My moment of truth is fast approaching. Will I succeed or fail to predict the future? I have been repeating my forecast that FAA will announce a draft of their newest regulation, called an NPRM (Notice of Proposed Rule Making) at EAA’s big summer celebration of flight. I’m not betting the farm, though. I think it’s a fairly safe prediction. To win an increase in their budget a few years back, FAA agreed to complete a new regulation by December 31, 2023. That new reg is widely known as Mosaic; its full name is Modernization of Special Airworthiness Certification. Because FAA has said the agency needs 16 months to read every comment and adjust the final regulation language accordingly, seeing the future is simple math. Go back in time 16 months from the end-of-year deadline in 2023 and you end up at… yep! — AirVenture Oshkosh 2022. We will see if they meet their goal.

Both airplane producer stories made it into mainstream media.

If we go way back in time, to 2003, that is, before Light-Sport Aircraft, we saw a world where Americans flew kit-built airplanes while European pilots were flying what they called ultralights or microlights. Of course, this is an oversimplification but we had no idea the two methods of production would converge as they have in the last two decades.

Using widely-accepted consensus standards, Light-Sport Aircraft can operate in multiple countries — thanks to the useful work of many volunteers that assembled and maintain ASTM standards embraced by FAA and other CAAs all over the planet.

Let's look at these two stories…

Both airplane producer stories made it into mainstream media.

If we go way back in time, to 2003, that is, before Light-Sport Aircraft, we saw a world where Americans flew kit-built airplanes while European pilots were flying what they called ultralights or microlights. Of course, this is an oversimplification but we had no idea the two methods of production would converge as they have in the last two decades.

Using widely-accepted consensus standards, Light-Sport Aircraft can operate in multiple countries — thanks to the useful work of many volunteers that assembled and maintain ASTM standards embraced by FAA and other CAAs all over the planet.

Let's look at these two stories…

“At this point, there are about 10 to 12 airframes at the Kherson plant,” Peghiny said to AOPA. "Ordinarily, the airframes would be sent to Flight Design’s final assembly and completion center in the city of Šumperk in the Czech Republic."

“We’ve found a new, 25,000-square-foot site [in Šumperk that is] suitable for use as a production and paint shop, and will use that in the future,” Peghiny said in the AOPA article. Engineering work is also conducted in Šumperk.

"Flight Design is offering to move its Ukraine staff and their families to the Šumperk facility," AOPA wrote. "Peghiny said that the Kherson plant will function as long as conditions allow. However, tooling currently remaining in Kherson will have to be replaced by newly manufactured tooling for use in Šumperk. The company will fund new tooling, but it may take six to nine months to build."

“At this point, there are about 10 to 12 airframes at the Kherson plant,” Peghiny said to AOPA. "Ordinarily, the airframes would be sent to Flight Design’s final assembly and completion center in the city of Šumperk in the Czech Republic."

“We’ve found a new, 25,000-square-foot site [in Šumperk that is] suitable for use as a production and paint shop, and will use that in the future,” Peghiny said in the AOPA article. Engineering work is also conducted in Šumperk.

"Flight Design is offering to move its Ukraine staff and their families to the Šumperk facility," AOPA wrote. "Peghiny said that the Kherson plant will function as long as conditions allow. However, tooling currently remaining in Kherson will have to be replaced by newly manufactured tooling for use in Šumperk. The company will fund new tooling, but it may take six to nine months to build."

"Flight Design employs just under 200 technicians, assemblers, and engineers currently at the Kherson plant," continued Boatman, "and according to Peghiny, the company has been ramping up that number. 'We were hiring more aggressively in the past year because of the popularity of the F2, but the other models in the range have been selling well in Europe — simpler, lighter models in particular,' Tom said." Of course, Tom refers to the CT-series including CTLS that is one of the most popular LSA in America.

“We know [our employees] very well,” Peghiny said in Boatman's article. “Some have been with the company more than 20 years. We’re good friends, and we take this very personally.”

"Flight Design employs just under 200 technicians, assemblers, and engineers currently at the Kherson plant," continued Boatman, "and according to Peghiny, the company has been ramping up that number. 'We were hiring more aggressively in the past year because of the popularity of the F2, but the other models in the range have been selling well in Europe — simpler, lighter models in particular,' Tom said." Of course, Tom refers to the CT-series including CTLS that is one of the most popular LSA in America.

“We know [our employees] very well,” Peghiny said in Boatman's article. “Some have been with the company more than 20 years. We’re good friends, and we take this very personally.”

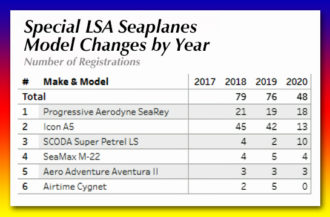

Dave Hirschman wrote, "Dennis Long, a dealer for Aeroprakt… said he spoke with factory officials who said they plan to remain on the job. 'They told me they’re going to keep making airplanes until they can’t'," AOPA reported. 'For the time being, it’s business as usual, although my next two airplanes will likely have to be shipped from Poland because the port of Odessa [in Ukraine] is closed.'”

Aeroprakt has steady registered more aircraft with the FAA. When asked by AOPA's writer, Dennis said, "Right now, due to all the uncertainty, I’m not taking any new deposits. I’m more concerned about the people over there than the airplanes at this moment."

Dave Hirschman wrote, "Dennis Long, a dealer for Aeroprakt… said he spoke with factory officials who said they plan to remain on the job. 'They told me they’re going to keep making airplanes until they can’t'," AOPA reported. 'For the time being, it’s business as usual, although my next two airplanes will likely have to be shipped from Poland because the port of Odessa [in Ukraine] is closed.'”

Aeroprakt has steady registered more aircraft with the FAA. When asked by AOPA's writer, Dennis said, "Right now, due to all the uncertainty, I’m not taking any new deposits. I’m more concerned about the people over there than the airplanes at this moment."

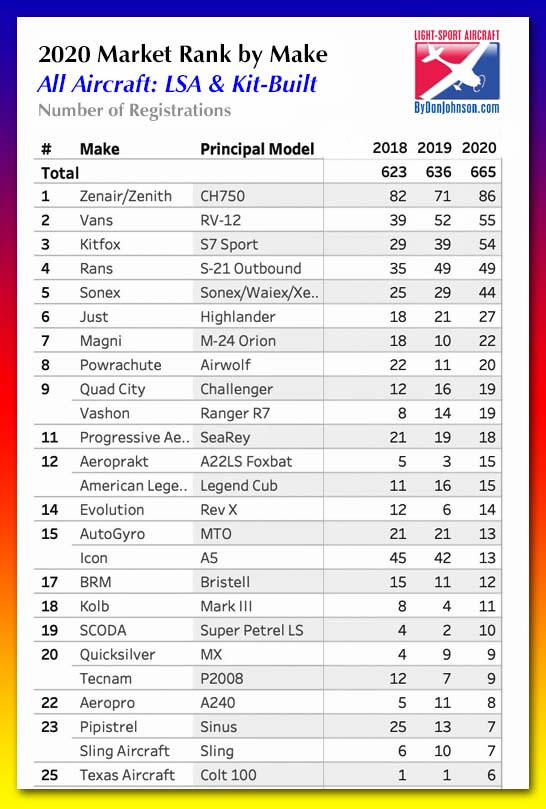

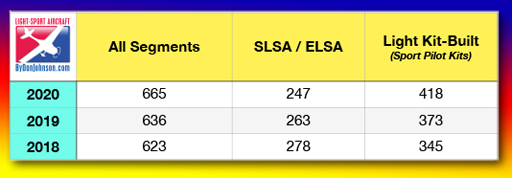

This report took a bit more time as the effort to begin counting Part 103 ultralights altered our view of the FAA aircraft registration data. Most of you may prefer this simpler report, but the data hounds among readers can drill all the way down to the last aircraft on

This report took a bit more time as the effort to begin counting Part 103 ultralights altered our view of the FAA aircraft registration data. Most of you may prefer this simpler report, but the data hounds among readers can drill all the way down to the last aircraft on  Many may be surprised. Registrations grew? …in 2020!? Indeed, they did, and that's without counting Part 103 ultralights that do not need to be registered with FAA. We'll have lots more on Part 103s in a couple months (the

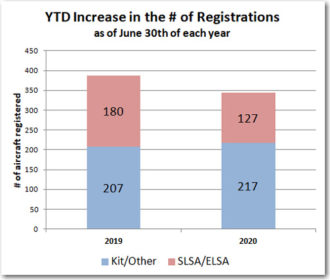

Many may be surprised. Registrations grew? …in 2020!? Indeed, they did, and that's without counting Part 103 ultralights that do not need to be registered with FAA. We'll have lots more on Part 103s in a couple months (the

Why is this true? Many reasons might explain but affordability is a key element and, no question about it, investing your labor reduces the cash outlay to have your own airplane. At the same time, the sophistication of Special LSA has risen over the years. Features such as bigger, more powerful engines, autopilot, big fancy panel displays, leather interiors, complex manufacturing with carbon fiber, and the cost of complying with ASTM standards has increased the cost of some SLSA beyond $200,000. At this price point, some readers note a recreational aircraft can cost more than your house (not in California or New England, perhaps, but in many U.S. regions this may be true).

Why is this true? Many reasons might explain but affordability is a key element and, no question about it, investing your labor reduces the cash outlay to have your own airplane. At the same time, the sophistication of Special LSA has risen over the years. Features such as bigger, more powerful engines, autopilot, big fancy panel displays, leather interiors, complex manufacturing with carbon fiber, and the cost of complying with ASTM standards has increased the cost of some SLSA beyond $200,000. At this price point, some readers note a recreational aircraft can cost more than your house (not in California or New England, perhaps, but in many U.S. regions this may be true).

"Look at the slope of the lines," Steve advises. "The brown (kit) line is steeper, especially last year. That means two things: First, a lot of people finished their kit planes in 2020 – more than finished them in 2019 (so that’s how they spent their lockdown time). Secondly, people are buying more kits than factory-built aircraft. Of course, there’s a lag in the data

"Look at the slope of the lines," Steve advises. "The brown (kit) line is steeper, especially last year. That means two things: First, a lot of people finished their kit planes in 2020 – more than finished them in 2019 (so that’s how they spent their lockdown time). Secondly, people are buying more kits than factory-built aircraft. Of course, there’s a lag in the data

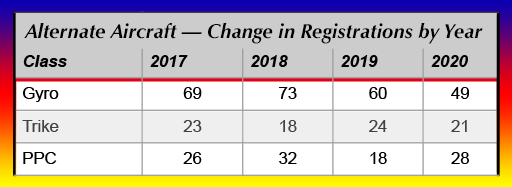

Whatever the explanation, Italy-based Magni surged from well behind the market leader to race ahead in the American gyroplane market for 2020.

Whatever the explanation, Italy-based Magni surged from well behind the market leader to race ahead in the American gyroplane market for 2020.

"

" "

"

In this context, how might the aviation industry be holding up? We read — and some brave travelers have experienced first-hand — how the airline industry is in a deep hole, prompting large layoffs.

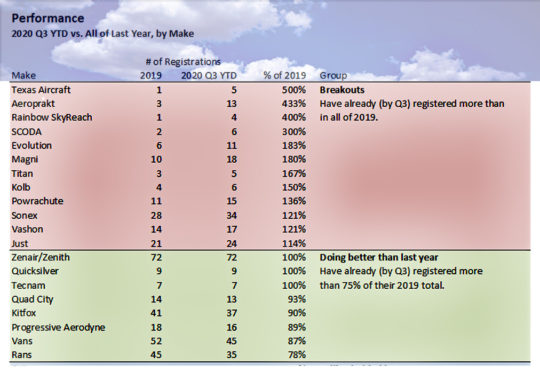

In this third quarter report for the calendar year, I'll look at some numbers for general aviation manufacturers as well as the light aviation industry that has my full focus.

The short answer: some are doing surprisingly well.

In this context, how might the aviation industry be holding up? We read — and some brave travelers have experienced first-hand — how the airline industry is in a deep hole, prompting large layoffs.

In this third quarter report for the calendar year, I'll look at some numbers for general aviation manufacturers as well as the light aviation industry that has my full focus.

The short answer: some are doing surprisingly well.

It bears repeating. You can go poke around FAA's database yourself …but while you access the same information you won't get the same details as we have here without a lot of work.

What you see here is thanks to Steve's noteworthy skills at organizing data and solving the puzzles made by aircraft with varying registration information.

To better understand Steve's marvelous work,

It bears repeating. You can go poke around FAA's database yourself …but while you access the same information you won't get the same details as we have here without a lot of work.

What you see here is thanks to Steve's noteworthy skills at organizing data and solving the puzzles made by aircraft with varying registration information.

To better understand Steve's marvelous work,  Steve summarized, "Some [producers] are doing stupendously better than last year. Others, not so much."

Some, like "Most Improved"

Steve summarized, "Some [producers] are doing stupendously better than last year. Others, not so much."

Some, like "Most Improved"

Many pilots expect the first appearance of a new model at the biggest airshows, but here's one of those times when the sector-specific shows win. It's all about timing and the new Aeroprakt A32 just won it's SLSA approval (#147 on our

Many pilots expect the first appearance of a new model at the biggest airshows, but here's one of those times when the sector-specific shows win. It's all about timing and the new Aeroprakt A32 just won it's SLSA approval (#147 on our  First blush: This is a great flying airplane, reflecting Aeroprakt's experience producing more than 1,000 of the predecessor

First blush: This is a great flying airplane, reflecting Aeroprakt's experience producing more than 1,000 of the predecessor  When deploying or retracting flaps, the pitch change is very minor. True, two notches is only 20° of flaps but deploying them made quite an aerodynamic change, just not a pitch change. On one landing I made with no flaps, I had to raise the nose significantly high to put A32 on the ground.

A32 uses a full flying stabilator, a change from A22 and it was more responsive than the former. It will take a bit longer to get used to but it is a powerful surface. On takeoff, importer Dennis Long demonstrated how immediate the stabilator will lift the nose off the ground. In fact, that's his preferred takeoff technique: power to full, almost immediately pull aft on the Y-stick, control the nose so it sits a few inches off the runway, and let A32 then fly herself into the air. I followed his method and it worked wonderfully well.

When deploying or retracting flaps, the pitch change is very minor. True, two notches is only 20° of flaps but deploying them made quite an aerodynamic change, just not a pitch change. On one landing I made with no flaps, I had to raise the nose significantly high to put A32 on the ground.

A32 uses a full flying stabilator, a change from A22 and it was more responsive than the former. It will take a bit longer to get used to but it is a powerful surface. On takeoff, importer Dennis Long demonstrated how immediate the stabilator will lift the nose off the ground. In fact, that's his preferred takeoff technique: power to full, almost immediately pull aft on the Y-stick, control the nose so it sits a few inches off the runway, and let A32 then fly herself into the air. I followed his method and it worked wonderfully well.

A32 uses the identical wing from A22 from the fuselage root out. However, the many clean-ups of the fuselage — and they are many, which you will see more fully in the Video Pilot Report to follow after editing — make the new model more efficient. A pilot literally has to work at getting it back on the ground …and that's a good thing.

I reduced power to 3000 rpm abeam my touchdown target and then began to retard speed, lowering one notch of flaps after we got in flap speed range (<93 mph). On base leg I had both notches in and was monitoring my speed carefully. Using 60-65 mph was fine on base turning final but I moved it to 55-60 on short final and was ideally at 50-55 over the numbers.

With two notches of flaps and with a modest headwind, A32 landed very short. You have excellent visibility on landing as you do in flight in A32 Vixxen. It lacks a skylight but otherwise offers a wide view all around. I could even watch as the main gear touched down (when Dennis was controlling the aircraft).

A32 uses the identical wing from A22 from the fuselage root out. However, the many clean-ups of the fuselage — and they are many, which you will see more fully in the Video Pilot Report to follow after editing — make the new model more efficient. A pilot literally has to work at getting it back on the ground …and that's a good thing.

I reduced power to 3000 rpm abeam my touchdown target and then began to retard speed, lowering one notch of flaps after we got in flap speed range (<93 mph). On base leg I had both notches in and was monitoring my speed carefully. Using 60-65 mph was fine on base turning final but I moved it to 55-60 on short final and was ideally at 50-55 over the numbers.

With two notches of flaps and with a modest headwind, A32 landed very short. You have excellent visibility on landing as you do in flight in A32 Vixxen. It lacks a skylight but otherwise offers a wide view all around. I could even watch as the main gear touched down (when Dennis was controlling the aircraft).

Takeoff and landing has been quoted at "under 100 meters" (300 feet) and I believe it. No question it was short, assuming, of course, decent technique.

A32 Vixxen was easy to fly with a joystick that provided enough feedback yet offered crisp response. In flight, I found the aircraft very well behaved and suitable for less experienced flyers, naturally assuming proper instruction and transition training.

In all, I think Aeroprakt has a winner. Dennis Long equipped this particular example with most available options, including the

Takeoff and landing has been quoted at "under 100 meters" (300 feet) and I believe it. No question it was short, assuming, of course, decent technique.

A32 Vixxen was easy to fly with a joystick that provided enough feedback yet offered crisp response. In flight, I found the aircraft very well behaved and suitable for less experienced flyers, naturally assuming proper instruction and transition training.

In all, I think Aeroprakt has a winner. Dennis Long equipped this particular example with most available options, including the