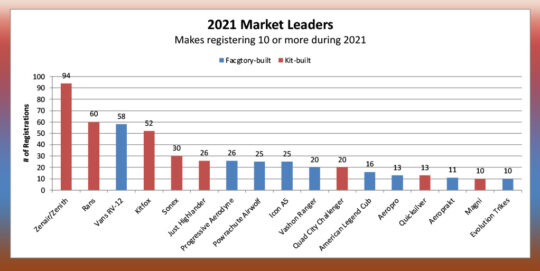

In 2020, perhaps because builders were locked down at home and completed more projects, kit registrations blew the doors off factory-built. For 2021, the ratio equalized again with kits narrowly edging out factory-built (nearby chart).

Note that for this reporting, datastician Steve Beste said, “We define kit-built as aircraft registered as Experimental Amateur Built. Factory-built are everything else, including SLSA, ELSA, Exhibition, Primary, and Standard.” To understand how Steve solves the FAA database mysteries, check this PDF.

How Healthy Is the Market?

Generally speaking, the leaders from 2019 and 2020 remain in similar positions for 2021 — the second year everyone endured the virus pandemic. While actions to reduce the problems caused upset in many industries, light, recreational, affordable aviation seemed to have prospered surprisingly well.

A pair of Icon A5 amphibians in formation.

As I relate performance numbers below, please keep this important point in mind: Factory-built LSA registrations generally mean a new aircraft that got built and delivered in the last year, where kit-built aircraft were probably delivered some years earlier and finished in the year discussed. This mismatch evens out over time. Also, these numbers may not identically match what producers claim they sold in any given year.

Steve Beste wrote, “Of the 19 companies that registered 10 or more aircraft in 2020, 15 did so again. Those who slipped from 2020 included AutoGyro, BRM Aero, Kolb, and Scoda. New to the list were Aeropro and Quicksilver. Standouts were Icon, whose A5 amphibian registrations almost doubled from 13 to 25 and Aeropro, whose two Aerotrek models got 13 registrations, up from 5 last year.

Who’s Leading the Market?

Zenith Aircraft’s 751 Cruzer.

Zenair/Zenith (up 9%) retained their market leading position. In fact, their builders registered a third more than builders of #2 kit maker, Rans (up 22%). Trailing Zenith with Rans was Kitfox (down 4%). These are the Big Three among Sport Pilot kit suppliers.

All the top kit-built producers increased their growth except Sonex, which slid 32%. The company changed hands from founder John Monnet to longtime manager Mark Schaible and we may see them resume their position for 2023 (except for that time delay between kit sales and kit completions).

Van’s Aircraft RV-12 Special or Experimental LSA or Amateur Built.

Van’s (up 5%) and their RV-12 again came in as the #1 producer of fully-built LSA. Their registrations show the hard work of our premiere datastician Steve Beste. Anyone can access these numbers but none I’ve found can match Steve’s gift at deciphering what the registration variations mean. Van’s registered 43 Experimental LSA, 9 Special LSA, 5 Experimental Amateur Built, and 1 Other. With the ELSA likely delivered ready-to-fly as they can be, an owner can then register as Experimental LSA and gain some privilege at the loss of being able to use the aircraft for paid flight instruction.

Progressive Aerodyne’s Searey carves a turn on water.

Among factory-built manufacturers, Progressive Aerodyne had strong results, growing 44% to register 26 new Searey LSA in 2021. Icon also rebounded from a low 2020 to output 25 A5s last year (a 92% growth).

Another factory-built producer, Aeropro — sold in the USA under the name Aerotrek — was up 160% in 2021. This company is one of the steadiest producers in all of light aviation. The company famously refuses to expand and as a result is extremely consistent about production. The big growth in 2021 surely reflects some registration delays in 2020 more than any spike in manufacturing.

When you combine both production methods, the total (317 aircraft in 2021) compares favorably to deliveries of Part 23 single engine piston aircraft (the closest comparison). As you can see, for 2020, kit-built aircraft had more than double the factory-built totals but for 2021, the equilibrium returned.

The Light(est) Stuff

Although their numbers are modest, it’s good to see Air-Tech and their assumption of all production of the Quicksilver line had good growth in 2021 (up 63% in registered aircraft without including Part 103 unregistered models). The longtime Louisiana supplier of Quicksilver aircraft and accessories took over all rights other than the GT500 and they continue to serve this market well.

Quicksilver MX, precursor to the modern Sprint.

Among Alternative Aircraft — Gyroplanes continue on a long slope downward, not declining fast but steadily. Difficulties with insurance may be a problem plus they are the only category of LSA not allowed to fully build aircraft. This should be solved with Mosaic in 2024.

For this report Steve Beste wrote, “Gyroplane registrations were way down. Only SilverLight and Tango had (slight) increases. This once-hot segment cooled a bit in 2020 and now even more in 2021.”

Among other categories, weight shift trike sales were off to their 2018 level (Part 103 trikes are doing better but don’t show up on the registration database).

Powered parachutes enjoyed continuing growth, led by Powrachute (up 25%).

Rans Outbound on tundra tires.

One More (New) Thing — A new trick for our datastician Steve was to count Part 103 aircraft that were registered as Experimental Amateur Built. Conforming Part 103 vehicles do not need N-numbers.

“Perhaps the owners wanted to add features that bumped the planes over the 254-pound ultralight limit. If so, credit to them for being honest about it and registering the planes,” wrote Steve.

Aeromarine LSA leads among Part 103 manufacturers with their Zigolo registering 10. Air-Bike registered 7, Phantom and Legal Eagle 5 each, Affordaplane 4, and Cloudbase (maker of Skylite and Lil’ Bitts) 3. All these are in addition to any Part 103 models the companies delivered. For lots more information and links to every producer and all 89 models, see our new Part 103 List.

Market Observations

Aeropro Aerotrek on big tundra tires.

Steve Beste wrote, “Many manufacturers have left the market. Tableau Public for LSA tracks 140 manufacturers who are registering aircraft with FAA. Of those, only 71 manufacturers registered an aircraft last year.” He added a caution, “This is a world in which a lot of dreamers bring promising aircraft to market… and then fizzle. Prospective buyers — especially prospective kit buyers — should keep this mind.”

The LSA and Sport Pilot kit industry can be compared fairly well to single-engine piston models of conventionally-certified aircraft. Some years it’s been closer, but for 2021 Steve noted, “GA sales dwarf these LSA and Sport Pilot kit numbers. Just to keep our beloved world in perspective, in 2021, Cirrus registered 272 single-engine piston aircraft; Cessna, 148; Piper, 92. Just those three companies registered 512 aircraft in 2021, to the light recreational aircraft industry’s 317 combined Factory-Built and Kit-Built.

Hi Dan. Thanks a lot for this list. I live in Canada, but the U.S. numbers are a great reference for us (I won’t be mad if you add our numbers though). My list is now closing to Skyreach’s Bushcat and Aerotrek’s A220. Is good to see they’re close in the numbers. You’ve covered both on every airshow for the past years. Any thoughts on both?

Thanks in advance.

I’m pleased you find the information useful. I don’t know the challenge of Canada‘s registration database, but I’ll speak to datastician Steve Beste about this.

It’s great that you’ve narrowed your search. At this point it is much more personal decision than anything I can add besides the articles and videos I’ve produced. Either will make a wonderful airplane for you. Good luck with your decision!

I believe the Aerotrek has a much faster cruise than the Bushcat. And you will have to decide if the zippered cloth that the Bushcat uses lasts as long as the standard covering the Aerotrek uses. Like Dan says, they are both good aircraft.

Dan,

I believe that ELSA that were impacted by the “Warbird” experimental case decision can apply for a Letter of Deviation Authority (LODA) 14 CFR Section 91.319(h) in order to receive training in Experimental Category Aircraft. (See your comment in relation to the VANS-12.) The application is made by template form and emailed to 9-AVS-AFG-LODA@faa.gov. Conditions of/for the LODA are contained in the Letter of Deviation Authority and must be complied with and the LODA must be present in the airplane with the other ARROW documents. LODAs generally have expiration dates so calendar reminders should be in place.

Yes, LODA is a known procedure that instructors have used and some say they received approval quickly as I noted in my talk from the DeLand 2021 show.

However, my comment about the RV-12 in this article refers to being able to earn compensation without needing a LODA in a LSA. If a buyer elects a ELSA RV-12 to gain other permissions, such as changing installed equipment, the permissions change. An ELSA could be used for training with a LODA, but in normal times (such as before FAA took the warbird purveyor to court), no LODA was needed to use a SLSA RV-12 for compensated flight instruction.

Cubcrafters ???

I presume you were asking where CubCrafters appears on the list. You can find any company or aircraft by going to Tableau Public, which will allow you to drill down to a desired brand or even to one specific aircraft.

You’d think that with Steve Henry bringing in the money on every STOL Drag competition that Just Aircraft’s Highlander would be a top seller. Were they in the top ten?

And while on the subject of Just Aircraft, what ever happened to the Just Aircraft (Top Rudder Aircraft) Solo 103 that was due in late 2018? The website is tacit.

You evidently missed “Just Highlander” in the chart that shows the top producers; it appears just after or to the right of Sonex. The Highlander model referenced is merely an indication of the most common model registered under that brand, but the SuperSTOL is included in the total count.

I’ve had another question about the Top Rudder Solo 103 and I have made an inquiry to find out its status. However, a lack of response plus the comments of other people suggest something is amiss, regretfully. Many people were excited about this entry.

Hi Dan,

I like your web site and visit often. You’re providing a valuable service for the flying community.

I see that Quicksilver is listed as having 13 registrations last year. How is that? I thought they were out of business. Their web site works, but the first thing at the top is an offer to sell the company. Are they actually delivering aircraft?

Keep up your good work 🙂

Thank you for your kind words, Mark; always appreciated.

The Quicksilver models are available under the brand Air-Tech, Inc., as linked in the article. The former Quicksilver Aeronautics company may still have a live website but they are not selling aircraft. The website may be kept alive because they are apparently still seeking a buyer for the GT500. All other models are now being produced by and supported by Air-tech.

It’s great to see American-made kits and planes at the top of the list! Thanks for compiling this data.

I sure wish Kolb would start up production again. Thanks Dan, for breaking it all down for us.