We have a new year upon us. With our new reporting capabilities for LSA and SP kit market shares, we can now quickly report results from 2019.

As always, be advised that our data comes from FAA’s aircraft registration database. That means it is impartial — hopefully meaning reliable and dependable — but it also means some massaging of the information is needed to be completely accurate. (See this article for more detail on the effort involved; it is not trivial.) Steve’s valuable ability to manipulate database resources combines with his knowledge of light aircraft to make an unbeatable combination.

As much as any data allows — and as the saying goes… “you can take this info to the bank.” It’s solid!

2019 In Review

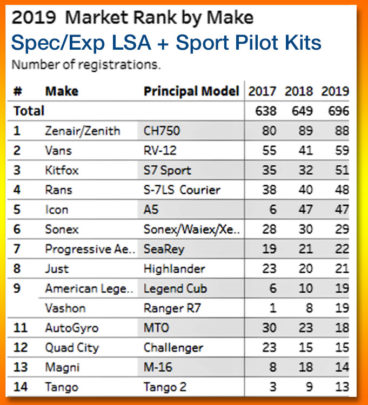

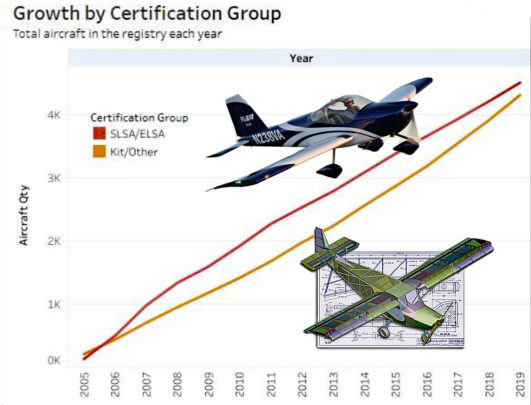

Compared to 2018, Steve observed, “Sport Pilot kit aircraft are gaining on LSA though not by much; the kit market slightly closed the gap with the LSA market comprised of both Special, fully-built LSA and Experimental, kit-built LSA.” Sport Pilot kits do not meet ASTM standards but have less regulations and the owner, having built his or her plane, is allowed to maintain it without oversight by an A&P.

As Steve uncovered, the market leaders involve the same seven brands that have been leading the pack.

For reference, here is our 3Q19 market share report with additional details you might find interesting.

LSA Seaplanes — Icon continues to do well (but see the next paragraph). The last quarter of 2019 was good for SeaMax and Super Petrel. The latter gained two new owners in the last quarter while SeaMax gained three. Both companies are based in Brazil but SeaMax has been working hard on their U.S. presence (see more here) and, apparently, it is paying off.

Despite these necessary adjustments, we maintain the figures used in this report are the best available and are of very high reliability. In fact, the adjustments Steve and I make are proof of the effort to report accurate, dependable data.

As always, I offer a loud and heartfelt THANKS! to Steve Beste for his work to make this information available.

Alternative Aircraft

(all other than Fixed Wing)

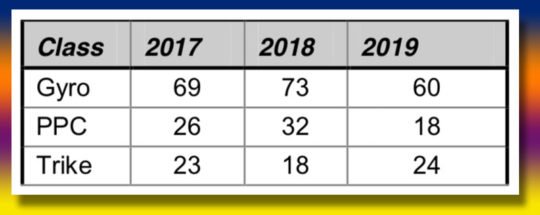

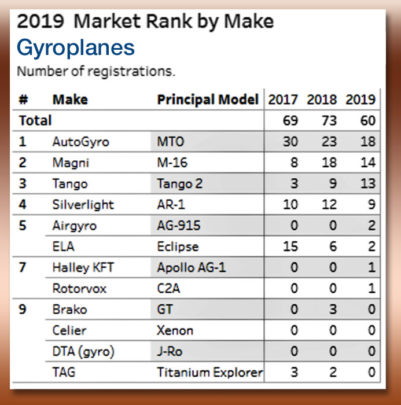

He reported, “We have no change from our third quarter 2019 report: Gyroplanes registrations are slowing slightly but are still hot. Trike registrations are holding steady. Powered parachutes registrations are off a bit (nearby chart).

Steve notes a new gyroplane entry, “The database now shows Airgyro and their AG-915. It’s a derivative of the Celier Xenon obviously, but with many changes.”

“Wild Sky’s Goat by Denny Reed has done well,” exclaimed Steve! “What on earth are those Goat buyers doing with them? Could they all be flying back country,” he asked? Our earlier report and video will tell you more about this trike entry.

** When using our online market share reporting system called Tableau Public — please do have a look; it’s free! — be advised this website may appear best on your desktop or laptop. Smaller screen smartphones and tablets do not portray the information as conveniently.

I am so excited that the TangoGyro has made it onto this list. It has been a long time coming.

I can only make one small comment.

The TangoGyro that sold with the Rotax 582 was a Tango1 (single seat).

The Tango2 is a tandem and therefore needs a power plant that has a bit more oomph.

Hi. Interesting data. Don’t forget the Magni M24 – 4 in 2017, 8 in 2018, and 9 in 2019, (and 5 or 6 unknown airworthiness dates in the database). Ours is one of those so I was intrigued to find out how many others were in the US.

Not sure how you did your research, but if it was as manual as what I just had to do (search the FAA DB and then click on every link for the date), kudos to your energy and persistence!

(Edit, I just re-read your article and found the how-we-did-it link and went back and found the database download. Still a gargantuan task!)

With the exception of Tango, all gyro manufacturer’s numbers went down in 2019. It makes one wonder whether the market for $100k+ gyroplanes is saturated. It also may (rightly or wrongly) imply that prices will be coming down, in order to compete.

Hi Robert: Hmmm… glass half full or half empty? I don’t think you’ve drawn the right conclusions about a shrinking market. Plus most gyroplanes are not over $100,000 unless they are fully enclosed and loaded with options. On the other hand, you may be right. That’s the funny thing about forecasting the future. We simply don’t know what happens tomorrow.

How accurate is this? Viking Aircraft Engines sold 20 engines to PPC machines in 2019. so, we delivered more than 100% of all delivered PPC machines?

Hi Jan: These numbers are about as good as it gets, barring only FAA data entry clerk errors. Sales numbers from manufacturers rarely match precisely to FAA registration data although the two will draw closer together over time. Especially the kit aircraft your company supplies may be some time before hitting the registry. In addition, an already registered kit-built aircraft that changes engines does not require a new registration. However, it sounds like Viking is doing quite well… bravo!