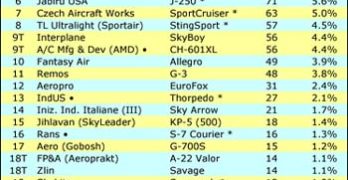

With one month to go (and it’s hard to imagine a big December), we have figures to report for this most extraordinary year. We’re all (painfully) aware of the economic predicament, but how has this impacted light-sport aviation? Here’s my observations. *** In 11 months, the industry has increased fleet size by 35% to 1,510 fixed wing airplanes from 1,118 on January 1st. Annualizing the numbers, all airplane LSA should register 427 airplanes, which equates to about 35 aircraft per month, which means sales were about 20% off the monthly pace recorded since early 2006. *** Flight Design held its top spot and again delivered the most, but just barely. Remos has been the rising star of 2008 with a 147% increase over their total on January 1st. Tecnam became only the third company to pass 100 units registered. Other solid gains were logged by Czech Aircraft Works (up 69% in the year); Jabiru (up 53%); FPNA (up 55%, though from a lower number, which makes larger percentage gains easier); Aeropro (up 52%).

Search Results for : tecnam

Not finding exactly what you expected? Try our advanced search option.

Select a manufacturer to go straight to all our content about that manufacturer.

Select an aircraft model to go straight to all our content about that model.

LAMA Pushing Hard to Provide Audit Oversight

These days, “oversight” is a heavily used word on national media. But far from the strangeness of government bailouts is the world of Light-Sport Aircraft. For the new aviation sector, industry oversight is seen as critical by LAMA and many aviation leaders. *** A conversation with LAMA founder* Larry Burke shows the LSA industry organization is moving steadily toward its oversight goals. Insurance companies and others hope LAMA will audit companies supplying 80% of purchased LSA. Once that “critical mass” is reached, insurers feel they can advise customers do as LAMA encourages…”Look for the LAMA Label.” *** A LAMA audit verifies that a company which declares compliance to ASTM standards actually possesses the documentation to prove their declaration. After successfully passing a LAMA audit, a company can place LAMA Labels on their LSA so that potential customers are aware the company has satisfactorily completed a voluntary third party audit.

LSA on their Way to San Jose (AOPA Expo)

Everyone is talking about tough economic times and aviators note the effect on the LSA and GA industries. But that won’t stop a good selection of Light-Sport Aircraft from appearing at AOPA’s annual Expo, this year in San Jose, California over November 6-7-8. In fact, with 60+ display airplanes expected and 14-15 of them LSA (list below photo), the light sector once again has a strong presence. *** Thanks to cooperation from AOPA static aircraft display organizers, LSA will once again be presented largely as a group (think LSA Mall). And the location for the collected LSA is sweet indeed: immediately inside the entryway to AOPA’s static aircraft display at Norman Mineta airport. You won’t be able to miss the LSA collection, so come on out and do a little shopping. *** In addition to aircraft displays, AOPA offers a wide range of seminars, including two presentations I will give called, “State of the Light-Sport Aircraft Industry” (TH-11/6 and SA-11/8, both at 11 AM to noon).

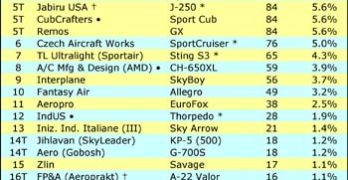

Shifting LSA Market Share Positions in Tough 2008

Reading the headlines these days shows the USA is flying through turbulence. Light-Sport Aircraft sales are suffering as are GA sales. Growth rates are off, without question, but not uniformly. We have a few companies that improved their positions in this difficult year. *** If you measure by the number of aircraft registered, top producers held on quite well, with Flight Design, Remos, Tecnam, Jabiru, Czech Aircraft Works and Legend, in order, recording the most registrations through eight months of 2008. If you measure by percentage of growth, we observe some interesting developments. But remember, those with the most total registrations are unlikely to also show the highest percentage of growth since their count on January 1, 2008. Smaller or new players logging some sales may have high percentages as they started low. *** Leading the percentage action was Urban Air, whose Lambada fleet has grown 140% (to 12).

FAA Begins “Assessment” of LSA Industry

At Oshkosh, FAA held a meeting to announce their LSA Assessment Project. The agency that gave birth to Light-Sport Aircraft in the summer of 2004 is now embarking on a fact-finding tour they say will judge the “health of the industry,” part of their “aviation safety oversight.” Sounds rather ominous, doesn’t it? However, officials also stated clearly and repeatedly, “What this assessment and evaluation is not is an individual Light-Sport manufacturer’s compliance audit.” *** Indeed, Terry Chasteen, the new head LSA man in the Small Aircraft Directorate characterized the day-long visits by two teams of two inspectors as benign. He’ll be joined by Tom Gunnarson, former president of LAMA now with the LSA office. The visits started this week at Tecnam’s U.S. quarters; AMD, Aircraft Manufacturing and Design; Fantasy Air USA / LSA America; and P&M Aviation USA.

Light-Sport Aircraft Massing for Sun ‘n Fun

Lots more fun than a military build-up but bearing some resemblance, companies across the USA are preparing for Sun ‘n Fun starting Tuesday the 4th. I was on the grounds today and it already looks busy. I also traveled to Lockwood Aviation at the Sebring, Florida airport. A busy crew was assembling airplanes from Flight Design and Tecnam in preparation for the show in nearby Lakeland. Other companies set up at South Lakeland Airpark — the relaxed strip a mere three air miles from Sun ‘n Fun (where I do the majority of my flight evaluations). Today, I got a chance to compare a late-model 2005 CTsw with the 2006 model; look for the full report in EAA Sport Pilot for June 2006. Tomorrow, the folks at Sport Aircraft Works are hosting me to fly the Parrot, Sport Cruiser, and Mermaid from Czech Aircraft Works.

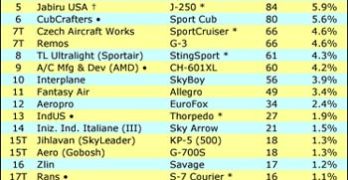

Strong Survive 2008; LSA Market Share Adjustments

Through the first six months of 2008, Light-Sport Aircraft deliveries have reflected the same challenges afflicting the rest of general or sport aviation…and for that matter, the overall U.S. economy. In fact, LSA registrations aren’t off as badly as are GA deliveries, perhaps due to significantly better fuel economy in an LSA. These FAA registrations can be analyzed to show trends. *** In the first half of 2008, the LSA industry registered 248 aircraft, which is 22% of all registrations from April 2005 through December 2007 (1,118). Many find it interesting to observe how market leaders compare. If a supplier registered less than 22% of their fleet in 2008, they slipped in market share (even if they registered more total airplanes). If they exceeded that figure, they gained market share. In the first half of 2008 gainers included: Remos up 62%; Czech Aircraft Works 47%; FPNA 45%; Gobosh 38%; Tecnam 35%; Aeropro 32%; and AMD 28%.

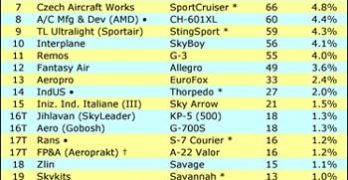

Aircraft Sales through April ’08 Reflect Economy

I can identify four factors in the economy presently affecting airplane sales: Potential customers (often with plenty of assets or creditworthiness) see the value of their stock portfolio going up and down like a roller coaster; worry over their once-soaring real estate, now down markedly in some areas; witness the continuing rise of the euro-dollar exchange rate, bringing much higher prices for many LSA; and, fret over a climate of political uncertainty during another election cycle. *** Perhaps due to these factors GA single engine piston sales are off 28% compared to the same period last year, according to GAMA. LSA sales are off 30% compared to trends six months to a year ago. *** Jet and turbine aircraft sales are up, but 2008 deliveries of those aircraft stem from orders taken 2-3 years ago. Contrarily, personal and sport aircraft sales react quickly to the slightest perception of economic shakiness. *** Despite that we have some bright spots.

Hansen Air Group Imports the German Peregrine

You probably know the Sky Arrow. This smooth tandem Light-Sport Aircraft from Italy uses exquisite construction and I found it to fly beautifully (read my report). Sky Arrow is imported by Jon Hansen and his family. Jon represented Tecnam aircraft (also of Italy) for several years, helping to launch that brand. Hansen Air Group and Tecnam ended their relationship a couple years back, and since then Jon and his team have been seeking another aircraft to represent. That search is over. *** At Sun ‘n Fun 2008, Hansen Air Group showed their new entry, the FA-04 Peregrine, built by Flaeming Air of Germany. The low wing beauty is mostly carbon fiber and was refashioned to be a Special LSA, following Flaeming’s success at winning VLA approval in Europe. Interesting Note: Hansen’s Sky Arrow also started with VLA approval, which helped it qualify as an SLSA.

Sky Arrow Special Light-Sport Aircraft

Ultralight pilots

may not believe the Sky Arrow has achieved Part 23 certified status the same as a Cessna or Cirrus, but it has done precisely that. This sleek Italian tandem 2-seater earned European JAR/VLA certification and, after careful review, FAA gave its approval under international reciprocity agreements.

That makes the Sky Arrow something like the RANS S-7, which won approval under FAA’s last new certification program, Primary category. As a side note, the Kansas company also received its S-LSA airworthiness certificate with less challenge than companies that had not taken the earlier effort

Therefore, once FAA introduced the Light-Sport Aircraft regulation, few were surprised that the Sky Arrow could win approval. In fact, the aircraft was number 18 out of ranks that have now swelled to 40 new models approved.

Let’s forget about FAA approval for the moment and focus on the Sky Arrow’s ability to fly much like an ultralight.