For a week last month, the center of the aviation universe was headquartered in Oshkosh, Wisconsin — population around 50,000 until AirVenture brings in five times that many on the biggest days. AirVenture Oshkosh is arguably the most important aviation event in the world each year, bringing people together from all points on the compass… or, at least it usually does. For 2021, international representation was far below the usual. I don’t have hard numbers but few of my overseas airshow friends could make this year’s event. Internationally-Speaking Despite the lack of international visitors EAA AirVenture Oshkosh afforded a large helping of personal contacts and conversations. Even in the age of Zoom and Skype, Facebook and Twitter, websites and YouTube channels, meeting in-person retains immense value, both personally and professionally. My article about the FAA “pivot” reported one of those fortunate meetings; same for the XE Part 103 helicopter resulting in our most-read Oshkosh 2021 article.

AirVenture Oshkosh is arguably the most important aviation event in the world each year, bringing people together from all points on the compass… or, at least it usually does.

For 2021, international representation was far below the usual. I don't have hard numbers but few of my overseas airshow friends could make this year's event.

AirVenture Oshkosh is arguably the most important aviation event in the world each year, bringing people together from all points on the compass… or, at least it usually does.

For 2021, international representation was far below the usual. I don't have hard numbers but few of my overseas airshow friends could make this year's event.

One objective of mine was achieved when a trusted, reliable source provided me with hard data about the state of the light aviation industry around the world. Most readers know I follow the

One objective of mine was achieved when a trusted, reliable source provided me with hard data about the state of the light aviation industry around the world. Most readers know I follow the

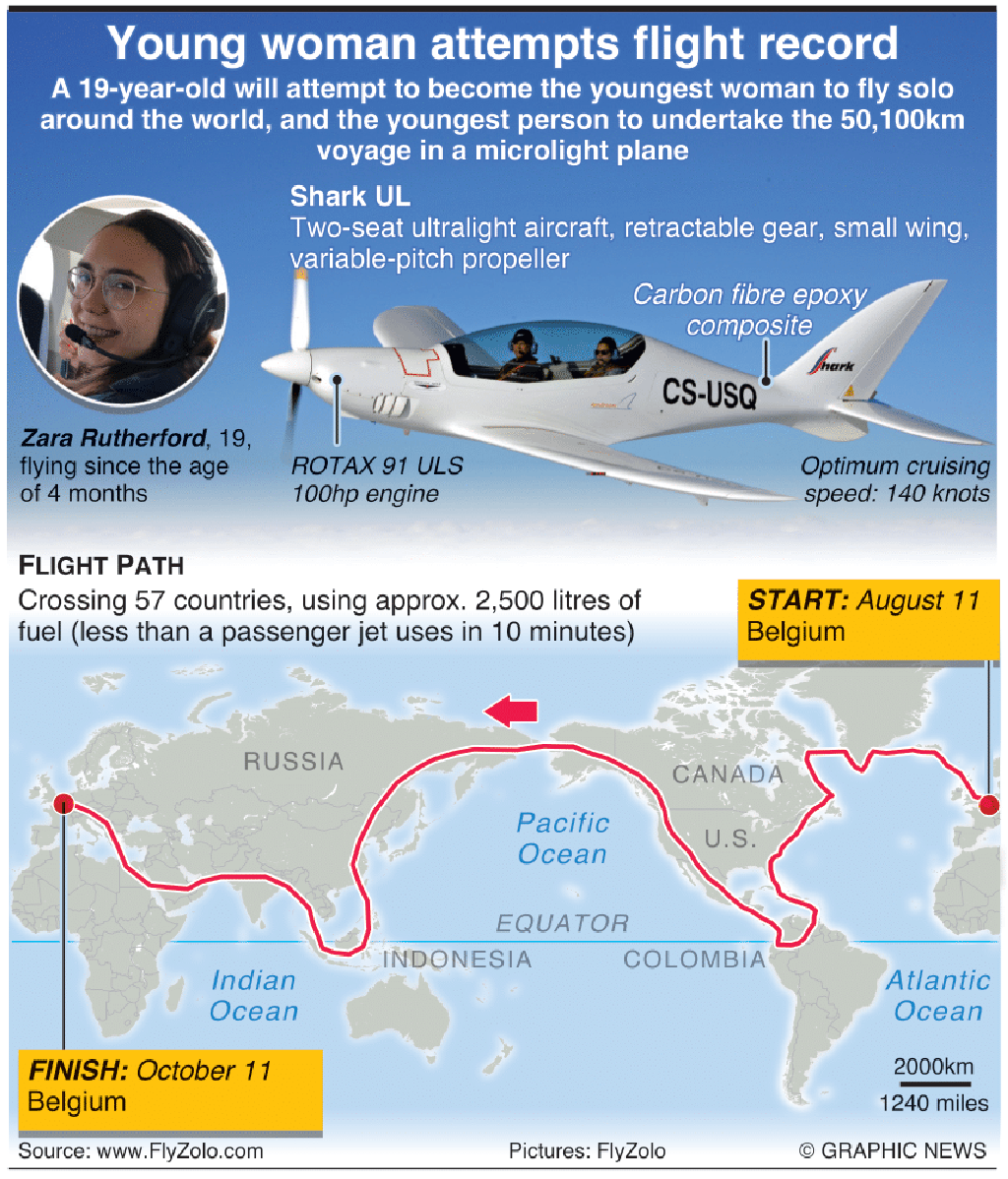

Do you think you have what it takes to fly around the world?

At minimum, such a trek involves lot of hours in a fairly confined space plus a challenging amount of waiting (for weather, maintenance, permission). At worst, it could be intimidating and dangerous, for example when crossing the frigid North Atlantic. You also have to cope with foreign languages and different customs. Your body clock would be catching up for weeks.

Do you think you have what it takes to fly around the world?

At minimum, such a trek involves lot of hours in a fairly confined space plus a challenging amount of waiting (for weather, maintenance, permission). At worst, it could be intimidating and dangerous, for example when crossing the frigid North Atlantic. You also have to cope with foreign languages and different customs. Your body clock would be catching up for weeks.

Zara has a good aviation foundation. She reports traveling in small planes since the age of six, skydiving at 11, and flying a plane at 14. After all that why not go for broke at 19? Ah, youth!

"I will be flying a

Zara has a good aviation foundation. She reports traveling in small planes since the age of six, skydiving at 11, and flying a plane at 14. After all that why not go for broke at 19? Ah, youth!

"I will be flying a  The title isn't new.

For 14 years I wrote a column I called "The Light Stuff" for Kitplanes magazine. The column name was an adaptation of "The Right Stuff" movie about astronauts.

The title isn't new.

For 14 years I wrote a column I called "The Light Stuff" for Kitplanes magazine. The column name was an adaptation of "The Right Stuff" movie about astronauts.

Through those years, a man I learned to deeply admire edited the publication. Many readers will recognize the name Dave Martin from earlier days. He had an impeccable reputation earned through thoroughness and fairness, capability and approachability. I could never slack off when preparing material for Dave. He could be a tough taskmaster but also acknowledged when a piece was good. My writing undoubtedly improved because of years of input he offered me. I so enjoyed working with him.

With sadness I note his passing, alerted by mutual friend Phil Lockwood, developer of the AirCam (photo) in which Dave is seated when the two made a flight to the Bahamas. So long, Dave!

Through those years, a man I learned to deeply admire edited the publication. Many readers will recognize the name Dave Martin from earlier days. He had an impeccable reputation earned through thoroughness and fairness, capability and approachability. I could never slack off when preparing material for Dave. He could be a tough taskmaster but also acknowledged when a piece was good. My writing undoubtedly improved because of years of input he offered me. I so enjoyed working with him.

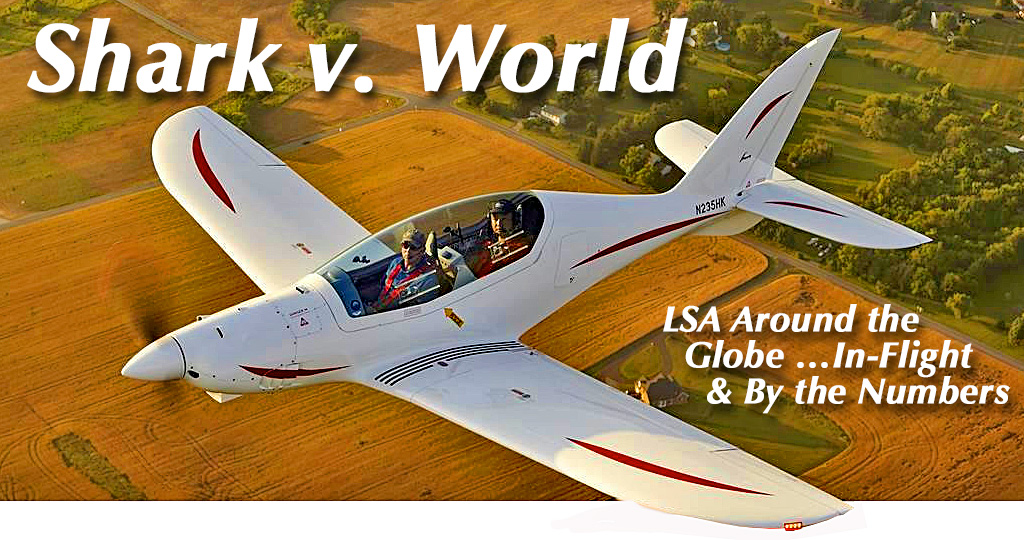

With sadness I note his passing, alerted by mutual friend Phil Lockwood, developer of the AirCam (photo) in which Dave is seated when the two made a flight to the Bahamas. So long, Dave!  This Shark is one I've long admired since meeting its creator, Jaro Dostal many years ago at the German airshow

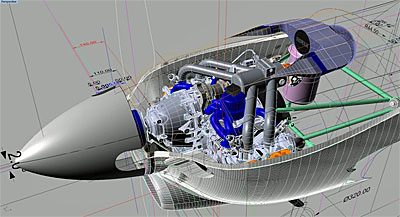

This Shark is one I've long admired since meeting its creator, Jaro Dostal many years ago at the German airshow  A special "Mako" Shark is now available, reported an enthusiastic Jon. "The Rotax 915-powered Shark will enhance high altitude performance, increase cruising speed, and rate of climb" he said. "The first prototype is expected to be completed this summer." The factory is now taking orders. The nearby images show new, larger cowlings to accommodate a turbocharged, intercooler-equipped 135 horsepower engine.

If you are enticed, here are two ways to acquire Shark.

Order a new aircraft — "The factory will now take €4,000 (about $5,000 but this can change) non-refundable or €15,000 (about $19,000) refundable deposit to hold a production slot. Upon receiving the deposit, the factory will assign a production slot and an expected delivery date. Progress payments will be requested at various intervals.

A special "Mako" Shark is now available, reported an enthusiastic Jon. "The Rotax 915-powered Shark will enhance high altitude performance, increase cruising speed, and rate of climb" he said. "The first prototype is expected to be completed this summer." The factory is now taking orders. The nearby images show new, larger cowlings to accommodate a turbocharged, intercooler-equipped 135 horsepower engine.

If you are enticed, here are two ways to acquire Shark.

Order a new aircraft — "The factory will now take €4,000 (about $5,000 but this can change) non-refundable or €15,000 (about $19,000) refundable deposit to hold a production slot. Upon receiving the deposit, the factory will assign a production slot and an expected delivery date. Progress payments will be requested at various intervals.

"The current factory backlog is between 18-24 months for a ready-to-fly aircraft or approximately 5-6 months for a kit," wrote Jon. However, he added, "With the factory ramping up to three from one aircraft per month, the wait is expected to decrease."

If you want the current final price and options list, contact Jon via email (see below).

If you can't handle the long wait or don't want to send chunks of money overseas, another way exists to own a Shark and no building is required.

"Shark UL 025, our current demonstrator aircraft, is up for sale," wrote Jon. "It is ready for delivery in April 2018 and has all the options, has been superbly cared for and is fully up to date with the latest features." How much? "We are asking €150,000 (about $188,000) plus delivery charges. Please contact me (via

"The current factory backlog is between 18-24 months for a ready-to-fly aircraft or approximately 5-6 months for a kit," wrote Jon. However, he added, "With the factory ramping up to three from one aircraft per month, the wait is expected to decrease."

If you want the current final price and options list, contact Jon via email (see below).

If you can't handle the long wait or don't want to send chunks of money overseas, another way exists to own a Shark and no building is required.

"Shark UL 025, our current demonstrator aircraft, is up for sale," wrote Jon. "It is ready for delivery in April 2018 and has all the options, has been superbly cared for and is fully up to date with the latest features." How much? "We are asking €150,000 (about $188,000) plus delivery charges. Please contact me (via