At the Midwest LSA Expo that concluded a few days back, I delivered a presentation called “20+ Reasons to Buy an LSA.” However, to handle the subject a little bit differently, I turned it into an audience participation exercise. As I presented each slide of one particular reason, I explained what was meant and elaborated on how each reason made LSA different from other sorts of aircraft someone might consider buying. Then, I asked the audience to raise their hand if that reason was one that might cause them to buy a Light-Sport. I advised that no one was recording their names, so they remained anonymous. Each person could raise their hand as many times as they wanted or never raise their hand if they chose. No one had to participate. About 35 people listened and somewhere between 15 and 25 answered most of the time. The following chart shows the responses.

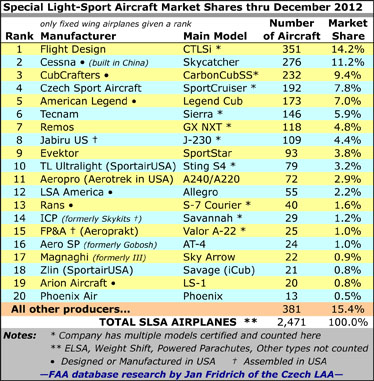

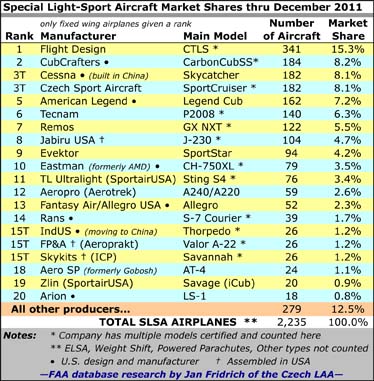

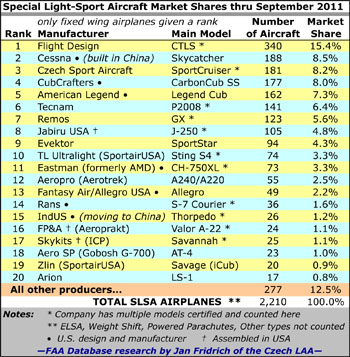

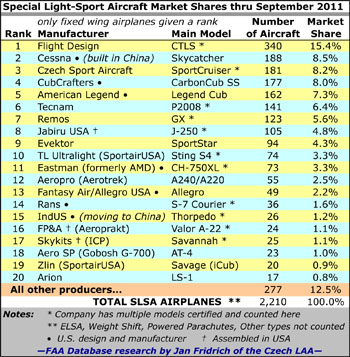

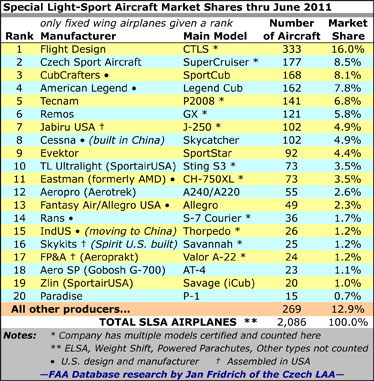

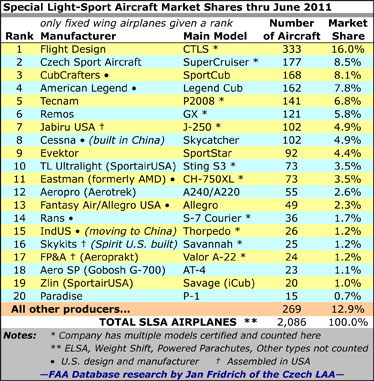

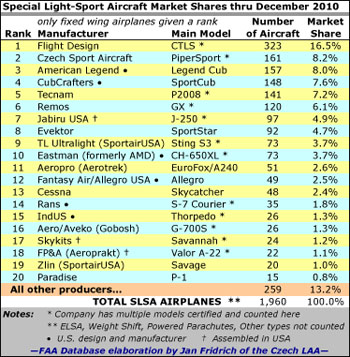

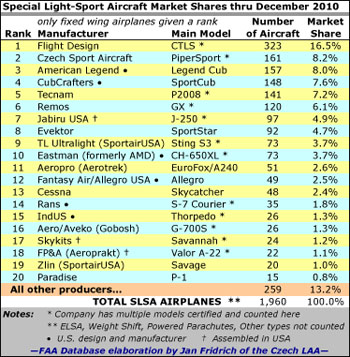

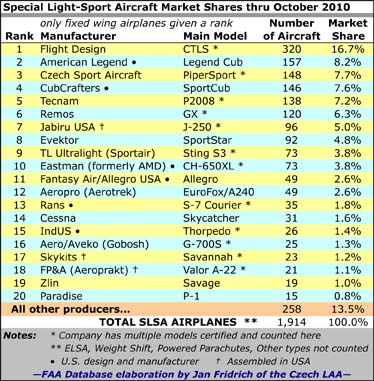

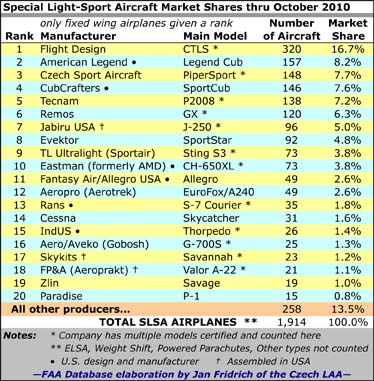

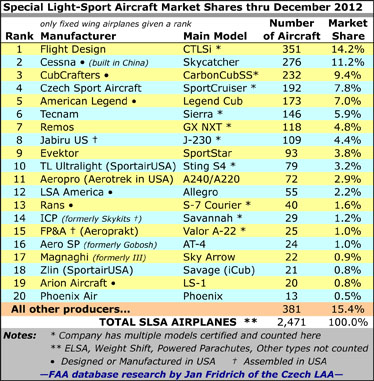

Our annual review of LSA Market Share brings our updated fleet chart and a second chart showing prior-year registrations. While sales of new SLSA remains below par, the market appears to be experiencing spotty but regular recovery from earlier low points. The first half the year foretold a better recovery but the last half of the year stalled somewhat. Regardless, based on traffic to this website, LSA interest is higher than ever. For January 2013, ByDanJohnson.com set all-time records in Unique Visitors and all other measuring criteria Thank you for your support!

2012 Market Share report — Nearby, we present our standard market share numbers. Our original chart remains consistent, illustrating the "installed base," or "fleet size." Because we know many of you seek recent-year information we are repeating the Calendar Year chart that debuted last year.

Our annual review of LSA Market Share brings our updated fleet chart and a second chart showing prior-year registrations. While sales of new SLSA remains below par, the market appears to be experiencing spotty but regular recovery from earlier low points. The first half the year foretold a better recovery but the last half of the year stalled somewhat. Regardless, based on traffic to this website, LSA interest is higher than ever. For January 2013, ByDanJohnson.com set all-time records in Unique Visitors and all other measuring criteria Thank you for your support!

2012 Market Share report — Nearby, we present our standard market share numbers. Our original chart remains consistent, illustrating the "installed base," or "fleet size." Because we know many of you seek recent-year information we are repeating the Calendar Year chart that debuted last year.

For the second year in a row

For the second year in a row  Perhaps the most noteworthy story in 2012 registrations is an even better performance by

Perhaps the most noteworthy story in 2012 registrations is an even better performance by  A remarkably steady climber is

A remarkably steady climber is  Other top guns in 2012 include perennial leaders like

Other top guns in 2012 include perennial leaders like  A member of the exclusive Over-100 Club listing only eight SLSA producers is

A member of the exclusive Over-100 Club listing only eight SLSA producers is  Unfortunately, one former high flyer, Remos, lost its U.S representative and has become very quiet though earlier this year, their CEO said they had recovered from the previous CEO's high-spending ways.

We are watching a few companies not on our fleet chart. One new entry to the SLSA scene is

Unfortunately, one former high flyer, Remos, lost its U.S representative and has become very quiet though earlier this year, their CEO said they had recovered from the previous CEO's high-spending ways.

We are watching a few companies not on our fleet chart. One new entry to the SLSA scene is  We are also watching the pulse on seaplanes lead this year by

We are also watching the pulse on seaplanes lead this year by  As I have said for years, a loud shout-out is owed to Jan Fridrich of the Czech LAA for the LSA Market Share report. Jan is also head of

As I have said for years, a loud shout-out is owed to Jan Fridrich of the Czech LAA for the LSA Market Share report. Jan is also head of  Notice: As always, we observe for you that all numbers here are derived from FAA's N-number registration database and are subject to data entry errors. Figures presented are not identical to sales recorded by the companies though over time the numbers draw closer.

UPDATE 2/13/13: GAMA held a press conference today where they released their industry numbers. Get more on GAMA

Notice: As always, we observe for you that all numbers here are derived from FAA's N-number registration database and are subject to data entry errors. Figures presented are not identical to sales recorded by the companies though over time the numbers draw closer.

UPDATE 2/13/13: GAMA held a press conference today where they released their industry numbers. Get more on GAMA