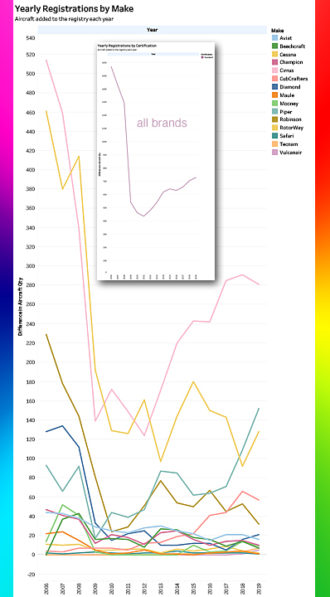

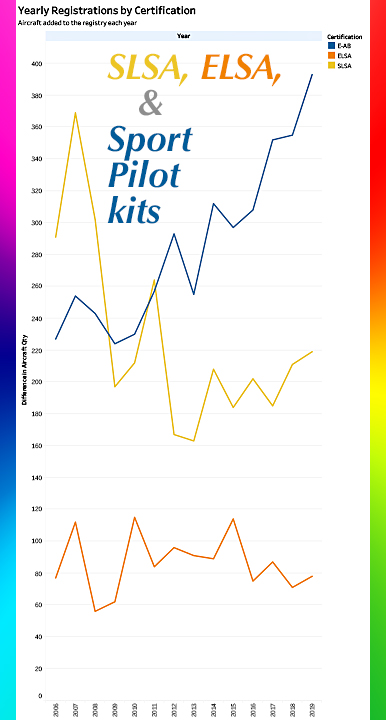

The comparisons below relate to the numbers of Single Engine Piston (SEP) general aviation (GA) aircraft on the U.S. registry compared to an umbrella group including SLSA, ELSA, and kit-built aircraft that Sport Pilots may fly (or those using a different certificate but exercising the privileges of Sport Pilot) …in other words, all the aircraft we cover on this website.

Even after more than 15 years of LSA and the kits that Sport Pilots can fly, the GA fleet still seems immeasurably larger. The truth is, we can measure it; in fact, we have up-to-date info and both are as accurate as FAA’s database allows.

Which Is Bigger?

The total SEP GA fleet numbers approximately 135,000 aircraft, 15 times larger than LSA/SP kits (by our criteria, about 9,000 aircraft) but the bigger number includes aircraft made since the 1940s and significantly in the ’60s and ’70s.

As most aviators know, the GA fleet averages better than 40 years old where the entire LSA/SP kit fleet is less than 15 years old. It will be decades before LSA/SP kits catch up with the GA fleet, if ever …although that’s before the LSA sector undergoes a major transformation and likely expansion in 2023 (more on that here, and we will offer regular updates).

Aero Adventure‘s Aventura kit aircraft models are part of a gaggle of Sport Pilot kits enjoying solid growth.

The size difference takes on a different view when we compare only the period from 2005 forward. This is when the first LSA started winning FAA acceptance signaling the official start of the industry.

Given this history, all our data points start in 2005; we count nothing before even if that aircraft would today be called a Sport Pilot kit aircraft.

(To save space, I will use “LSA/SP kits” to represent Special, fully-built LSA plus Experimental LSA plus Experimental Amateur Built Sport Pilot kit aircraft.)

The table is turned upside down for LSA/SP kits, where the USA has about 20% of the global total and all other countries account for 80%. However, the U.S. share appears to be increasing gradually since the recession of 2007-2009. As you can note that recession hit GA very hard; the GA industry has yet to recover to pre-recession registrations.

Since 2005

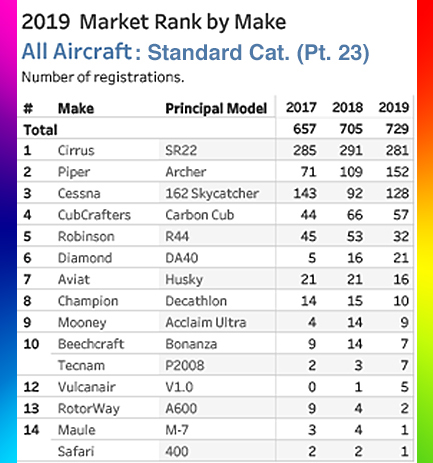

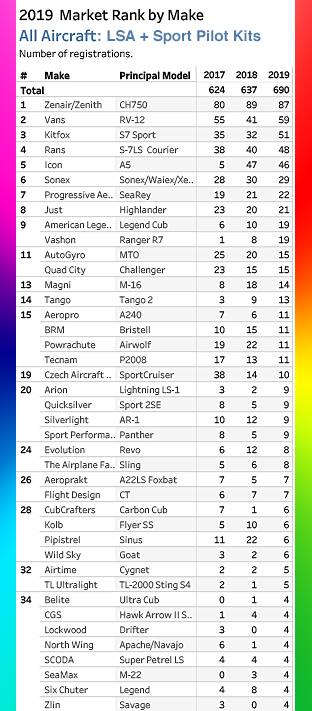

Viewed in total, the numbers for GA compared to LSA/SP kits are remarkably close. For all of 2019, the LSA/SP kit market registered 690 aircraft (up 8.3% over 2018) while GA registered 729 single engine aircraft (up 3.5% over 2018).

Although SEP GA registered about 6% more aircraft in 2019, a major share of that count comes from one brand, Cirrus Design. The Minnesota company alone accounts for close to 40% of all GA airplanes registered last year. Cirrus registrations have been quite steady over the last three years, though 2019 was the lowest of the three.

As always, please remember registrations will not precisely equal a manufacturer’s reported deliveries perhaps due to year-end paperwork delays that affected at least two producers of light aircraft in 2019.

Although we have clear leaders in LSA/SP kits (see chart), the 690 aircraft come from an impressive list of 171 producers, more than 11 times more manufacturers than for SEP GA aircraft. This clearly illustrates what happens when you free up the design energy and productive spirit of small aviation companies.

Given a means of market entry, we saw the arrival of a new batch of manufacturers with a flock of new models to satisfy the diverse interests of pilots: from those seeking speedy cross country cruisers to back country taildraggers to special flying machines like gyroplanes, weight shift trikes, and powered parachutes. Go LSA and Sport Pilot kits!

Again a shout-out to Steve Beste, our supreme “datastician.” The GA info presented here was stimulated after an exchange between Steve and General Aviation News publisher, Ben Sclair. All data is from FAA’s registration database but, other than the tables and charts, all statements in this article are mine alone.

Is there a general sense of how much a popular LSA depreciates after 3, 5 and 10 years? It seems to me that LSAs hold their value better than a car. Many seem to depreciate only 25-50% from new and then level off. Thanks, Jim

Hi Jim: A general sense is all I have… well, that and many conversations with people selling LSA. However, while I lack hard data, it certainly appears a used LSA holds its value long-term much better than automobiles. I agree with your view on the percentages.

Thank you Dan.

While not the purpose of your article, do you have any thoughts about the largest reductions; i.e., Czech Sport Aircraft and Pipistrel?

Hello Harris: Remember, I report developments in the last year as that is what most readers appear to want, but you should not over-focus on one year’s results. The Tableau Public page will provide a wealth of additional information that you can explore any way you want.

I think both brands remain strong in the USA though both have some challenges. Pipistrel’s main U.S. distributor is based in Australia, even further away than the factory. CSA has a solid market position but changing their distribution a couple years ago altered how that company does business in the USA. These factors may, or may not, have been a factor in their success. Please also remember that registrations are not the same as sales, though the two measurements should converge over time.

Keep up the good work Dan

Hi Paddy: Thanks for the kind words, sir!

Listing the Cessna Skycatcatcher as the “Principle Model” seems odd.

Same for Lockwood Drifter.

Doesn’t really reflect most recent registrations as both have been out of production for many years now…..

Hi Jon: I just noticed this myself. “Skycatcher” is a hangover from our LSA data research where we only looked at Cessna’s LSA product. Their most popular GA model must be Cessna 172 Skyhawk I’m sure, but I will point out this oversight to our datastician, Steve.

Lockwood should call AirCam the principal model, I’m sure you think, but… Drifter can still be obtained from Lockwood and only this model can qualify for a Sport Pilot to fly as AirCam requires a multiengine rating, not available to Sport Pilot certificate holders. I hope we can include AirCam after LSA 2023 happens; it is a terrific airplane.

As a Geek who likes FACTS…this is very informational…PLEASE continue to support the work of your “Data Dude”.