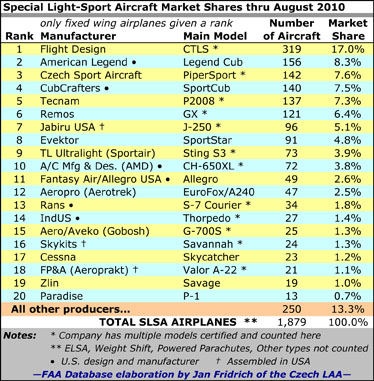

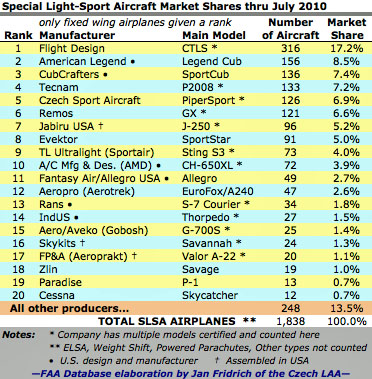

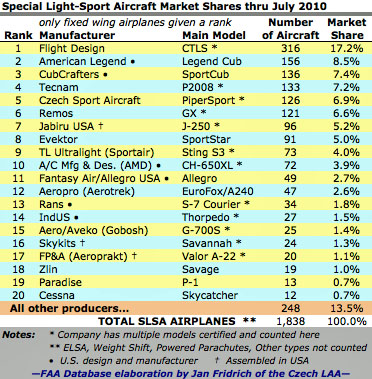

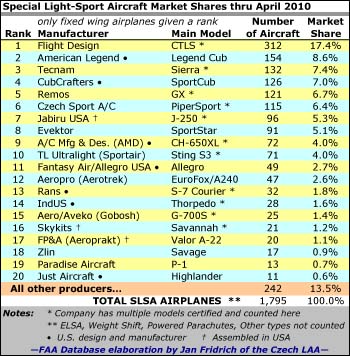

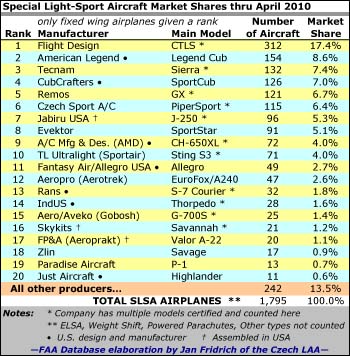

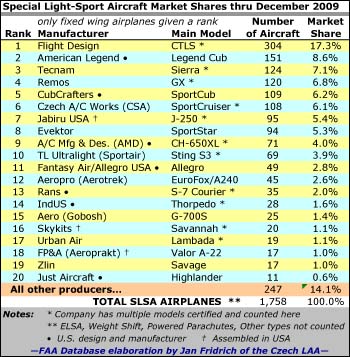

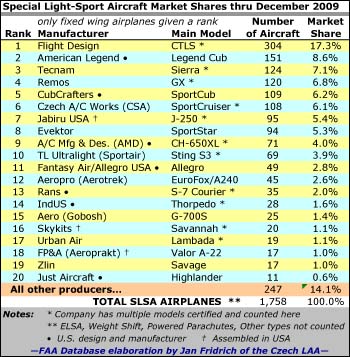

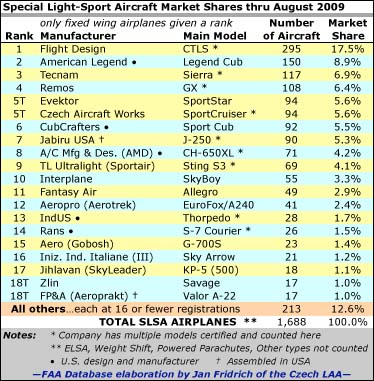

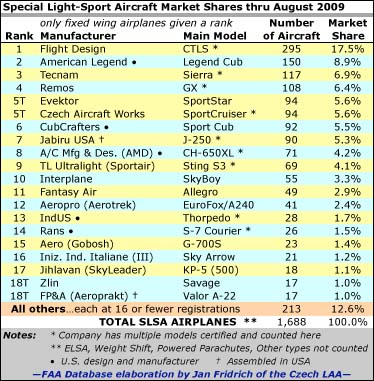

Perhaps you’ve noticed we have not been reporting market share information as often as we once did. Two reasons: (1) the market has matured, meaning the leaders are distancing themselves from niche producers and the rank positions aren’t moving around as much; (2) in the economic doldrums, the numbers simply haven’t been changing as quickly. *** But since the last report, some action occurred that shines a spotlight on an expected development. The aviation Big Boys are climbing upward… Piper advanced into the #3 spot, pushing also-strong CubCrafters down a notch. The legacy Florida company is closing on #2 American Legend. Secondly, while still well down the chart, Cessna moved up from #20 to #17 enroute toward the top. Based on the company’s reported 1,000+ orders, it seems only a matter of time before they outrun everyone. Or, will they…? *** Nothing is sure in business (or economies, it appears).