Our fastest-with-the-mostest partner tracks the health and performance of the light aircraft industry and is once again punctual. Datastician Steve Beste has proven his capabilities to collect the registration data quickly, accurately, and with an insider’s viewpoint. Steve is a trike pilot, so he is “one of us.” In his former life he was a database expert in the tech field explaining his great facility with these systems.

This is the home page from Tableau Public; visit to see much more detail.

Here we are reporting facts for the period of April, May, and June 2020. Given the spectacular upheaval around the world, I’m happy to see the recreational aircraft industry holding its own fairly well. Reporting for the companies making larger, heavier aircraft, the General Aviation Manufacturers Association also reported sales are down. I cannot imagine anyone is surprised.

If I was reporting numbers for the restaurant, bar, hotel, airline, theater, sports, or concert industries it would be an ugly bloodbath. This report is far less glum and beaten-down than those enterprises.

Broad View of Market

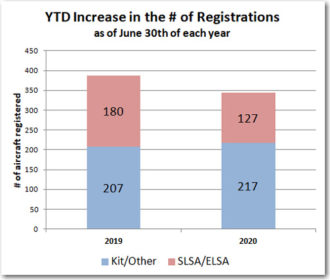

As Steve notes from his study of the current data, “Overall, registrations are down 11% year-to-date from what they were at this time a year ago.” Total registrations declined rom 387 to 344 aircraft of all types. This still speaks to a year with around 700 aircraft registered.

Comparing the YTD situation now with the YTD situation a year ago. —chart by Steve Beste

However, Steve further observed, “The decrease is all in ready-to-fly aircraft. Kit registrations have actually increased a bit.”

He continued, “This data is consistent with a [statement] that says that people [may be] buying fewer new aircraft this year, but kit builders are continuing to work on their projects. Indeed, they’re completing slightly more projects than they were last year.” Considering recent events, he added, “This is just what you’d expect for a time of economic downturn and quarantines.”

Looking at the big picture for overall numbers, when comparing the first half of 2020 to the first half of 2019, we see total registrations are down by 11%, almost identical to GAMA’s first quarter 2020 figures. Piston GA aircraft deliveries were down 11.7%; their second quarter info should be out before long and we can wonder if they will take a harder turn south.

However, an interesting aspect to the story is that kit-built light aircraft registrations are up for 2020, from 207 last year to 217, both representing 6-month totals, an increase of 4.8%.

Please remember that registrations — especially for kit-built aircraft — represents completions of kits not sales of kits. The two are displaced by 1-3 years or more of work to take a kit from assembly to flight.

The suffering comes as Light-Sport Aircraft kits and fully built models were down from 180 in last year’s first half compared to 127 this year, a reduction of 29%.

Most Notable: Icon

One well-known company heads our list of most-changed …and unfortunately, not for the best. You guessed it: Icon Aircraft and their handsome, if troubled, A5 LSA seaplane.

Icon A5 aloft over California. —photo by Icon Aircraft

After two relatively steady years of registering around 50 aircraft a year, enough to rise near the top of the fully-built Special LSA segment, Icon’s 2020 registrations plummeted from 44 in 2019 to 6 so far in 2020. Do please remember that these numbers are for the first half of 2020, a very difficult time, and with any luck, the last half of this weird year may improve.

As if Icon was not facing strong headwinds, it just got more turbulent as Aero News-Net reported. Original founder and visionary, Kirk Hawkins — described by the company as being “on sabbatical leave” — is suing the Chinese company that is the primary stockholder of the California builder with extensive operations in Mexico.

The last Chief Operating Officer has resigned and been replaced by another but the company is struggling to right the ship. Their aircraft is the most expensive, by far, in the LSA industry. They have two large facilities and more than 300 personnel on the payroll (although two thirds are in Mexico where wages are surely much lower than in California). That much overhead and payroll cannot be sustained with a dozen aircraft a year so Icon’s new leader certainly has his work cut out for him.

As Steve discovered, “Icon registrations have dropped off a cliff, from 44 in 2019 to six so far in 2020.” No question this is the biggest change in light aviation prompting Steve to ask, “What is going on there?”

Good News Leaders

In better news, though, Steve said, “Magni gyroplanes are doing very well. They’ve already exceeded last year’s total (10) by 50% and the year is only half over.” As I’ve written recently Magni is active in promoting their business during this difficult economy and that effort is evidently bringing benefits to the Italian producer.

Another brilliant photo from teacher-photographer-videographer, Paul Hamilton flying his Evolution Revo.

Steve continued, “Likewise, Aeroprakt has gone from 3 last year to 8 already this year.” If Aeroprakt USA importer Dennis Long can keep up this pace, he’ll hit 16 aircraft for the year, which is a worthy performance.

In our full-year 2019 report, Evolution Trikes looked rather weak but boss Larry Mednick reported that some registrations that should have made it into 2019 didn’t and we assured him they would show up in our 2020 reporting. They did, as Steve stated, “Evolution Trikes are back, going from 3 in 2019 to 8 in the first half of 2020. Like Aeroprakt, this suggests they are back on track …or alternatively, the database figures confirm Larry’s comment at the end of last year.

Please remember, as always, registration data is not sales data. For one obvious example, Evolution sells trikes outside the USA and these are not counted in this report.

Gyroplanes Go “Inside”

This beautifully-lighted image of a Magni M16 tandem gyroplane was taken on a flight from Texas to Cuba (here’s the whole story).

Combing the database thoroughly, Steve added a closing thought: “Looking elsewhere, I see that among gyroplanes, the enclosed side-by-side models are [now] favored over the tandem and open models, that is, AutoGyro‘s Cavalon is their top model, as is the M-24 Orion for Magni.

Thanks a million to Steve Beste and his efforts to keep us all informed. Please go visit Tableau Public for much more information, which you can shape and change at will — see the blue boxes at the left of your screen, especially the bottom two that may be most helpful, plus the tabs across the top.

What is the news out of CubCrafters? They went from No. 1 with a bullet just a few years ago to only a few a year?

Thanks for the great info.

Greg: It appears CubCrafters has turned their attention to non-LSA models. This may have caused their LSA registrations to have dropped.

Thanks Dan. As always you do good work! You are like Santa delivering hopeful news in the middle of the plague.

Hi Grant: Thanks for the kind words. Not everyone agrees, of course. Another man took me to task for writing “with the virus panic behind us,” asking if I was from another planet. (…sigh…) He left out part of what I wrote, which was “with the virus panic behind us, we hope“. This coronavirus thing has really upset our society — but I fully intend to keep reporting great aircraft news and the best of that is that at least flying solo still gives great pleasure while keeping more distance than usual. ???

Thank you Dan for good news for us.

Hi Yury (designer of the Aeroprakt airplanes): I am always happy to help people who create and build great aircraft. ???

Aeroprakt could easily double again if they catch on in the U.S. like they did in Australia. They are much loved down here.

Vans?

Presuming you want to know how well Van’s Aircraft did in 1-2Q2020, all you have to do is visit Tableau Public, where you can rearrange the resource to zero in on Van’s or any other company.

Kit prices went up, which discouraged me from purchasing a CGS Hawk Arrow II It went up $2,000 in these tough times from $14,500 to $16,500, plus upgrades. I am sure sales will decline; you don’t increase prices in a pandemic. —Mac

I always believed in the Homebuilt / Experimental / Kit Built aircraft part of this hobby. It is nice to see it grow.