If you like airplane statistics and facts, this article may interest you. Some pilots don’t follow such things while others eat it up (you know who you are). For these readers, we have a new perspective that many may find intriguing. The comparisons below relate to the numbers of Single Engine Piston (SEP) general aviation (GA) aircraft on the U.S. registry compared to an umbrella group including SLSA, ELSA, and kit-built aircraft that Sport Pilots may fly (or those using a different certificate but exercising the privileges of Sport Pilot) …in other words, all the aircraft we cover on this website. Even after more than 15 years of LSA and the kits that Sport Pilots can fly, the GA fleet still seems immeasurably larger. The truth is, we can measure it; in fact, we have up-to-date info and both are as accurate as FAA’s database allows. Which Is Bigger? The total SEP GA fleet numbers approximately 135,000 aircraft, 15 times larger than LSA/SP kits (by our criteria, about 9,000 aircraft) but the bigger number includes aircraft made since the 1940s and significantly in the ’60s and ’70s.

If you like airplane statistics and facts, this article may interest you. Some pilots don't follow such things while others eat it up (you know who you are). For these readers, we have a new perspective that many may find intriguing.

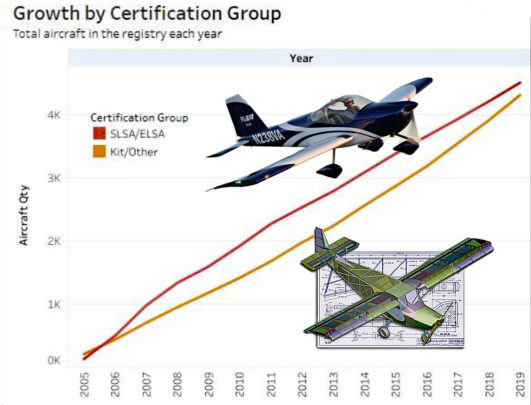

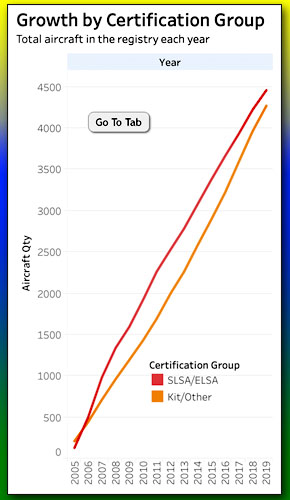

The comparisons below relate to the numbers of Single Engine Piston (SEP) general aviation (GA) aircraft on the U.S. registry compared to an umbrella group including SLSA, ELSA, and kit-built aircraft that Sport Pilots may fly (or those using a different certificate but exercising the privileges of Sport Pilot) …in other words, all the aircraft we cover on this website.

Even after more than 15 years of LSA and the kits that Sport Pilots can fly, the GA fleet still seems immeasurably larger. The truth is, we can measure it; in fact, we have up-to-date info and both are as accurate as FAA's database allows.

If you like airplane statistics and facts, this article may interest you. Some pilots don't follow such things while others eat it up (you know who you are). For these readers, we have a new perspective that many may find intriguing.

The comparisons below relate to the numbers of Single Engine Piston (SEP) general aviation (GA) aircraft on the U.S. registry compared to an umbrella group including SLSA, ELSA, and kit-built aircraft that Sport Pilots may fly (or those using a different certificate but exercising the privileges of Sport Pilot) …in other words, all the aircraft we cover on this website.

Even after more than 15 years of LSA and the kits that Sport Pilots can fly, the GA fleet still seems immeasurably larger. The truth is, we can measure it; in fact, we have up-to-date info and both are as accurate as FAA's database allows.

When you go global with these two aviation sectors, you find the USA has 80% of the GA fleet with the entire rest of the globe flying the other 20%.

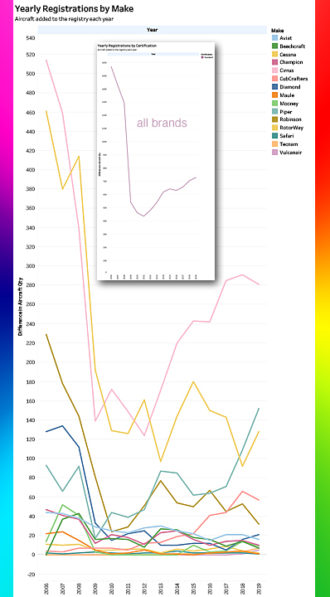

The table is turned upside down for LSA/SP kits, where the USA has about 20% of the global total and all other countries account for 80%. However, the U.S. share appears to be increasing gradually since the recession of 2007-2009. As you can note that recession hit GA very hard; the GA industry has yet to recover to pre-recession registrations.

When you go global with these two aviation sectors, you find the USA has 80% of the GA fleet with the entire rest of the globe flying the other 20%.

The table is turned upside down for LSA/SP kits, where the USA has about 20% of the global total and all other countries account for 80%. However, the U.S. share appears to be increasing gradually since the recession of 2007-2009. As you can note that recession hit GA very hard; the GA industry has yet to recover to pre-recession registrations.

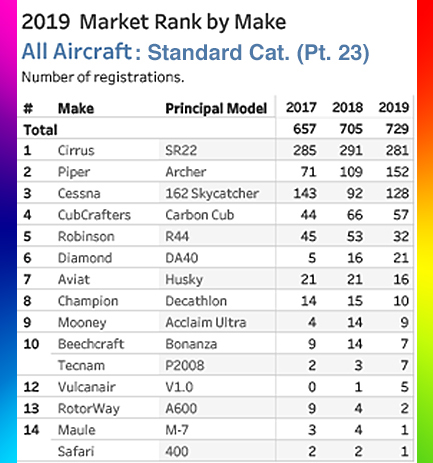

Take Cirrus out of the count and GA registered 448 aircraft from 15 producers, only 65% as many as all LSA/SP kit producers registered.

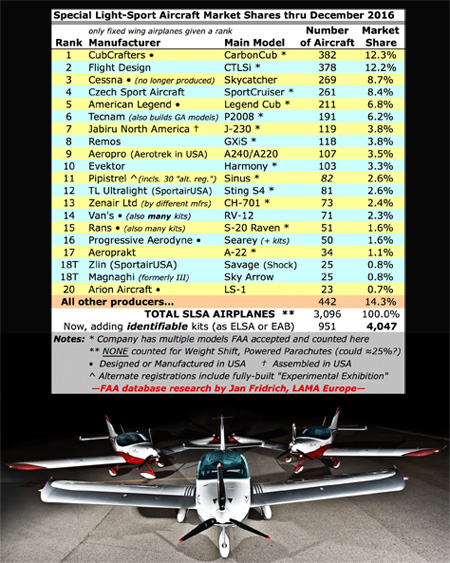

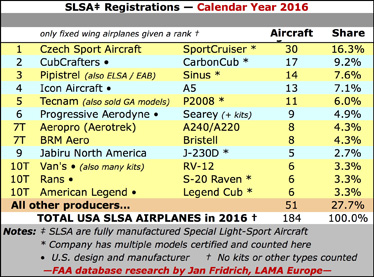

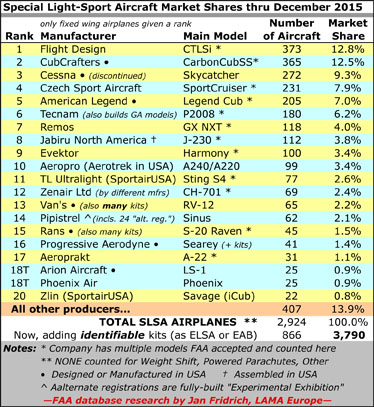

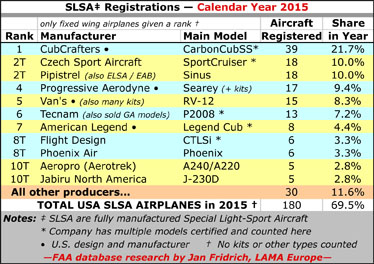

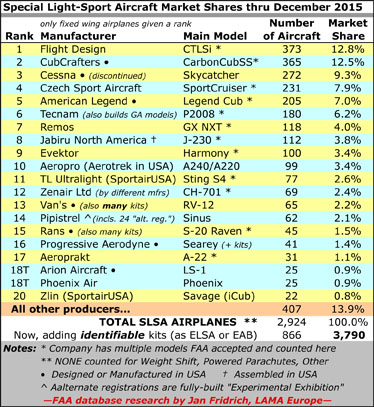

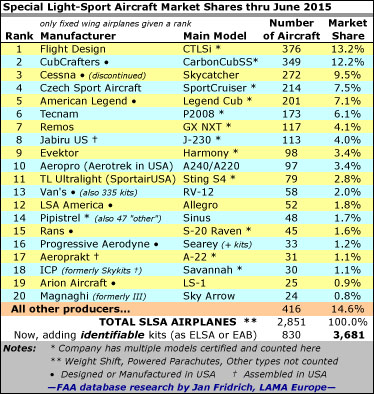

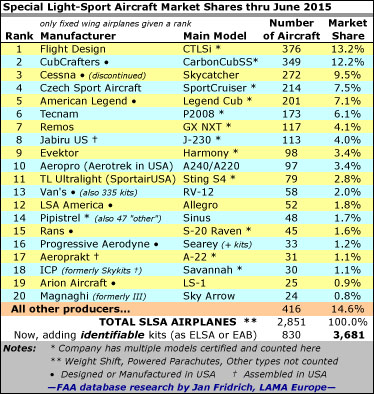

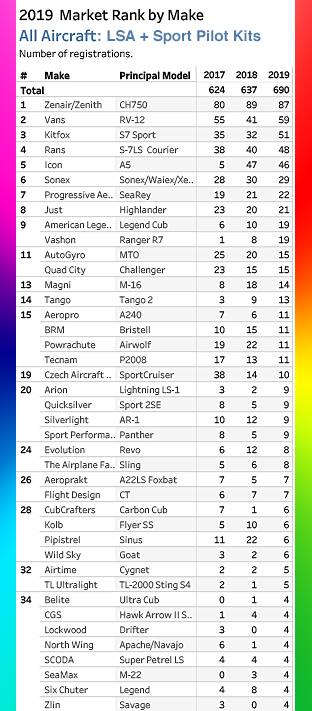

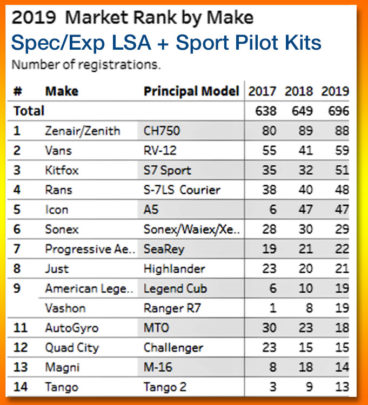

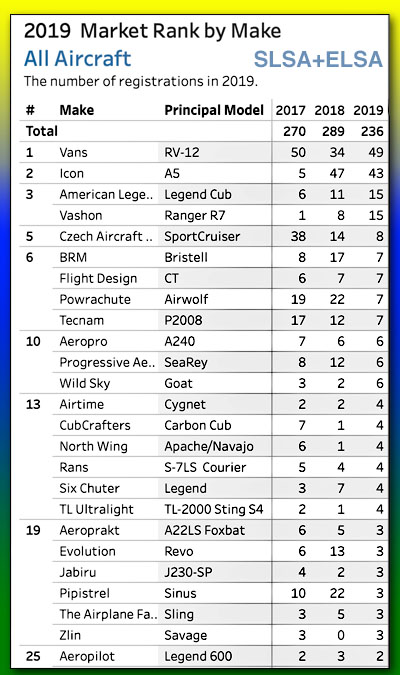

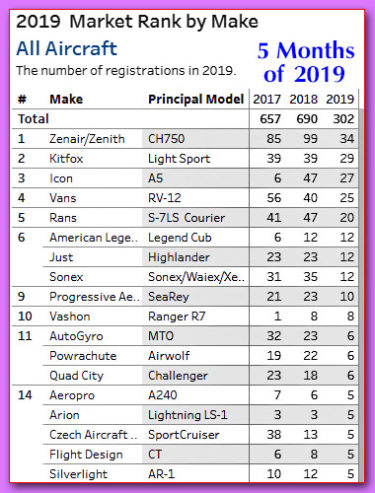

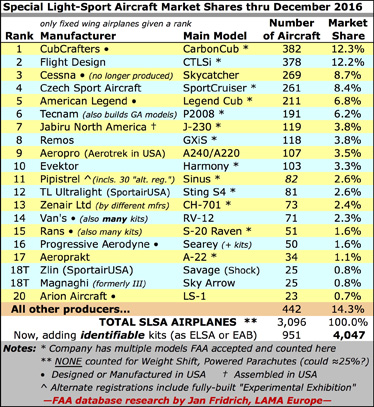

Although we have clear leaders in LSA/SP kits (see chart), the 690 aircraft come from an impressive list of 171 producers, more than 11 times more manufacturers than for SEP GA aircraft. This clearly illustrates what happens when you free up the design energy and productive spirit of small aviation companies.

Given a means of market entry, we saw the arrival of a new batch of manufacturers with a flock of new models to satisfy the diverse interests of pilots: from those seeking speedy cross country cruisers to back country taildraggers to special flying machines like gyroplanes, weight shift trikes, and powered parachutes.

Take Cirrus out of the count and GA registered 448 aircraft from 15 producers, only 65% as many as all LSA/SP kit producers registered.

Although we have clear leaders in LSA/SP kits (see chart), the 690 aircraft come from an impressive list of 171 producers, more than 11 times more manufacturers than for SEP GA aircraft. This clearly illustrates what happens when you free up the design energy and productive spirit of small aviation companies.

Given a means of market entry, we saw the arrival of a new batch of manufacturers with a flock of new models to satisfy the diverse interests of pilots: from those seeking speedy cross country cruisers to back country taildraggers to special flying machines like gyroplanes, weight shift trikes, and powered parachutes.

A huge thanks to our supreme "datastician," Steve Beste for making such swift and accurate reporting possible. I assure you that I've looked high and low for every year LSA have existed to find no comparable information.

As always, be advised that our data comes from FAA's aircraft registration database. That means it is impartial — hopefully meaning reliable and dependable — but it also means some massaging of the information is needed to be completely accurate. (

A huge thanks to our supreme "datastician," Steve Beste for making such swift and accurate reporting possible. I assure you that I've looked high and low for every year LSA have existed to find no comparable information.

As always, be advised that our data comes from FAA's aircraft registration database. That means it is impartial — hopefully meaning reliable and dependable — but it also means some massaging of the information is needed to be completely accurate. ( Overview

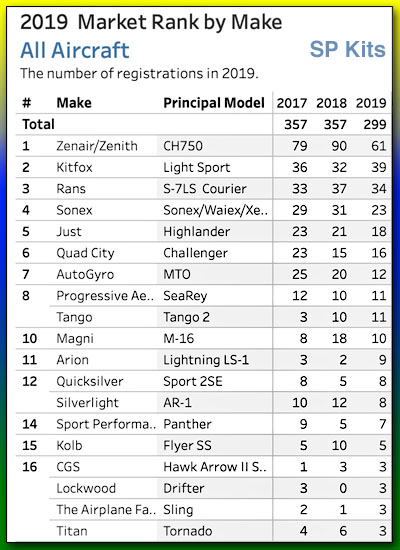

Overview However, as he added, "All did not have the same experience. Kitfox registrations increased by 60% (as the Idaho company appeared to lose some momentum in 2018). Van's Aircraft grew by 44% and Rans by 20% but Zenair/Zenith and Sonex were modestly off their previous pace (see chart below)."

For reference, here is our 3Q19 market share report with additional details you might find interesting.

However, as he added, "All did not have the same experience. Kitfox registrations increased by 60% (as the Idaho company appeared to lose some momentum in 2018). Van's Aircraft grew by 44% and Rans by 20% but Zenair/Zenith and Sonex were modestly off their previous pace (see chart below)."

For reference, here is our 3Q19 market share report with additional details you might find interesting.

Steve wrote, "Regarding Icon's numbers, note that historical figures often differ from what was previously reported," in this case with Icon and its A5. He continued, "This happens because FAA continues to perfect its data. For example, for 2018 the agency reported 57 Icon A5s as '2018' aircraft but FAA data clerks switched 11 of those to '2019' once their late-in-the-year paperwork was done. Thus, we now report fewer than 57 Icons for 2018."

Despite these necessary adjustments, we maintain the figures used in this report are the best available and are of very high reliability. In fact, the adjustments Steve and I make are proof of the effort to report accurate, dependable data.

As always, I offer a loud and heartfelt THANKS! to Steve Beste for his work to make this information available.

Steve wrote, "Regarding Icon's numbers, note that historical figures often differ from what was previously reported," in this case with Icon and its A5. He continued, "This happens because FAA continues to perfect its data. For example, for 2018 the agency reported 57 Icon A5s as '2018' aircraft but FAA data clerks switched 11 of those to '2019' once their late-in-the-year paperwork was done. Thus, we now report fewer than 57 Icons for 2018."

Despite these necessary adjustments, we maintain the figures used in this report are the best available and are of very high reliability. In fact, the adjustments Steve and I make are proof of the effort to report accurate, dependable data.

As always, I offer a loud and heartfelt THANKS! to Steve Beste for his work to make this information available.

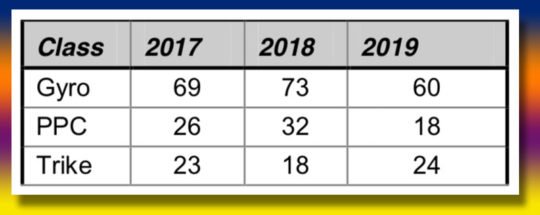

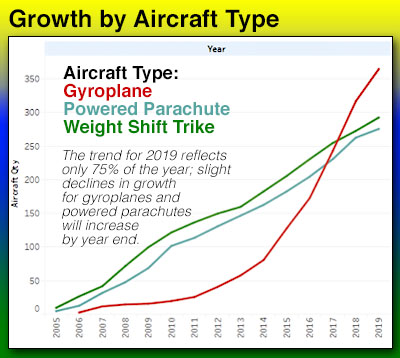

In general terms, Steve noted, "Alternate aircraft offer a mixed picture."

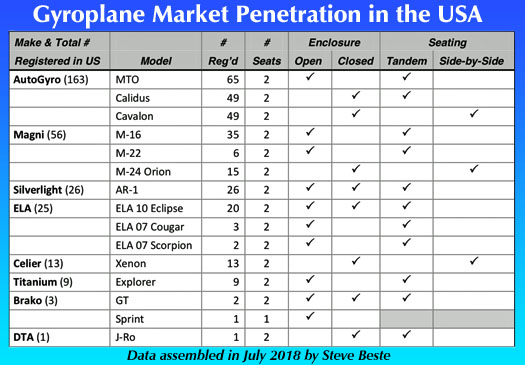

He reported, "We have no change from our third quarter 2019 report: Gyroplanes registrations are slowing slightly but are still hot. Trike registrations are holding steady. Powered parachutes registrations are off a bit (nearby chart).

In general terms, Steve noted, "Alternate aircraft offer a mixed picture."

He reported, "We have no change from our third quarter 2019 report: Gyroplanes registrations are slowing slightly but are still hot. Trike registrations are holding steady. Powered parachutes registrations are off a bit (nearby chart).

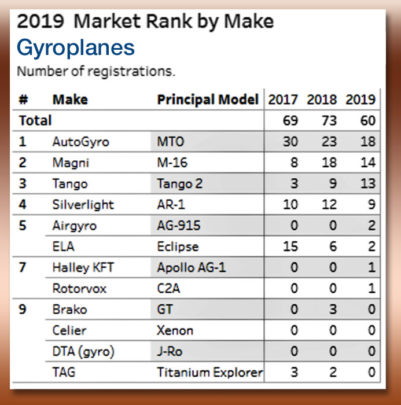

Gyroplanes

Gyroplanes Weight Shift Trikes

Weight Shift Trikes About this Report — “SP Kits” means Sport Pilot kit aircraft referring to amateur-built aircraft that can be flown by a pilot possessing a Sport Pilot certificate, or a pilot holding a Private Pilot certificate or higher who is exercising the privileges of Sport Pilot — meaning no aviation medical is required. Since Sport Pilot, as a form of pilot license, only arrived in late 2004, we collect information from FAA's Aircraft Registration database for all applicable kit-built aircraft that can be flown by a Sport Pilot plus, of course, all Special or Experimental LSA. Although some of the same kit aircraft existed before January 1, 2005, we omit them as it cannot be said those older aircraft could be flown by someone with a Sport Pilot certificate. This also evenly and fairly compares SP Kits with SLSA and ELSA.

** When using our online market share reporting system called

About this Report — “SP Kits” means Sport Pilot kit aircraft referring to amateur-built aircraft that can be flown by a pilot possessing a Sport Pilot certificate, or a pilot holding a Private Pilot certificate or higher who is exercising the privileges of Sport Pilot — meaning no aviation medical is required. Since Sport Pilot, as a form of pilot license, only arrived in late 2004, we collect information from FAA's Aircraft Registration database for all applicable kit-built aircraft that can be flown by a Sport Pilot plus, of course, all Special or Experimental LSA. Although some of the same kit aircraft existed before January 1, 2005, we omit them as it cannot be said those older aircraft could be flown by someone with a Sport Pilot certificate. This also evenly and fairly compares SP Kits with SLSA and ELSA.

** When using our online market share reporting system called

If you follow light aviation intently as many readers do, knowing what aircraft and subgroups (within LSA and SP kits

If you follow light aviation intently as many readers do, knowing what aircraft and subgroups (within LSA and SP kits Why? We don't claim to have all the answers but regular surveying of exhibitors at airshows revealed that many sellers say, "The market is good. People are buying." Of course, this is anecdotal not scientific but we heard it from enough vendors to believe they're feeling good about their enterprises. Many pilots backed up this finding with their own, personal assessment.

If you want to do your own analysis, you certainly can using our completely free-of-charge

Why? We don't claim to have all the answers but regular surveying of exhibitors at airshows revealed that many sellers say, "The market is good. People are buying." Of course, this is anecdotal not scientific but we heard it from enough vendors to believe they're feeling good about their enterprises. Many pilots backed up this finding with their own, personal assessment.

If you want to do your own analysis, you certainly can using our completely free-of-charge  This is the first time you've seen this because earlier, we segmented SLSA from ELSA from SP kits. This made it appear kits were growing faster than the LSA groups. In fact, they are nearly matched with kit-built aircraft.

Viewing all light aircraft as a group, Steve noted, "The same six brands continue to lead the pack." He refers to the full fleet of light aircraft a Sport Pilot may fly — led by kit-built aircraft producers: Zenair/Zenith, Van's, Rans, Sonex, and Kitfox plus SLSA builder,

This is the first time you've seen this because earlier, we segmented SLSA from ELSA from SP kits. This made it appear kits were growing faster than the LSA groups. In fact, they are nearly matched with kit-built aircraft.

Viewing all light aircraft as a group, Steve noted, "The same six brands continue to lead the pack." He refers to the full fleet of light aircraft a Sport Pilot may fly — led by kit-built aircraft producers: Zenair/Zenith, Van's, Rans, Sonex, and Kitfox plus SLSA builder,  Using

Using  However, fixed wing continue to be, by far, the biggest group of LSA (partly as very few kit-built aircraft are "alternative" types).

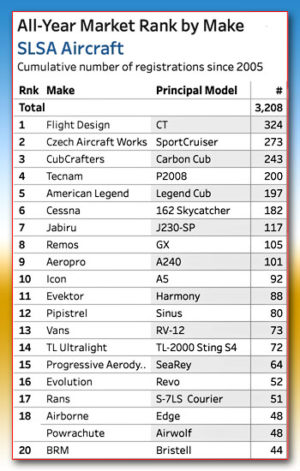

Among Special (fully built) LSA, Flight Design continues atop the ranking. They enjoyed a phenomenal start back in 2005-2006 and have never lost their leadership position. American Legend, Czech Sport Aircraft, CubCrafters, Tecnam, and

However, fixed wing continue to be, by far, the biggest group of LSA (partly as very few kit-built aircraft are "alternative" types).

Among Special (fully built) LSA, Flight Design continues atop the ranking. They enjoyed a phenomenal start back in 2005-2006 and have never lost their leadership position. American Legend, Czech Sport Aircraft, CubCrafters, Tecnam, and  As we head into the final quarter of 2019 — and the final LSA show of the year, the

As we head into the final quarter of 2019 — and the final LSA show of the year, the

The update to industry covered a lot of ground but here we've tried to make it a quicker read.

Two key points: First, FAA is in the early stages of this rulemaking; at least minor changes are certain. FAA itself does not know all the specific details of the proposed rule at this time.

Secondly, the steps reported here come from actual rule writers but their effort has support from top FAA leadership. Driven by a Congressional mandate we know this will go forward.

The update to industry covered a lot of ground but here we've tried to make it a quicker read.

Two key points: First, FAA is in the early stages of this rulemaking; at least minor changes are certain. FAA itself does not know all the specific details of the proposed rule at this time.

Secondly, the steps reported here come from actual rule writers but their effort has support from top FAA leadership. Driven by a Congressional mandate we know this will go forward.

Regarding the much-anticipated max weight increase, FAA refers to a "Power Index." This term means a formula-based method to replace maximum takeoff weight in the definition of a LSA, involving wing area, horsepower, and takeoff weight.

FAA is also looking at up to four seats, “for personal use and for flight training.” Airspeeds — referring to maximum horizontal and never-to-exceed speeds (Vh and Vne) — may be higher than in the current rule, but will still be limited.

Neither will FAA be prescriptive about (that is, tightly defining) powerplants. The 2004 version of the LSA rule prohibited electric motors because rule writers wanted to discourage turbine power and therefore specified reciprocating engines, which knocked out electric. FAA will now consider both electric and hybrid.

Yet FAA was clear, “Movement of people for hire (such as the multicopter air taxis proposed by numerous companies) is not part of this.”

FAA is also reviewing what type of mechanics (LSR-M or A&P) can do what kind of work on specific systems of aircraft (examples: in-flight adjustable prop or electric propulsion systems).

Regarding the much-anticipated max weight increase, FAA refers to a "Power Index." This term means a formula-based method to replace maximum takeoff weight in the definition of a LSA, involving wing area, horsepower, and takeoff weight.

FAA is also looking at up to four seats, “for personal use and for flight training.” Airspeeds — referring to maximum horizontal and never-to-exceed speeds (Vh and Vne) — may be higher than in the current rule, but will still be limited.

Neither will FAA be prescriptive about (that is, tightly defining) powerplants. The 2004 version of the LSA rule prohibited electric motors because rule writers wanted to discourage turbine power and therefore specified reciprocating engines, which knocked out electric. FAA will now consider both electric and hybrid.

Yet FAA was clear, “Movement of people for hire (such as the multicopter air taxis proposed by numerous companies) is not part of this.”

FAA is also reviewing what type of mechanics (LSR-M or A&P) can do what kind of work on specific systems of aircraft (examples: in-flight adjustable prop or electric propulsion systems).

The FAA Reauthorization Act of 2018 includes a deadline of 2023 for implementing a key mandate that suggests the longest it should take. Once an NPRM is published, a comment period follows to hear from the public after which FAA needs time to address the concerns raised during that comment period. After closure of that comment period, the FAA has 16 months to publish the Final Rule.

Throughout the LAMA/FAA teleconference some ideas were repeated by FAA personnel…

The FAA Reauthorization Act of 2018 includes a deadline of 2023 for implementing a key mandate that suggests the longest it should take. Once an NPRM is published, a comment period follows to hear from the public after which FAA needs time to address the concerns raised during that comment period. After closure of that comment period, the FAA has 16 months to publish the Final Rule.

Throughout the LAMA/FAA teleconference some ideas were repeated by FAA personnel…

“All of these requests are on the table,” FAA acknowledged in the June teleconference. Of course, this does not mean all are certain to be included, but they represent a “huge opportunity [for industry and for pilots].”

“All of these requests are on the table,” FAA acknowledged in the June teleconference. Of course, this does not mean all are certain to be included, but they represent a “huge opportunity [for industry and for pilots].”

Under this more performance-based approach, LSA manufacturers would have more flexibility in making trade-offs among these parameters to meet a new power index limit. That new limit is intended to allow for up to a safe, robust, four-seat airplane.

“All this is seen [within the agency] as relieving on industry; enabling, not tightening the screws,” said FAA.

Under this more performance-based approach, LSA manufacturers would have more flexibility in making trade-offs among these parameters to meet a new power index limit. That new limit is intended to allow for up to a safe, robust, four-seat airplane.

“All this is seen [within the agency] as relieving on industry; enabling, not tightening the screws,” said FAA.

“The Flight Standards people are considering [aerial work],” said FAA.

This important topic has been a priority for LAMA because it could become a vital activity to keep manufacturers healthy by expanding their capabilities and the markets they can serve. Pilots could also gain as this would provide more compensated flying jobs and business opportunities.

“The Flight Standards people are considering [aerial work],” said FAA.

This important topic has been a priority for LAMA because it could become a vital activity to keep manufacturers healthy by expanding their capabilities and the markets they can serve. Pilots could also gain as this would provide more compensated flying jobs and business opportunities.

Single Lever Control

Single Lever Control

Our first quarterly report in many years should have come about April 1st. It did not. That date came as

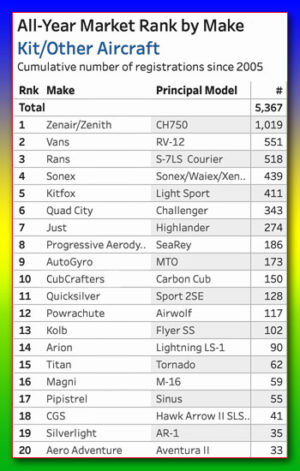

Our first quarterly report in many years should have come about April 1st. It did not. That date came as  Digging deeper, the chart shows that longtime market leader

Digging deeper, the chart shows that longtime market leader  Strong SP kit suppliers include

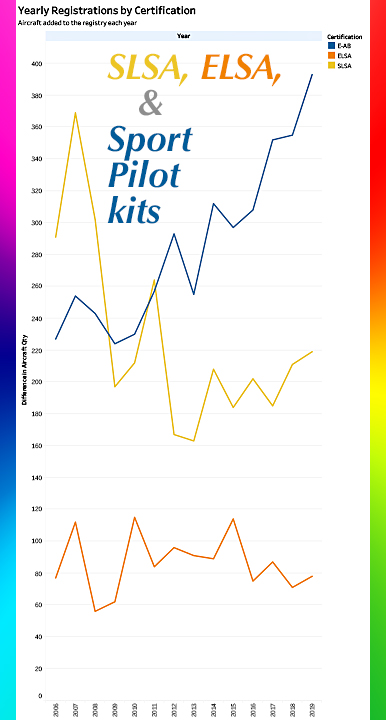

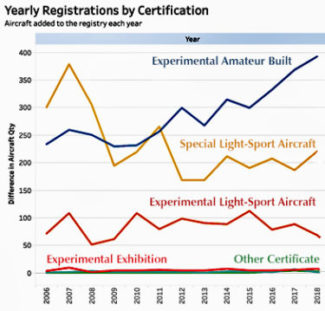

Strong SP kit suppliers include  Yet the real surprise comes when you look at our final chart of this article. Kits appear ascendant since 2013, especially when compared to Special LSA that seems to have found a stable registration rate of around 200 aircraft per year. However, when you combine SLSA with Experimental LSA, you can see that all LSA types number closer to 300 units per year, compared to all SP kits at just shy of 400. Specialty registrations like Experimental Exhibition are steady but at a far smaller unit count.

Yet the real surprise comes when you look at our final chart of this article. Kits appear ascendant since 2013, especially when compared to Special LSA that seems to have found a stable registration rate of around 200 aircraft per year. However, when you combine SLSA with Experimental LSA, you can see that all LSA types number closer to 300 units per year, compared to all SP kits at just shy of 400. Specialty registrations like Experimental Exhibition are steady but at a far smaller unit count.

Any ELSA must be shipped from the factory as a bolt-for-bolt copy of the SLSA model, as required under the regulation. No producer can sell an ELSA without first getting approved for a SLSA, so to my mind, combining SLSA and ELSA makes for a fairer comparison to Sport Pilot kit aircraft.

If you love these numbers, please visit

Any ELSA must be shipped from the factory as a bolt-for-bolt copy of the SLSA model, as required under the regulation. No producer can sell an ELSA without first getting approved for a SLSA, so to my mind, combining SLSA and ELSA makes for a fairer comparison to Sport Pilot kit aircraft.

If you love these numbers, please visit

Over many years, you have found

Over many years, you have found

Our new associate, Steve Beste, wrote an excellent article for his club newsletter and I will summarize that piece in another post.

In his article, he wrote, "[Along with better training] the other change since those days is the large horizontal stabilizer, mounted well aft. Some machines were prone to PIO, pilot-induced oscillations in pitch. The pilot would chase the oscillations, only making them worse until the gyro did a fatal bunt over. The large tail that Magni invented – as is used on all modern gyros – has fixed that."

Our new associate, Steve Beste, wrote an excellent article for his club newsletter and I will summarize that piece in another post.

In his article, he wrote, "[Along with better training] the other change since those days is the large horizontal stabilizer, mounted well aft. Some machines were prone to PIO, pilot-induced oscillations in pitch. The pilot would chase the oscillations, only making them worse until the gyro did a fatal bunt over. The large tail that Magni invented – as is used on all modern gyros – has fixed that."

As you can see,

As you can see,

"[However, FAA's] data is not clean," Steve observed. I am well aware of this problem. Uncertainty about data accuracy of "alternative" LSA is why we have reported fixed wing Special LSA, only offering guesses for weight shift trikes, powered parachutes, gyroplanes, motorgliders, and more.

However, we hope that will now change and our market share reporting will be more inclusive. Hurray!

"[However, FAA's] data is not clean," Steve observed. I am well aware of this problem. Uncertainty about data accuracy of "alternative" LSA is why we have reported fixed wing Special LSA, only offering guesses for weight shift trikes, powered parachutes, gyroplanes, motorgliders, and more.

However, we hope that will now change and our market share reporting will be more inclusive. Hurray!

Problems in FAA's database is not caused by incompetent clerks. Agency personnel must sort through inconsistently-reported aircraft. If, as Steve pointed out in one example, the registered name of the aircraft is slightly different, it won't show up on a casual investigation.

He added, "There's no end of that kind of thing …just so we know the limitations on this exercise. But with that understanding, I love this kind of thing, I have the skills to do it, and would be honored to support your good work for the sport." All such reporting will be available on the home page when fresh and catalogued on its own space found by

Problems in FAA's database is not caused by incompetent clerks. Agency personnel must sort through inconsistently-reported aircraft. If, as Steve pointed out in one example, the registered name of the aircraft is slightly different, it won't show up on a casual investigation.

He added, "There's no end of that kind of thing …just so we know the limitations on this exercise. But with that understanding, I love this kind of thing, I have the skills to do it, and would be honored to support your good work for the sport." All such reporting will be available on the home page when fresh and catalogued on its own space found by  Chuck's son Jim Vanek took over the business and revamped the Vancraft designs. He said his "award-winning, world’s-first, two-place gyroplane took the prestigious Charles Lindbergh award at the Oshkosh airshow in 1985." The company also reports his Sport Copter II design was voted as one of the Top Ten Best Designs at AirVenture in 2011.

An airshow performer, Jim said he wrote the parameters and guidelines for gyroplane looping for the FAA in 1998 after performing the world’s first loop in a conventional gyroplane, in 1997. The company's website reports, "He is the only gyro pilot in the world that holds an International Council of Air Shows card for gyroplane looping and rolling." Don't even think about trying this yourself, however.

Chuck's son Jim Vanek took over the business and revamped the Vancraft designs. He said his "award-winning, world’s-first, two-place gyroplane took the prestigious Charles Lindbergh award at the Oshkosh airshow in 1985." The company also reports his Sport Copter II design was voted as one of the Top Ten Best Designs at AirVenture in 2011.

An airshow performer, Jim said he wrote the parameters and guidelines for gyroplane looping for the FAA in 1998 after performing the world’s first loop in a conventional gyroplane, in 1997. The company's website reports, "He is the only gyro pilot in the world that holds an International Council of Air Shows card for gyroplane looping and rolling." Don't even think about trying this yourself, however.

The company said, "We offer 22 thru 28 foot rotor blades of our own design with a lift capability from ultralight thru 1,200 pounds gross weight." They added, "We are the only manufacturer that test flies all blade sets prior to shipping." For export, Rotor Flight will fully build their aircraft but in the USA, FAA will only permit them to deliver kits, the same as all gyroplane producers.

As with all the modern gyroplanes, Rotor Flight uses a substantial tailplane. "The Dominator [series of one and two-place machines] incorporate the Tall Tail design for stability." Asked how their product differs, the company's website states, "What makes the Dominator so unique is its high profile design. It sits up very high off the ground."

The company said, "We offer 22 thru 28 foot rotor blades of our own design with a lift capability from ultralight thru 1,200 pounds gross weight." They added, "We are the only manufacturer that test flies all blade sets prior to shipping." For export, Rotor Flight will fully build their aircraft but in the USA, FAA will only permit them to deliver kits, the same as all gyroplane producers.

As with all the modern gyroplanes, Rotor Flight uses a substantial tailplane. "The Dominator [series of one and two-place machines] incorporate the Tall Tail design for stability." Asked how their product differs, the company's website states, "What makes the Dominator so unique is its high profile design. It sits up very high off the ground."