to an initial assessment, Di Stefano wrote, "After Flight Design general aviation GmbH filed for insolvency… [we see] good restructuring opportunities for one of the world market leaders in the construction of light aircraft." He added, "The company's order situation is good and the products have a very good reputation on the international market, and the outstanding debts are manageable."

Aircraft on line in Sumperk, Czech Republic.

Additional Details

According to Flight Design management, the insolvency application became necessary because, on the one hand, an international customer has not yet paid undisputed claims in the mid-six-figure range and another payment in the mid-six-figure range was also delayed. Management was looking for alternative financing channels and investors. In addition to a signed but unpaid contract for €1 million, the main company shareholder could not agree to a short-term offer from an investor. Flight Design general aviation — based at Kindl airfield in Hörselberg-Hainich, Germany and production sites in Sumperk, Czech Republic, and Kherson, Ukraine — claims to be one of the world market leaders in the manufacture of light aircraft. The company is active in 48 markets worldwide.

Due to Russia's invasion of Ukraine and the temporary occupation of Kherson, production in Sumperk had to be rebuilt. Deliveries and thus sales were ramped up in the summer of 2024. There are currently 10 employees working in Germany, as well as 70 employees in the Czech Republic and 20 employees in the Ukraine. Since the company was founded in 1988 and the production facility was set up in Ukraine in 1993, the company has delivered more than 2,000 aircraft.

Flight Design general aviation — based at Kindl airfield in Hörselberg-Hainich, Germany and production sites in Sumperk, Czech Republic, and Kherson, Ukraine — claims to be one of the world market leaders in the manufacture of light aircraft. The company is active in 48 markets worldwide.

Due to Russia's invasion of Ukraine and the temporary occupation of Kherson, production in Sumperk had to be rebuilt. Deliveries and thus sales were ramped up in the summer of 2024. There are currently 10 employees working in Germany, as well as 70 employees in the Czech Republic and 20 employees in the Ukraine. Since the company was founded in 1988 and the production facility was set up in Ukraine in 1993, the company has delivered more than 2,000 aircraft.

"Buy an aircraft manufacturer with a certified product and also selling in the Light-Sport Aircraft class for, what? …£100 million? Try again and aim low: just over £12m ($15.3 million)," wrote Flyer staff.

The UK magazine reported that was the winning bid for the assets of Icon but continue reading.

"£134m ($170m) worth of debt was written off during the bankruptcy case for Icon Aircraft when it came before Judge Craig Goldblatt in Delaware last week," wrote Flyer.

"Buy an aircraft manufacturer with a certified product and also selling in the Light-Sport Aircraft class for, what? …£100 million? Try again and aim low: just over £12m ($15.3 million)," wrote Flyer staff.

The UK magazine reported that was the winning bid for the assets of Icon but continue reading.

"£134m ($170m) worth of debt was written off during the bankruptcy case for Icon Aircraft when it came before Judge Craig Goldblatt in Delaware last week," wrote Flyer.

Dürkopp Adler Group describes itself as "a global innovation and technology leader in the field of industrial sewing. We develop, produce and sell high-quality sewing machines and equipment."

ByDanJohnson.com readers will

Dürkopp Adler Group describes itself as "a global innovation and technology leader in the field of industrial sewing. We develop, produce and sell high-quality sewing machines and equipment."

ByDanJohnson.com readers will  Flyer reported the opposition

Flyer reported the opposition Law360 (paywall)

Law360 (paywall)

In our exchange, Tai and I agreed that the idea of eVTOLs may be technically achievable now, at least to some range of operation, but public acceptance of this aircraft development may still take years.

Meanwhile… Icon and its sleek A5 will continue in operation, the company has assured. Other sources I consulted were dubious about the $13.5 million investment being enough to rescue Icon, given the weight of servicing all prior investments. Only in time will we know for sure.

Americans who own an A5 aircraft are in no jeopardy, Icon assures. Sales and service will continue.

In our exchange, Tai and I agreed that the idea of eVTOLs may be technically achievable now, at least to some range of operation, but public acceptance of this aircraft development may still take years.

Meanwhile… Icon and its sleek A5 will continue in operation, the company has assured. Other sources I consulted were dubious about the $13.5 million investment being enough to rescue Icon, given the weight of servicing all prior investments. Only in time will we know for sure.

Americans who own an A5 aircraft are in no jeopardy, Icon assures. Sales and service will continue. LSA seaplanes constitute a highly fluid market yet we can see clues suggesting what might be ahead for some of the main brands. With summertime approaching, this State-of-the-Sector article attempts to keep up with the rapidly changing landscape (or waterscape).

LSA seaplanes constitute a highly fluid market yet we can see clues suggesting what might be ahead for some of the main brands. With summertime approaching, this State-of-the-Sector article attempts to keep up with the rapidly changing landscape (or waterscape).

We'll first look at two high-end entries that have been in the news and conclude with present LSA seaplanes and their status in the market.

We'll first look at two high-end entries that have been in the news and conclude with present LSA seaplanes and their status in the market.

Russ continued, "Founder Paul Vickers said the company is now raising capital to fund the push to begin deliveries on its backlog."

Vickers added, "The plane has finished its flight testing and shook out with a 120-knot cruise and useful load of 750 pounds with a Rotax 916 iS pushing it along."

Paul said the company is planning to manufacture Wave in the U.S. "Most current investors are Americans," Paul noted. A U.S. customer will receive the first Wave.

Russ continued, "Founder Paul Vickers said the company is now raising capital to fund the push to begin deliveries on its backlog."

Vickers added, "The plane has finished its flight testing and shook out with a 120-knot cruise and useful load of 750 pounds with a Rotax 916 iS pushing it along."

Paul said the company is planning to manufacture Wave in the U.S. "Most current investors are Americans," Paul noted. A U.S. customer will receive the first Wave.

Wave has had a long development cycle but their timing with Mosaic approaching next year looks prescient.

Wave has had a long development cycle but their timing with Mosaic approaching next year looks prescient.

However, Searey won

However, Searey won  According to a party I know to be reliable, new buyers are ready and have proposed to reacquire the onetime American company. Even original designer Kerry Ritcher is said to be part of the group interested in taking over from the Chinese. While plans remain uncertain, an American group could quickly breathe life back into a moribund brand. In recent years, the company's appearance at airshows was modest and unenthusiastic. Over the last year, no one has answered the phones. Now the factory is shuttered.

Under lock without access, Progressive Aerodyne is reportedly packed into containers in their former factory, while the rent continues unpaid. It looks dire, but a moderately-well-funded investor group could get up and running fairly quickly, it was imagined. The parts business alone has sustained the company and offers a route back to normal operation; reviving that would be a relief to current Searey owners. Action will depend on current ownership making a decision; when that may happen is not known.

Yet combined with the original talent that created this popular LSA seaplane, new investors could quickly brighten those cloudy skies.

According to a party I know to be reliable, new buyers are ready and have proposed to reacquire the onetime American company. Even original designer Kerry Ritcher is said to be part of the group interested in taking over from the Chinese. While plans remain uncertain, an American group could quickly breathe life back into a moribund brand. In recent years, the company's appearance at airshows was modest and unenthusiastic. Over the last year, no one has answered the phones. Now the factory is shuttered.

Under lock without access, Progressive Aerodyne is reportedly packed into containers in their former factory, while the rent continues unpaid. It looks dire, but a moderately-well-funded investor group could get up and running fairly quickly, it was imagined. The parts business alone has sustained the company and offers a route back to normal operation; reviving that would be a relief to current Searey owners. Action will depend on current ownership making a decision; when that may happen is not known.

Yet combined with the original talent that created this popular LSA seaplane, new investors could quickly brighten those cloudy skies.

The lightest-of-SLSA-seaplanes

The lightest-of-SLSA-seaplanes  "The company owes several million dollars to creditors and customers," a reliable source told me. "Employees have voiced concerns and some are taking action." Seamax leaders have reportedly managed to keep their core team using "informal payments."

"In North America, the Brazilian company allegedly has more than a dozen orders to fulfill, to customers that have made substantial deposits." The prognosis for those deliveries is unknown, though the company reportedly delivered one aircraft to America recently using unorthodox channels.

"The company owes several million dollars to creditors and customers," a reliable source told me. "Employees have voiced concerns and some are taking action." Seamax leaders have reportedly managed to keep their core team using "informal payments."

"In North America, the Brazilian company allegedly has more than a dozen orders to fulfill, to customers that have made substantial deposits." The prognosis for those deliveries is unknown, though the company reportedly delivered one aircraft to America recently using unorthodox channels.

While “buyer beware” is always good advice, one thing I've learned from decades of reporting on this particular sector of aviation: Never write off a worthy design as dead and gone. I've seen many popular aircraft such as Seamax return after internal reforms or under new leadership..

While “buyer beware” is always good advice, one thing I've learned from decades of reporting on this particular sector of aviation: Never write off a worthy design as dead and gone. I've seen many popular aircraft such as Seamax return after internal reforms or under new leadership..

Let's do this up front: the price of a ready-to-ship kit is $59,900. It's available today.

"Due to enhancements in our production capabilities," Aero Adventure stated in a recent mailing, "we produced an additional kit beyond our standard production last month (April, 2024), which is now available for purchase!"

Compare a low price and immediate delivery to any of the aircraft above. It seems like an earlier time when people could actually afford stuff and dealers had products in-stock, ready to deliver. Of course, you'll have to add an engine, avionics, and you might want to doll up the interior but the base price is righteous.

For not much more than $100,000 you could be airborne in a brand-new, well-proven seaplane from a stable manufacturer that is growing their enterprise. Given almost everything you buy has doubled in price during the 2020s, Aventura seems a genuine bargain in 2024.

Let's do this up front: the price of a ready-to-ship kit is $59,900. It's available today.

"Due to enhancements in our production capabilities," Aero Adventure stated in a recent mailing, "we produced an additional kit beyond our standard production last month (April, 2024), which is now available for purchase!"

Compare a low price and immediate delivery to any of the aircraft above. It seems like an earlier time when people could actually afford stuff and dealers had products in-stock, ready to deliver. Of course, you'll have to add an engine, avionics, and you might want to doll up the interior but the base price is righteous.

For not much more than $100,000 you could be airborne in a brand-new, well-proven seaplane from a stable manufacturer that is growing their enterprise. Given almost everything you buy has doubled in price during the 2020s, Aventura seems a genuine bargain in 2024.

If you believe it's worth a closer look,

If you believe it's worth a closer look,  I have often written about many seaworthy aircraft and invite you to

I have often written about many seaworthy aircraft and invite you to

OK, Mosaic is still around 15 months away (based on FAA's often-repeated statement). But good companies plan ahead for changes they can foresee. Icon is moving to increase capabilities on their A5 LSA seaplane… plus, the company is responding to customers who gave feedback to the California aircraft manufacturer.

OK, Mosaic is still around 15 months away (based on FAA's often-repeated statement). But good companies plan ahead for changes they can foresee. Icon is moving to increase capabilities on their A5 LSA seaplane… plus, the company is responding to customers who gave feedback to the California aircraft manufacturer.

As A5's Rotax 912iS burns less than five gallons of fuel per hour, the company said, "This equates to an additional two hours of endurance or the ability to carry more baggage or heavier passengers."

As A5's Rotax 912iS burns less than five gallons of fuel per hour, the company said, "This equates to an additional two hours of endurance or the ability to carry more baggage or heavier passengers."

“The 4-blade propeller is a huge upgrade to my Icon A5,” said Santiago Masdeau, an A5 owner based in South Florida. “I’ve flown more than 100 hours with the original 3-blade and now I have around 20 hours on the new carbon fiber 4-blade. Immediately, I noticed less vibration and noise, better acceleration, and improved takeoff distances. I’ve also experienced an increase on my cruise speed at 5,000 rpm and lower fuel burn. The entire experience is better, and it looks amazing, too!”

A 2024 A5 Limited Edition starts at $409,000 with the

“The 4-blade propeller is a huge upgrade to my Icon A5,” said Santiago Masdeau, an A5 owner based in South Florida. “I’ve flown more than 100 hours with the original 3-blade and now I have around 20 hours on the new carbon fiber 4-blade. Immediately, I noticed less vibration and noise, better acceleration, and improved takeoff distances. I’ve also experienced an increase on my cruise speed at 5,000 rpm and lower fuel burn. The entire experience is better, and it looks amazing, too!”

A 2024 A5 Limited Edition starts at $409,000 with the  Right before Christmas, read about the maiden flight of Junkers side-by-side A60, a year-end recap provided by Icon Aircraft, and year highlights from leading engine producer Rotax Aircraft Engines. Let's get started…

Right before Christmas, read about the maiden flight of Junkers side-by-side A60, a year-end recap provided by Icon Aircraft, and year highlights from leading engine producer Rotax Aircraft Engines. Let's get started…

"The style and fun factor of the A60 is enhanced by the new retractable undercarriage, the nose wheel and the fact that the pilot and passenger sit next to each other," continued Junkers. "With two different versions, a closed cabin and an open cockpit, the A60 offers a versatility that will delight pilots and aviation enthusiasts alike. Side by side it´s a celebration of freedom and a shared passion for flying."

Junkers A60 uses a 100-horsepower Rotax 912iS engine and features

"The style and fun factor of the A60 is enhanced by the new retractable undercarriage, the nose wheel and the fact that the pilot and passenger sit next to each other," continued Junkers. "With two different versions, a closed cabin and an open cockpit, the A60 offers a versatility that will delight pilots and aviation enthusiasts alike. Side by side it´s a celebration of freedom and a shared passion for flying."

Junkers A60 uses a 100-horsepower Rotax 912iS engine and features  The company continues to make progress after the global upset that came with Covid-induced shipping delays (and sky rocketing costs). "We are still quoting 8-10 months for deliveries," said Marc, though that figure is lower than most airframe producers are quoting in late 2023, so Rotax in Austria is catching up with orders.

"We are seeing lots of flight school activity," added Marc. He noted large producers like Tecnam and BRM Aero (Bristell) have order times exceeding two years for some models.

The company continues to make progress after the global upset that came with Covid-induced shipping delays (and sky rocketing costs). "We are still quoting 8-10 months for deliveries," said Marc, though that figure is lower than most airframe producers are quoting in late 2023, so Rotax in Austria is catching up with orders.

"We are seeing lots of flight school activity," added Marc. He noted large producers like Tecnam and BRM Aero (Bristell) have order times exceeding two years for some models.

"Vickers has commenced our flight testing program with Wave, wth the aircraft performing and handling as expected," announced company namesake and designer Paul Vickers. "The test pilot reported the hull is amazing and the Wave lands beautifully."

You see a long probe on the nose of the Wave. Paul said, "This allows us to easily adjust the center of gravity (CG) range and achieve the forwardmost CG." Such weight and balance changes are customary when doing flight envelope evaluations. As the video demonstrates, the pilot is growing quite comfortable with Wave.

"We are 13 years into the development of the Wave," noted Paul. "Our manufacturing facilities are complete, and initial deliveries are scheduled. We are releasing a few early delivery positions at each milestone and offering some great benefits to our early adopters."

Vickers Aircraft believes "Wave offers a unique combination of innovative features, performance, and safety." Interested parties are encouraged to

"Vickers has commenced our flight testing program with Wave, wth the aircraft performing and handling as expected," announced company namesake and designer Paul Vickers. "The test pilot reported the hull is amazing and the Wave lands beautifully."

You see a long probe on the nose of the Wave. Paul said, "This allows us to easily adjust the center of gravity (CG) range and achieve the forwardmost CG." Such weight and balance changes are customary when doing flight envelope evaluations. As the video demonstrates, the pilot is growing quite comfortable with Wave.

"We are 13 years into the development of the Wave," noted Paul. "Our manufacturing facilities are complete, and initial deliveries are scheduled. We are releasing a few early delivery positions at each milestone and offering some great benefits to our early adopters."

Vickers Aircraft believes "Wave offers a unique combination of innovative features, performance, and safety." Interested parties are encouraged to

Wayne and Kerry Richter started the company and created several designs including the flagship Searey. The Ritchers operated Progressive Aerodyne for two decades before selling to Adam Yang in 2011. Six years later, Adam sold a majority interest to Chinese investors and new management was installed.

News is sparse, as is common in such situations, but at last report Kerry indicated he was working the problem. Two days ago, Kerry posted on Facebook about his visit to China. One can hope he makes some headway for this popular design that has served more than 600 deeply-loyal customers to date.

Searey is definitely a benchmark design in the space with the longest history and the largest fleet.

Wayne and Kerry Richter started the company and created several designs including the flagship Searey. The Ritchers operated Progressive Aerodyne for two decades before selling to Adam Yang in 2011. Six years later, Adam sold a majority interest to Chinese investors and new management was installed.

News is sparse, as is common in such situations, but at last report Kerry indicated he was working the problem. Two days ago, Kerry posted on Facebook about his visit to China. One can hope he makes some headway for this popular design that has served more than 600 deeply-loyal customers to date.

Searey is definitely a benchmark design in the space with the longest history and the largest fleet.

With regret, I was forced to remove advertisements for both companies despite each supporting this website for many years. Not only were bills unpaid but repeated requests for communication, using multiple means of contact, all went unheeded. Until the lack of response is solved interested parties should be cautious and inquire carefully.

I'm an optimist and hope both brands settle their issues and return to market. I've flown Searey and Seamax and loved them both for their best qualities. I hope for better news to report.

With regret, I was forced to remove advertisements for both companies despite each supporting this website for many years. Not only were bills unpaid but repeated requests for communication, using multiple means of contact, all went unheeded. Until the lack of response is solved interested parties should be cautious and inquire carefully.

I'm an optimist and hope both brands settle their issues and return to market. I've flown Searey and Seamax and loved them both for their best qualities. I hope for better news to report.

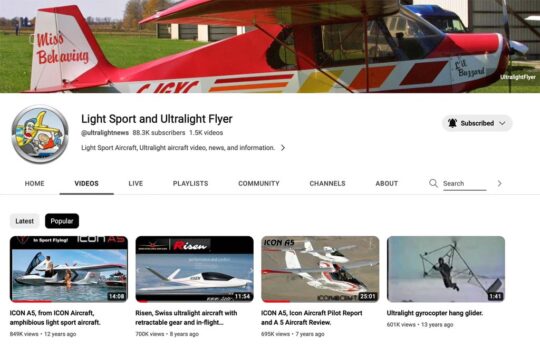

My series will touch on the top 50 most-watched videos on Videoman Dave's

My series will touch on the top 50 most-watched videos on Videoman Dave's

Here’s the #1 video in our list, followed by the #3, a Video Pilot Report on the Icon’s A5. With more than a million and a half views between them, clearly the LSA seaplane demonstrates strong appeal.

https://youtu.be/fuTaXIB4pbI

https://youtu.be/ONzOx6tEay4

Here’s the #1 video in our list, followed by the #3, a Video Pilot Report on the Icon’s A5. With more than a million and a half views between them, clearly the LSA seaplane demonstrates strong appeal.

https://youtu.be/fuTaXIB4pbI

https://youtu.be/ONzOx6tEay4

How about if the aircraft was essentially free? And what if you could choose between two highly-desirable models? What if the only cost to get your "lottery" ticket was to subscribe to a popular magazine?

Gee, fellow flying fans — I'd say that sounded like the bargain of 2023. It's the most lucrative giveaway that has been unveiled in the LSA space since it began almost 20 years ago.

How about if the aircraft was essentially free? And what if you could choose between two highly-desirable models? What if the only cost to get your "lottery" ticket was to subscribe to a popular magazine?

Gee, fellow flying fans — I'd say that sounded like the bargain of 2023. It's the most lucrative giveaway that has been unveiled in the LSA space since it began almost 20 years ago.

A couple years ago, the magazine — long headquartered in New York — relocated to Chattanooga, Tennessee. A new organization took it over under the banner of Flying Media. After this major move, Flying first went to quarterly while it boosted its presence online. After a year getting the electronic side running at full speed, Flying Media returned the print magazine to monthly even while keeping its thick, premium look and feel. The pages are smartly designed and full of great images and content.

LSA enthusiasts may be particularly interested to hear the top man in the organization is an LSA pilot and enthusiast. The leading magazine will keep a focus on jets and other high-end aircraft, but they have a fond view of lighter aviation and have plans to expand such coverage. They say you'll hear more about this at Sun 'n Fun.

A couple years ago, the magazine — long headquartered in New York — relocated to Chattanooga, Tennessee. A new organization took it over under the banner of Flying Media. After this major move, Flying first went to quarterly while it boosted its presence online. After a year getting the electronic side running at full speed, Flying Media returned the print magazine to monthly even while keeping its thick, premium look and feel. The pages are smartly designed and full of great images and content.

LSA enthusiasts may be particularly interested to hear the top man in the organization is an LSA pilot and enthusiast. The leading magazine will keep a focus on jets and other high-end aircraft, but they have a fond view of lighter aviation and have plans to expand such coverage. They say you'll hear more about this at Sun 'n Fun.

How does that deal sound? You buy a subscription for $40 — which you should get anyway — and you are automatically entered in the prize drawing for an aircraft worth $200,000 or more. If you give a friend a gift subscription, you get an additional entry, and you can give up to 10 gifts. Somebody is going to win and the odds are fantastically better than any state lottery. You won't be competing against millions of others. In my mind, winning a free airplane sounds like a great way to start a new year! Even if you don't win, you'll get a beautiful aviation magazine each month.

How does that deal sound? You buy a subscription for $40 — which you should get anyway — and you are automatically entered in the prize drawing for an aircraft worth $200,000 or more. If you give a friend a gift subscription, you get an additional entry, and you can give up to 10 gifts. Somebody is going to win and the odds are fantastically better than any state lottery. You won't be competing against millions of others. In my mind, winning a free airplane sounds like a great way to start a new year! Even if you don't win, you'll get a beautiful aviation magazine each month.

This year our favorite recreational flying area of the Lakeland show is sponsored by two leading names in aviation. Flying magazine is a sponsor of Paradise as is Junkers Aircraft.

You know the magazine but Junkers, though the brand may sound familiar, seems to recall an earlier time. Indeed, the storied German name has been around nearly a century, since the early days of aviation. Now… they're back and they are coming to America!

This year our favorite recreational flying area of the Lakeland show is sponsored by two leading names in aviation. Flying magazine is a sponsor of Paradise as is Junkers Aircraft.

You know the magazine but Junkers, though the brand may sound familiar, seems to recall an earlier time. Indeed, the storied German name has been around nearly a century, since the early days of aviation. Now… they're back and they are coming to America!

Welcome to Junkers and their American importer and partner,

Welcome to Junkers and their American importer and partner,

Both airplane producer stories made it into mainstream media.

If we go way back in time, to 2003, that is, before Light-Sport Aircraft, we saw a world where Americans flew kit-built airplanes while European pilots were flying what they called ultralights or microlights. Of course, this is an oversimplification but we had no idea the two methods of production would converge as they have in the last two decades.

Using widely-accepted consensus standards, Light-Sport Aircraft can operate in multiple countries — thanks to the useful work of many volunteers that assembled and maintain ASTM standards embraced by FAA and other CAAs all over the planet.

Let's look at these two stories…

Both airplane producer stories made it into mainstream media.

If we go way back in time, to 2003, that is, before Light-Sport Aircraft, we saw a world where Americans flew kit-built airplanes while European pilots were flying what they called ultralights or microlights. Of course, this is an oversimplification but we had no idea the two methods of production would converge as they have in the last two decades.

Using widely-accepted consensus standards, Light-Sport Aircraft can operate in multiple countries — thanks to the useful work of many volunteers that assembled and maintain ASTM standards embraced by FAA and other CAAs all over the planet.

Let's look at these two stories…

“At this point, there are about 10 to 12 airframes at the Kherson plant,” Peghiny said to AOPA. "Ordinarily, the airframes would be sent to Flight Design’s final assembly and completion center in the city of Šumperk in the Czech Republic."

“We’ve found a new, 25,000-square-foot site [in Šumperk that is] suitable for use as a production and paint shop, and will use that in the future,” Peghiny said in the AOPA article. Engineering work is also conducted in Šumperk.

"Flight Design is offering to move its Ukraine staff and their families to the Šumperk facility," AOPA wrote. "Peghiny said that the Kherson plant will function as long as conditions allow. However, tooling currently remaining in Kherson will have to be replaced by newly manufactured tooling for use in Šumperk. The company will fund new tooling, but it may take six to nine months to build."

“At this point, there are about 10 to 12 airframes at the Kherson plant,” Peghiny said to AOPA. "Ordinarily, the airframes would be sent to Flight Design’s final assembly and completion center in the city of Šumperk in the Czech Republic."

“We’ve found a new, 25,000-square-foot site [in Šumperk that is] suitable for use as a production and paint shop, and will use that in the future,” Peghiny said in the AOPA article. Engineering work is also conducted in Šumperk.

"Flight Design is offering to move its Ukraine staff and their families to the Šumperk facility," AOPA wrote. "Peghiny said that the Kherson plant will function as long as conditions allow. However, tooling currently remaining in Kherson will have to be replaced by newly manufactured tooling for use in Šumperk. The company will fund new tooling, but it may take six to nine months to build."

"Flight Design employs just under 200 technicians, assemblers, and engineers currently at the Kherson plant," continued Boatman, "and according to Peghiny, the company has been ramping up that number. 'We were hiring more aggressively in the past year because of the popularity of the F2, but the other models in the range have been selling well in Europe — simpler, lighter models in particular,' Tom said." Of course, Tom refers to the CT-series including CTLS that is one of the most popular LSA in America.

“We know [our employees] very well,” Peghiny said in Boatman's article. “Some have been with the company more than 20 years. We’re good friends, and we take this very personally.”

"Flight Design employs just under 200 technicians, assemblers, and engineers currently at the Kherson plant," continued Boatman, "and according to Peghiny, the company has been ramping up that number. 'We were hiring more aggressively in the past year because of the popularity of the F2, but the other models in the range have been selling well in Europe — simpler, lighter models in particular,' Tom said." Of course, Tom refers to the CT-series including CTLS that is one of the most popular LSA in America.

“We know [our employees] very well,” Peghiny said in Boatman's article. “Some have been with the company more than 20 years. We’re good friends, and we take this very personally.”

Dave Hirschman wrote, "Dennis Long, a dealer for Aeroprakt… said he spoke with factory officials who said they plan to remain on the job. 'They told me they’re going to keep making airplanes until they can’t'," AOPA reported. 'For the time being, it’s business as usual, although my next two airplanes will likely have to be shipped from Poland because the port of Odessa [in Ukraine] is closed.'”

Aeroprakt has steady registered more aircraft with the FAA. When asked by AOPA's writer, Dennis said, "Right now, due to all the uncertainty, I’m not taking any new deposits. I’m more concerned about the people over there than the airplanes at this moment."

Dave Hirschman wrote, "Dennis Long, a dealer for Aeroprakt… said he spoke with factory officials who said they plan to remain on the job. 'They told me they’re going to keep making airplanes until they can’t'," AOPA reported. 'For the time being, it’s business as usual, although my next two airplanes will likely have to be shipped from Poland because the port of Odessa [in Ukraine] is closed.'”

Aeroprakt has steady registered more aircraft with the FAA. When asked by AOPA's writer, Dennis said, "Right now, due to all the uncertainty, I’m not taking any new deposits. I’m more concerned about the people over there than the airplanes at this moment."

Contrary to common language, LSA are not "certified." Instead a manufacturer declares they meet ASTM standards and FAA "accepts" that declaration. Frequently at first, FAA audited producers in a point-by-point check of their declaration plus verifying that producers use generally-accepted best practices in their manufacturing. Companies with prior approvals may not be required to undergo an audit; it's always FAA's choice.

I've been involved with ASTM for many years and I can attest to these standards being very rigorous. They were welcomed by many countries where they are in active use. Indeed, FAA is using ASTM standards for LSA as a model for a future approval system for Part 23 general aviation aircraft. Nonetheless, a Standard Certificate is required for some countries; LSA have a Special Certificate. So, some companies believe it is in their best interest to obtain the higher level of approval.

Contrary to common language, LSA are not "certified." Instead a manufacturer declares they meet ASTM standards and FAA "accepts" that declaration. Frequently at first, FAA audited producers in a point-by-point check of their declaration plus verifying that producers use generally-accepted best practices in their manufacturing. Companies with prior approvals may not be required to undergo an audit; it's always FAA's choice.

I've been involved with ASTM for many years and I can attest to these standards being very rigorous. They were welcomed by many countries where they are in active use. Indeed, FAA is using ASTM standards for LSA as a model for a future approval system for Part 23 general aviation aircraft. Nonetheless, a Standard Certificate is required for some countries; LSA have a Special Certificate. So, some companies believe it is in their best interest to obtain the higher level of approval.

“We couldn’t be happier to see this important step for the F2 program, which ultimately will lead to the F4 four-seat version and the all-electric F2e,” said Matthias Betsch, Head of Flight Design's Design Organization department that created the F-Series and many of its advanced concepts.

"The F2-CS23 is the next step in Flight Design’s ‘Vision Zero’ concept which incorporates all commercially available safety features appropriate for this type of aircraft," the company elaborated. "These features include: a passive stall and spin resistant airframe design; airframe emergency parachute system; Amsafe-brand airbags and inertial reel harnesses; Garmin ESP (electronic stability and envelope protection); a strong occupant-protective enclosure for the pilot and passengers; automatic fuel management; simplified controls such as a combined throttle and brake lever; and a more modern, car-like atmosphere and operation."

“We couldn’t be happier to see this important step for the F2 program, which ultimately will lead to the F4 four-seat version and the all-electric F2e,” said Matthias Betsch, Head of Flight Design's Design Organization department that created the F-Series and many of its advanced concepts.

"The F2-CS23 is the next step in Flight Design’s ‘Vision Zero’ concept which incorporates all commercially available safety features appropriate for this type of aircraft," the company elaborated. "These features include: a passive stall and spin resistant airframe design; airframe emergency parachute system; Amsafe-brand airbags and inertial reel harnesses; Garmin ESP (electronic stability and envelope protection); a strong occupant-protective enclosure for the pilot and passengers; automatic fuel management; simplified controls such as a combined throttle and brake lever; and a more modern, car-like atmosphere and operation."

“EASA's CS-23 category is an internationally-recognized certification standard which will allow the new F2-CS23 to be easily accepted in all markets worldwide,” said Dieter Koehler, Project Manager the F2 and F4 projects.

Flight Design sees the F2-CS23 as "an excellent choice for flight schools with its wide and easy-to-enter cockpit, fuel efficiency, unique safety features, and state-of-the-art avionics suite. All new Flight Design aircraft come with carbon compensation up to TBO under Flight Design’s Pro-Climate plan." F2-CS23 follows the company's F2-LSA that began deliveries earlier in 2021.

“EASA's CS-23 category is an internationally-recognized certification standard which will allow the new F2-CS23 to be easily accepted in all markets worldwide,” said Dieter Koehler, Project Manager the F2 and F4 projects.

Flight Design sees the F2-CS23 as "an excellent choice for flight schools with its wide and easy-to-enter cockpit, fuel efficiency, unique safety features, and state-of-the-art avionics suite. All new Flight Design aircraft come with carbon compensation up to TBO under Flight Design’s Pro-Climate plan." F2-CS23 follows the company's F2-LSA that began deliveries earlier in 2021.

"In countries that do not have a Light-Sport category (Canada and others), the Type Certified version of the

"In countries that do not have a Light-Sport category (Canada and others), the Type Certified version of the  Primary Category certification also has benefits in the U.S., Icon reported. One is that any A&P is authorized to work on it. Because it is not a SLSA, owners will not need to use designated Icon Service Partners, though the company will still encourage them to do so.

Another benefit is international travel, for example, flying your Icon A5 to islands in the Caribbean, or to keep your A5 on a yacht when you are in another country (image). "Light-Sport Aircraft do not receive a Type Certificate," Icon explained, "so typically, special permission is required before you can fly in another country just like if you are flying an Experimental aircraft." Some exceptions exist, notably in the Bahamas, which does allow U.S.-registered LSAs. The Bahamas is further unique among other countries in that they accept FAA's Sport Pilot certificate.

Primary Category certification also has benefits in the U.S., Icon reported. One is that any A&P is authorized to work on it. Because it is not a SLSA, owners will not need to use designated Icon Service Partners, though the company will still encourage them to do so.

Another benefit is international travel, for example, flying your Icon A5 to islands in the Caribbean, or to keep your A5 on a yacht when you are in another country (image). "Light-Sport Aircraft do not receive a Type Certificate," Icon explained, "so typically, special permission is required before you can fly in another country just like if you are flying an Experimental aircraft." Some exceptions exist, notably in the Bahamas, which does allow U.S.-registered LSAs. The Bahamas is further unique among other countries in that they accept FAA's Sport Pilot certificate.

"Note that we will continue to make the SLSA version, as well," assured Huang. This continues the chance for American pilots to fly A5 without the need for an aviation medical, using only their driver's license in lieu of a medical approval.

Why not pursue approval using the coming regulation often referred to as Mosaic?

"Mosaic is an FAA initiative that doesn’t translate globally," stated the company. "Thus, pursuing Primary Category Certification is the action we needed to coincide with our global expansion plans."

"Note that we will continue to make the SLSA version, as well," assured Huang. This continues the chance for American pilots to fly A5 without the need for an aviation medical, using only their driver's license in lieu of a medical approval.

Why not pursue approval using the coming regulation often referred to as Mosaic?

"Mosaic is an FAA initiative that doesn’t translate globally," stated the company. "Thus, pursuing Primary Category Certification is the action we needed to coincide with our global expansion plans."

Tuesday, I hiked up to the north side, where the main displays are located. Most of the higher end Light-Sport Aircraft are located in this high-traffic area. Several LSA companies have jockeyed for years to find what they consider to be the optimal location for their exhibit. Being near the main foot-traffic road is very alluring to vendors.

In almost two decades of Light-Sport Aircraft (the then-new rule was announced at AirVenture 2004), LSA have integrated themselves into mainstream aircraft manufacturing …and not simply because of the aircraft offered. As late-night TV ads once said, "There's more!"

Tuesday, I hiked up to the north side, where the main displays are located. Most of the higher end Light-Sport Aircraft are located in this high-traffic area. Several LSA companies have jockeyed for years to find what they consider to be the optimal location for their exhibit. Being near the main foot-traffic road is very alluring to vendors.

In almost two decades of Light-Sport Aircraft (the then-new rule was announced at AirVenture 2004), LSA have integrated themselves into mainstream aircraft manufacturing …and not simply because of the aircraft offered. As late-night TV ads once said, "There's more!"

VASHON

VASHON And, speaking of area movements…

And, speaking of area movements…

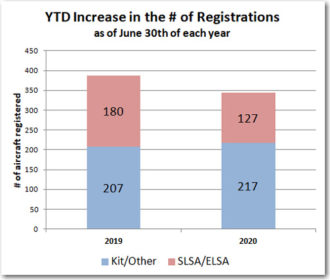

Our first quarterly report in many years should have come about April 1st. It did not. That date came as

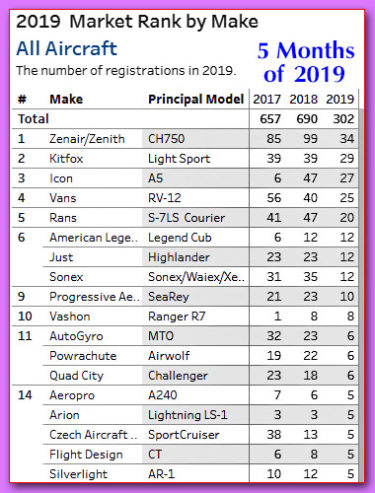

Our first quarterly report in many years should have come about April 1st. It did not. That date came as  Digging deeper, the chart shows that longtime market leader

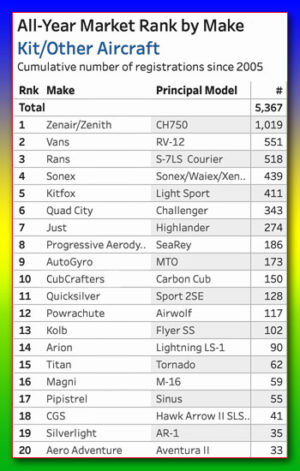

Digging deeper, the chart shows that longtime market leader  Strong SP kit suppliers include

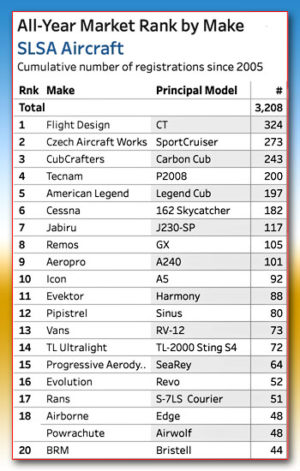

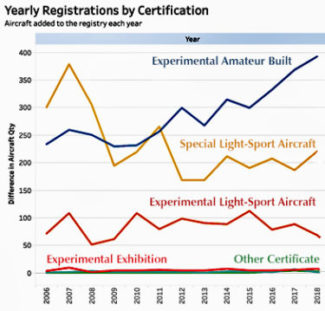

Strong SP kit suppliers include  Yet the real surprise comes when you look at our final chart of this article. Kits appear ascendant since 2013, especially when compared to Special LSA that seems to have found a stable registration rate of around 200 aircraft per year. However, when you combine SLSA with Experimental LSA, you can see that all LSA types number closer to 300 units per year, compared to all SP kits at just shy of 400. Specialty registrations like Experimental Exhibition are steady but at a far smaller unit count.

Yet the real surprise comes when you look at our final chart of this article. Kits appear ascendant since 2013, especially when compared to Special LSA that seems to have found a stable registration rate of around 200 aircraft per year. However, when you combine SLSA with Experimental LSA, you can see that all LSA types number closer to 300 units per year, compared to all SP kits at just shy of 400. Specialty registrations like Experimental Exhibition are steady but at a far smaller unit count.

Any ELSA must be shipped from the factory as a bolt-for-bolt copy of the SLSA model, as required under the regulation. No producer can sell an ELSA without first getting approved for a SLSA, so to my mind, combining SLSA and ELSA makes for a fairer comparison to Sport Pilot kit aircraft.

If you love these numbers, please visit

Any ELSA must be shipped from the factory as a bolt-for-bolt copy of the SLSA model, as required under the regulation. No producer can sell an ELSA without first getting approved for a SLSA, so to my mind, combining SLSA and ELSA makes for a fairer comparison to Sport Pilot kit aircraft.

If you love these numbers, please visit

Tomorrow's forecast:

Tomorrow's forecast: