This week kicks off the truly gigantic trade show known by its sponsoring organization’s abbreviation: NBAA, or in common lingo, “Enn, Bee, Double A.” While not taking up the extensive terra firms of Oshkosh, NBAA actually has more paying exhibitors. They even tow aircraft down city streets in the dark of night so a reported 100 aircraft can be on display at the Orlando Civic Center. The show has become so large that supposedly only two U.S. convention centers are big enough to contain the sprawling affair: Las Vegas and Orlando. The latter is just down the street for me so every other year I go and look for something to report amidst my wandering around astonished at the sheer size of the event and how much money gets spent for a three-day show. I always find something of interest to the light aviation, recreational flying community. This year, I’m on the lookout for Tecnam, one of this website’s longtime sponsors and surely the largest company serving up Light-Sport Aircraft around the world.

This week kicks off the truly gigantic trade show known by its sponsoring organization's abbreviation:

This week kicks off the truly gigantic trade show known by its sponsoring organization's abbreviation:  I always find something of interest to the light aviation, recreational flying community. This year, I'm on the lookout for

I always find something of interest to the light aviation, recreational flying community. This year, I'm on the lookout for

Over many years, you have found

Over many years, you have found

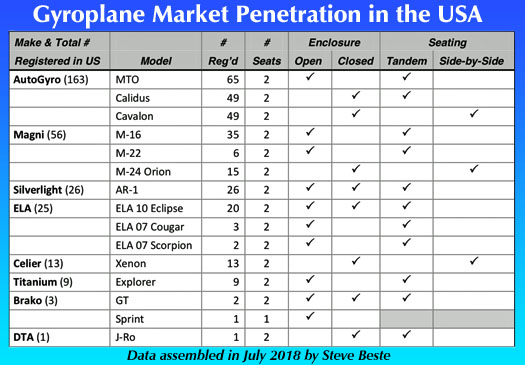

Our new associate, Steve Beste, wrote an excellent article for his club newsletter and I will summarize that piece in another post.

In his article, he wrote, "[Along with better training] the other change since those days is the large horizontal stabilizer, mounted well aft. Some machines were prone to PIO, pilot-induced oscillations in pitch. The pilot would chase the oscillations, only making them worse until the gyro did a fatal bunt over. The large tail that Magni invented – as is used on all modern gyros – has fixed that."

Our new associate, Steve Beste, wrote an excellent article for his club newsletter and I will summarize that piece in another post.

In his article, he wrote, "[Along with better training] the other change since those days is the large horizontal stabilizer, mounted well aft. Some machines were prone to PIO, pilot-induced oscillations in pitch. The pilot would chase the oscillations, only making them worse until the gyro did a fatal bunt over. The large tail that Magni invented – as is used on all modern gyros – has fixed that."

As you can see,

As you can see,

"[However, FAA's] data is not clean," Steve observed. I am well aware of this problem. Uncertainty about data accuracy of "alternative" LSA is why we have reported fixed wing Special LSA, only offering guesses for weight shift trikes, powered parachutes, gyroplanes, motorgliders, and more.

However, we hope that will now change and our market share reporting will be more inclusive. Hurray!

"[However, FAA's] data is not clean," Steve observed. I am well aware of this problem. Uncertainty about data accuracy of "alternative" LSA is why we have reported fixed wing Special LSA, only offering guesses for weight shift trikes, powered parachutes, gyroplanes, motorgliders, and more.

However, we hope that will now change and our market share reporting will be more inclusive. Hurray!

Problems in FAA's database is not caused by incompetent clerks. Agency personnel must sort through inconsistently-reported aircraft. If, as Steve pointed out in one example, the registered name of the aircraft is slightly different, it won't show up on a casual investigation.

He added, "There's no end of that kind of thing …just so we know the limitations on this exercise. But with that understanding, I love this kind of thing, I have the skills to do it, and would be honored to support your good work for the sport." All such reporting will be available on the home page when fresh and catalogued on its own space found by

Problems in FAA's database is not caused by incompetent clerks. Agency personnel must sort through inconsistently-reported aircraft. If, as Steve pointed out in one example, the registered name of the aircraft is slightly different, it won't show up on a casual investigation.

He added, "There's no end of that kind of thing …just so we know the limitations on this exercise. But with that understanding, I love this kind of thing, I have the skills to do it, and would be honored to support your good work for the sport." All such reporting will be available on the home page when fresh and catalogued on its own space found by  Chuck's son Jim Vanek took over the business and revamped the Vancraft designs. He said his "award-winning, world’s-first, two-place gyroplane took the prestigious Charles Lindbergh award at the Oshkosh airshow in 1985." The company also reports his Sport Copter II design was voted as one of the Top Ten Best Designs at AirVenture in 2011.

An airshow performer, Jim said he wrote the parameters and guidelines for gyroplane looping for the FAA in 1998 after performing the world’s first loop in a conventional gyroplane, in 1997. The company's website reports, "He is the only gyro pilot in the world that holds an International Council of Air Shows card for gyroplane looping and rolling." Don't even think about trying this yourself, however.

Chuck's son Jim Vanek took over the business and revamped the Vancraft designs. He said his "award-winning, world’s-first, two-place gyroplane took the prestigious Charles Lindbergh award at the Oshkosh airshow in 1985." The company also reports his Sport Copter II design was voted as one of the Top Ten Best Designs at AirVenture in 2011.

An airshow performer, Jim said he wrote the parameters and guidelines for gyroplane looping for the FAA in 1998 after performing the world’s first loop in a conventional gyroplane, in 1997. The company's website reports, "He is the only gyro pilot in the world that holds an International Council of Air Shows card for gyroplane looping and rolling." Don't even think about trying this yourself, however.

The company said, "We offer 22 thru 28 foot rotor blades of our own design with a lift capability from ultralight thru 1,200 pounds gross weight." They added, "We are the only manufacturer that test flies all blade sets prior to shipping." For export, Rotor Flight will fully build their aircraft but in the USA, FAA will only permit them to deliver kits, the same as all gyroplane producers.

As with all the modern gyroplanes, Rotor Flight uses a substantial tailplane. "The Dominator [series of one and two-place machines] incorporate the Tall Tail design for stability." Asked how their product differs, the company's website states, "What makes the Dominator so unique is its high profile design. It sits up very high off the ground."

The company said, "We offer 22 thru 28 foot rotor blades of our own design with a lift capability from ultralight thru 1,200 pounds gross weight." They added, "We are the only manufacturer that test flies all blade sets prior to shipping." For export, Rotor Flight will fully build their aircraft but in the USA, FAA will only permit them to deliver kits, the same as all gyroplane producers.

As with all the modern gyroplanes, Rotor Flight uses a substantial tailplane. "The Dominator [series of one and two-place machines] incorporate the Tall Tail design for stability." Asked how their product differs, the company's website states, "What makes the Dominator so unique is its high profile design. It sits up very high off the ground."

The big Italian company that LSA enthusiasts know very well through models such as P92, Sierra, and P2008 has a large and growing presence in global aviation. Their developments are broad and delve into aviation segments large and small. They are also getting ready to celebrate a benchmark birthday.

This year Tecnam Costruzioni Aeronautiche — most pilots simply say “

The big Italian company that LSA enthusiasts know very well through models such as P92, Sierra, and P2008 has a large and growing presence in global aviation. Their developments are broad and delve into aviation segments large and small. They are also getting ready to celebrate a benchmark birthday.

This year Tecnam Costruzioni Aeronautiche — most pilots simply say “

The Leica CityMapper is specifically designed for 3D city modelling and urban mapping. It is the world’s first hybrid airborne sensor combining both oblique and nadir imaging as well as a LiDAR system.

Tecnam has a large staff to accomplish these diverse projects while building as many as four aircraft a week. Even with many employees, however, this is a impressive penetration of all aviation's nooks and crannies.

The Leica CityMapper is specifically designed for 3D city modelling and urban mapping. It is the world’s first hybrid airborne sensor combining both oblique and nadir imaging as well as a LiDAR system.

Tecnam has a large staff to accomplish these diverse projects while building as many as four aircraft a week. Even with many employees, however, this is a impressive penetration of all aviation's nooks and crannies.

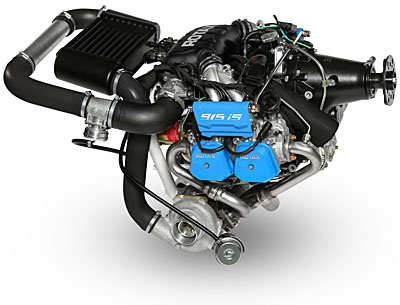

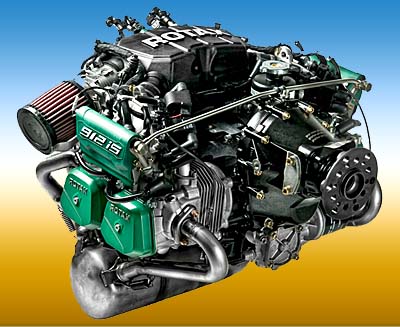

I will cover many aircraft stories, but allow me to take the most recent first: flying the brand-new Rotax 915iS and comparing it to the 912iS, although not in the same airframe. Other than official Rotax pilots and select airframe builders, we were among the first to experience the powerful new engine from the world’s leading producer of engines for light aircraft.

I will cover many aircraft stories, but allow me to take the most recent first: flying the brand-new Rotax 915iS and comparing it to the 912iS, although not in the same airframe. Other than official Rotax pilots and select airframe builders, we were among the first to experience the powerful new engine from the world’s leading producer of engines for light aircraft.

Fuel consumption was higher than I expected, but speed was also higher. To get below 3 gph, a surprisingly low consumption rate, speed dropped below 100 knots true or 85 indicated. When zipping along faster than 170 miles an hour true, consumption rose to the 7-9 gph range.

The 915iS fuel injected, turbocharged, and intercooled engine can produce 141 horsepower for five minutes, then sustain 135 horsepower indefinitely.

Once at altitude, Christian demonstrated use of the throttle and prop controls — this was not a single lever control airplane — to adjust for speed or economy. As you can see in the contrasting Stock Box images, we saw as low as 2.8 gallons per hour resulting, of course, in lower speed flight.

Fuel consumption was higher than I expected, but speed was also higher. To get below 3 gph, a surprisingly low consumption rate, speed dropped below 100 knots true or 85 indicated. When zipping along faster than 170 miles an hour true, consumption rose to the 7-9 gph range.

The 915iS fuel injected, turbocharged, and intercooled engine can produce 141 horsepower for five minutes, then sustain 135 horsepower indefinitely.

Once at altitude, Christian demonstrated use of the throttle and prop controls — this was not a single lever control airplane — to adjust for speed or economy. As you can see in the contrasting Stock Box images, we saw as low as 2.8 gallons per hour resulting, of course, in lower speed flight.

Christian demonstrated that you can move the throttle and prop control without my experience of adjusting each very cautiously and slowly. Christian jockeyed them around liberally without detriment. A key reason this is possible is because of liquid cooling versus my older experience in air-cooled legacy engines, for example, in a Cessna 182 Skylane.

A fellow aviation journalist — a pilot of 300 different aircraft — Dave Unwin felt the 915 started "softer." He also felt it seemed to run slightly smoother. Rotax engine experts felt most of this is attributable to software and the same code can also be applied to the 912iS.

Christian demonstrated that you can move the throttle and prop control without my experience of adjusting each very cautiously and slowly. Christian jockeyed them around liberally without detriment. A key reason this is possible is because of liquid cooling versus my older experience in air-cooled legacy engines, for example, in a Cessna 182 Skylane.

A fellow aviation journalist — a pilot of 300 different aircraft — Dave Unwin felt the 915 started "softer." He also felt it seemed to run slightly smoother. Rotax engine experts felt most of this is attributable to software and the same code can also be applied to the 912iS.

Yet for those who yearn for more power or are building an aircraft of higher capabilities, the 915iS is going to be a welcome powerplant. It does come with a few costs, as did the 912iS fuel injected engine compared to the 912ULS carbureted engine.

Marc Becker summarized, "The 915iS is about 12 kilos (26 pounds) more for the engine only; 40-50 more pounds when installed and about €3,000 ($3,750 at today's exchange rates) more than the 914." It is significantly more than the 912iS, as you should expect for an engine with substantially more power and the ability to use that power up to higher altitudes.

Fuel needs of both 915iS and 912iS are essentially the same. Thomas Uhr, head of Rotax's Austria plant and a longtime engine expert and enthusiast — and also a pilot — advises the highest octane auto fuel, preferably without alcohol, to get the most power and best results.

Yet for those who yearn for more power or are building an aircraft of higher capabilities, the 915iS is going to be a welcome powerplant. It does come with a few costs, as did the 912iS fuel injected engine compared to the 912ULS carbureted engine.

Marc Becker summarized, "The 915iS is about 12 kilos (26 pounds) more for the engine only; 40-50 more pounds when installed and about €3,000 ($3,750 at today's exchange rates) more than the 914." It is significantly more than the 912iS, as you should expect for an engine with substantially more power and the ability to use that power up to higher altitudes.

Fuel needs of both 915iS and 912iS are essentially the same. Thomas Uhr, head of Rotax's Austria plant and a longtime engine expert and enthusiast — and also a pilot — advises the highest octane auto fuel, preferably without alcohol, to get the most power and best results.

When most pilots think of imports, they assume a foreign manufacturer builds an aircraft in another country, finds a U.S. representative, and sends their product here. That's certainly the standard practice.

For years, especially after the fall of Communism and the opening of Eastern European nations, rates of pay for highly qualified workers was so low that building in America was considered by many to be noncompetitive. Slowly, though, the situation has changed and now American production makes more sense, at least when the company intends to sell to Yankee pilots.

At Sun 'n Fun 2018 I uncovered two new projects; one about which I had some knowledge, another that surprised me.

When most pilots think of imports, they assume a foreign manufacturer builds an aircraft in another country, finds a U.S. representative, and sends their product here. That's certainly the standard practice.

For years, especially after the fall of Communism and the opening of Eastern European nations, rates of pay for highly qualified workers was so low that building in America was considered by many to be noncompetitive. Slowly, though, the situation has changed and now American production makes more sense, at least when the company intends to sell to Yankee pilots.

At Sun 'n Fun 2018 I uncovered two new projects; one about which I had some knowledge, another that surprised me.

Sky Arrow has long been well represented by

Sky Arrow has long been well represented by  I described this experience but soon thereafter I was called to account for allegedly trampling on the rights of a Columbian designer who claimed the Serbian company had no right to produce it. At

I described this experience but soon thereafter I was called to account for allegedly trampling on the rights of a Columbian designer who claimed the Serbian company had no right to produce it. At  Initial production will be mostly done in Serbia, but as the U.S. operation gears up, raw materials such as aluminum sheet that have come from American sources will be partially prepared in the U.S., sent to Serbia for labor-intensive work by Serbians, and returned to American for final assembly and fitting of components such as avionics and engines that come from still other countries, including the USA. Though this may sound complex, it is very similar to what Boeing and Airbus do as they build airlines. It works for small companies, too.

I expect to report more on both projects — Sky Arrow and Discovery 600 — as they progress but our videos will fill in gaps in the meantime. Whatever way these projects evolve, it is interesting to see manufacturing come to American shores. Mr. Trump may be smiling, but much more important is the satisfaction of American pilots who will be given more aircraft choices.

Welcome to more of a famous label… Made in the USA.

Initial production will be mostly done in Serbia, but as the U.S. operation gears up, raw materials such as aluminum sheet that have come from American sources will be partially prepared in the U.S., sent to Serbia for labor-intensive work by Serbians, and returned to American for final assembly and fitting of components such as avionics and engines that come from still other countries, including the USA. Though this may sound complex, it is very similar to what Boeing and Airbus do as they build airlines. It works for small companies, too.

I expect to report more on both projects — Sky Arrow and Discovery 600 — as they progress but our videos will fill in gaps in the meantime. Whatever way these projects evolve, it is interesting to see manufacturing come to American shores. Mr. Trump may be smiling, but much more important is the satisfaction of American pilots who will be given more aircraft choices.

Welcome to more of a famous label… Made in the USA. Besides LSA seaplanes, one area of furious development (and sales) is gyroplanes, the term modern industry prefers to "gyrocopter," which was actually a branded name used since the days of Igor Benson.

A new player, arriving on the scene about five years ago, is Rotorvox. Americans have not seen this aircraft but will soon get an opportunity at

Besides LSA seaplanes, one area of furious development (and sales) is gyroplanes, the term modern industry prefers to "gyrocopter," which was actually a branded name used since the days of Igor Benson.

A new player, arriving on the scene about five years ago, is Rotorvox. Americans have not seen this aircraft but will soon get an opportunity at

Rotorvox Aero will act as the U.S. importer and will display C2A in Lakeland from April 10

Rotorvox Aero will act as the U.S. importer and will display C2A in Lakeland from April 10 C2A is sold ready-to-fly in Europe but must be sold as an Experimental Amateur Built kit in the USA.

C2A is sold ready-to-fly in Europe but must be sold as an Experimental Amateur Built kit in the USA.  Pilots and builders seeking more power can welcome the Rotax 915iS fuel-injected, turbo-charged, intercooler-equipped 135-horsepower engine. Talk about a kick in the pants!

The engine recently

Pilots and builders seeking more power can welcome the Rotax 915iS fuel-injected, turbo-charged, intercooler-equipped 135-horsepower engine. Talk about a kick in the pants!

The engine recently  Bryan enthusiastically reported, "I had a recent opportunity to fly with the 915is on Rotax guru, Ronnie Smith's Rans S-7 that he is testing. I was very impressed!" Ronnie, proprietor of

Bryan enthusiastically reported, "I had a recent opportunity to fly with the 915is on Rotax guru, Ronnie Smith's Rans S-7 that he is testing. I was very impressed!" Ronnie, proprietor of  For pilots, builders, or repair shops interested in information on the 915is, or for those ready to place an order please visit the California Power Systems

For pilots, builders, or repair shops interested in information on the 915is, or for those ready to place an order please visit the California Power Systems  Sebastien Heintz of

Sebastien Heintz of  Deane's STOL CH 701 is powered by a 130-horsepower

Deane's STOL CH 701 is powered by a 130-horsepower

Because we are about 50 miles away, the sound of these (count 'em) 27 rocket motors traveled to Daytona in about four minutes. The rumbling from those huge motors throbbed on and on, longer than any launch I can remember. The winds need to be rather calm for the sound to travel this far and today we got lucky.

Cool! Go private space companies like SpaceX, Blue Origin, and others. I'm a NASA fan, too, but I want to see these private enterprises take the baton and race outward to the planets …and it's happening.

I just hope that Tesla can find a parking spot when it gets to Mars orbit.

https://youtu.be/RSc__x0rO9k

https://youtu.be/Tk338VXcb24

Because we are about 50 miles away, the sound of these (count 'em) 27 rocket motors traveled to Daytona in about four minutes. The rumbling from those huge motors throbbed on and on, longer than any launch I can remember. The winds need to be rather calm for the sound to travel this far and today we got lucky.

Cool! Go private space companies like SpaceX, Blue Origin, and others. I'm a NASA fan, too, but I want to see these private enterprises take the baton and race outward to the planets …and it's happening.

I just hope that Tesla can find a parking spot when it gets to Mars orbit.

https://youtu.be/RSc__x0rO9k

https://youtu.be/Tk338VXcb24

Chip continued, "The crisp performance hasn’t changed [with the HKS versus the Rotax 582]. In fact, the early tests are showing near-identical takeoff and climb, but with higher cruise numbers, compared to the Merlin with the Rotax 582 two-stroke." The Rotax engine outputs 65 horsepower while the HKS has 60. Two-stroke engines also spool up quicker than a four stroke. However, the HKS offers higher torque, useful during launch and climb out.

The four-stroke, horizontally-opposed, two-cylinder HKS and its gearbox "weighs a bit more" than the two-stroke option, Chip noted.

“We moved the battery aft, and the whole airplane gives up about twenty pounds of payload,” Chip said, “but the HKS burns less fuel so its flight time is longer at any given weight.” Another positive: HKS can run on avgas or premium mogas.

Chip continued, "The crisp performance hasn’t changed [with the HKS versus the Rotax 582]. In fact, the early tests are showing near-identical takeoff and climb, but with higher cruise numbers, compared to the Merlin with the Rotax 582 two-stroke." The Rotax engine outputs 65 horsepower while the HKS has 60. Two-stroke engines also spool up quicker than a four stroke. However, the HKS offers higher torque, useful during launch and climb out.

The four-stroke, horizontally-opposed, two-cylinder HKS and its gearbox "weighs a bit more" than the two-stroke option, Chip noted.

“We moved the battery aft, and the whole airplane gives up about twenty pounds of payload,” Chip said, “but the HKS burns less fuel so its flight time is longer at any given weight.” Another positive: HKS can run on avgas or premium mogas.

“We will bring a Merlin from our build program that isn’t yet 100% completed,” said Chip. "That will give people a chance to see how easy it is to build their own Merlin.” The fully enclosed Merlin claims to be one of the quickest-build 51% kits available.

I went to observe a customer building his own Merlin to see how easy and quick it really was. I came away suitably impressed.

"So complete and builder-ready is the Quick Build Kit that most major assemblies and skins are already tacked into position for shipping (using colored soft rivets)," Chip explained, "requiring the builder to actually do some disassembly to bring it to the 51% stage."

“There is no 'Slow Build' option,” deadpanned Erwin in his characteristic humor.

“Precision matched-hole technology means that the holes punched are not just pilot holes; the accuracy is so high that holes in the skins match the holes in the ribs and bulkheads at final size, so next to zero drilling is required," Chip said. "This precision saves dozens if not hundreds of assembly time hours.” My own eyes proved to me that this precision matched-hole technology works as advertised.

“We will bring a Merlin from our build program that isn’t yet 100% completed,” said Chip. "That will give people a chance to see how easy it is to build their own Merlin.” The fully enclosed Merlin claims to be one of the quickest-build 51% kits available.

I went to observe a customer building his own Merlin to see how easy and quick it really was. I came away suitably impressed.

"So complete and builder-ready is the Quick Build Kit that most major assemblies and skins are already tacked into position for shipping (using colored soft rivets)," Chip explained, "requiring the builder to actually do some disassembly to bring it to the 51% stage."

“There is no 'Slow Build' option,” deadpanned Erwin in his characteristic humor.

“Precision matched-hole technology means that the holes punched are not just pilot holes; the accuracy is so high that holes in the skins match the holes in the ribs and bulkheads at final size, so next to zero drilling is required," Chip said. "This precision saves dozens if not hundreds of assembly time hours.” My own eyes proved to me that this precision matched-hole technology works as advertised.

They added, "It will also offer the possibility to carry up to four persons" for aircraft such as

They added, "It will also offer the possibility to carry up to four persons" for aircraft such as

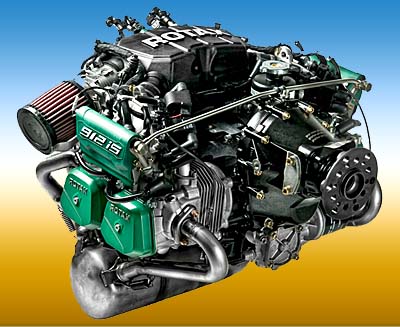

Rotax Aircraft Engines

Rotax Aircraft Engines

BRM has been flying a prototype aircraft with the 915 iS engine installed. Their preliminary flying shows some solid results.

BRM has been flying a prototype aircraft with the 915 iS engine installed. Their preliminary flying shows some solid results.

“Vessel CEO was present for the ground testing and first flight of the KLA-100,” said Mr. Kiman Seo, CEO of Vessel Co., Ltd. “Vessel is running a parallel development and flight test program in South Korea to gather as much experience for certification in Korea.”

KLA-100 wing is a modern aeronautical design using Flight Design's extensive experience at designing and building Light-Sport Aircraft or European microlights. A high aspect ratio wing planform is used to reduce drag and increase climb, a new proprietary airfoil has an improved coefficient of lift and reduced drag through a greater percentage of laminar flow. The Stall-Safe drooped leading edge (see cuff in photos) is designed to keep the airflow attached at the tips, promote post-stall aileron control and resist spins.

“Vessel CEO was present for the ground testing and first flight of the KLA-100,” said Mr. Kiman Seo, CEO of Vessel Co., Ltd. “Vessel is running a parallel development and flight test program in South Korea to gather as much experience for certification in Korea.”

KLA-100 wing is a modern aeronautical design using Flight Design's extensive experience at designing and building Light-Sport Aircraft or European microlights. A high aspect ratio wing planform is used to reduce drag and increase climb, a new proprietary airfoil has an improved coefficient of lift and reduced drag through a greater percentage of laminar flow. The Stall-Safe drooped leading edge (see cuff in photos) is designed to keep the airflow attached at the tips, promote post-stall aileron control and resist spins.

KLA-100 is powered by 100 horsepower (74 KW) from a fuel injected

KLA-100 is powered by 100 horsepower (74 KW) from a fuel injected  Prominently displayed in front of the Rotax Aircraft Engines exhibit at Sun 'n Fun — right at the main entrance to the large spring show — was a strikingly-painted Searey kit-built aircraft (photo). Why? The mission was to showcase how a Rotax-powered amphibian aircraft can get more push… without complexity.

Named Searey ATD, Advanced Technology Demonstrator, the collaborators include

Prominently displayed in front of the Rotax Aircraft Engines exhibit at Sun 'n Fun — right at the main entrance to the large spring show — was a strikingly-painted Searey kit-built aircraft (photo). Why? The mission was to showcase how a Rotax-powered amphibian aircraft can get more push… without complexity.

Named Searey ATD, Advanced Technology Demonstrator, the collaborators include

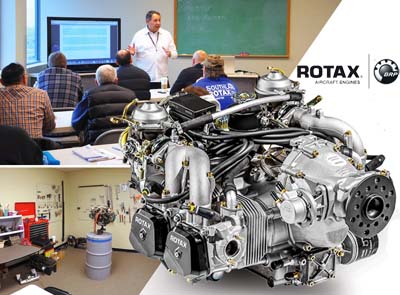

How is it that Rotax so dominates the supply of engines to light aircraft? Many reasons might be cited but one is the superlative training they offer. For 2017, the company is going even further, now offering essential training opportunities to the legions who attend airshows in both the USA and Europe.

How is it that Rotax so dominates the supply of engines to light aircraft? Many reasons might be cited but one is the superlative training they offer. For 2017, the company is going even further, now offering essential training opportunities to the legions who attend airshows in both the USA and Europe.