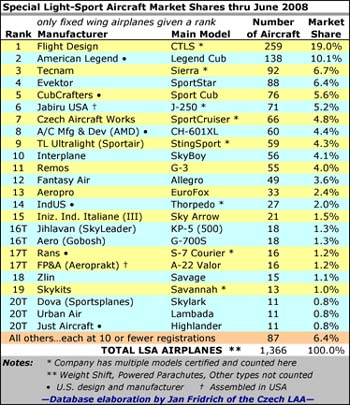

REPORTING FROM SUN ‘N FUN — Early estimates from Sun ‘n Fun show total attendance down just slightly (between 5 and 10%) compared to April 2008. A year ago, sub-prime loans were the concern and few knew how difficult the following year would be. Measured by exhibitors, Sun ‘n Fun was also off last year’s all-time record of 522 but only by 4%. The best news included no serious accidents though a SportCruiser ran off the end of the Light Plane Area’s 1,400-foot runway. *** From my view in the LSA Mall positioned right at the main gate, crowds were especially thick on Thursday, Friday, and Saturday while serious buyers arrived early on Tuesday and Wednesday (following a common airshow routine evident the last few years). Airplane shoppers were plentiful though sales reports were uneven. Some, like Flight Design, FPNA, and Evektor, reported sales transacted in the first days of the show.