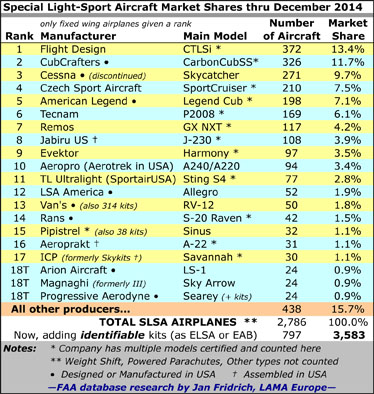

As spring approaches and with major airshows like Aero Friedrichshafen in Germany and Sun ‘n Fun in Florida about to trigger a new season of recreational flying, it is time for an annual update of Light-Sport Aircraft market shares. Our well-known “fleet” chart appears nearby; this table refers to all Special LSA registered with FAA in the United States since the first aircraft was accepted by FAA almost ten years ago (on April 5, 2005).

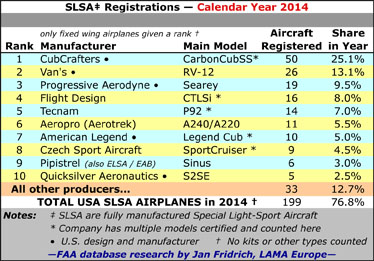

We again post our Calendar 2014 tally that shows the success only in that year as a means of drawing attention to those brands and models performing the best in the last twelve months. We remind you that these charts use as their source the FAA registration (N-number) database, that is then carefully studied and corrected to make the most reliable report possible. However, two points: (1) this report will still have some errors as the database on which we rely has some faulty information … though we believe this to be modest and, as noted, we correct it where we can; and, (2) aircraft registrations are not likely to be perfectly in sync with company records of sales for a variety of reasons. Other organizations ask companies to report deliveries and this, too, can have weaknesses, but we stand by our chart and the text report as the most factual details we can locate.

It is also worth noting that we only attempt to tally the Top-20 for ranking yet we draw your attention to the “All Other Producers” category that, by itself, represents the largest segment at 15.7% or about one in six aircraft. Further, we repeat the chart notes that these figures are only fixed-wing airplanes, which leaves out weight shift, powered parachutes, gliders, gyroplanes, and other worthy categories. We wish to include them but the information has proven too unreliable so in the interest of the most accuracy we can report, we regretfully omit these interesting aircraft.

As you can see from the nearby Calendar Year 2014 Report, CubCrafters again lead the field. They have done well for several years, however, the most notable movement of the year was from worldwide kit airplane manufacturer, Van’s Aircraft who works with Synergy Air to build ready-to-fly RV-12s. Seemingly overnight, Van’s appeared on our fleet chart and rocketed up to the #13 spot. Given the Van’s RV-series popularity and the existence of a large number of RV-12 kits, it seems clear Van’s will overtake several other producers in the years ahead and rise to near the top of the chart. More on that below.

Another up and comer, not even on last year’s fleet chart, is Progressive Aerodyne‘s Seayrey amphibian SLSA. Over many years this company has delivered more than 600 kit versions of its amphib. They won FAA audit approval to make SLSA models in late 2013 and went right to work filling demand. They’ve also won Chinese TDA approval and may break into that market, which many expect to explode. Clearly, Searey is leading the charge on LSA seaplanes even while some other interesting designs go through design and production exercises.

Regular top players such as Flight Design, Tecnam, Aerotrek, American Legend, Czech Sport Aircraft, and Pipistrel — some of the top and best-established brands — also fared well in 2014. Yet another appearing for the first time is Quicksilver Aeronautics. They won FAA audit approval to sell SLSA versions of their immensely popular kit aircraft in late 2014 and notched up their first Special LSA sales. The company can boast more than 15,000 kit aircraft flying.

A couple other honorable mentions go to Bristell (BRM Aero), which though new, is seeing good interest; Sling, which is rising and has a four seater kit to offer as well; and deluxe motorglider Phoenix. Their numbers were not big but these companies are ones to watch, we believe. Others holding up their brands include Evektor with its sleeker Harmony, Aeroprakt, and Jabiru (the last went through a manufacturing evolution and can offer even better pricing).

As we show an image of the handsome Van’s RV-12, we want to bring your attention to the small print alongside the Van’s rank. This company, known for their kit-making prowess — with more than 9,000 delivered and flying — has registered 314 kit versions of RV-12 for a total impact of 364 aircraft. Were we to combine these, they would vault to second place, ready to challenge longtime leader Flight Design for the largest LSA fleet in the country.

You may also note that our chart this year, for the first time, incorporates a number for “identifiable” kits, either as Experimental LSA (ELSA) or Experimental Amateur Built (EAB) models. The figure we felt we could correctly identify amounted to 797 airplanes (again … no weight shift, powered parachutes, or gyros), which represent an additional 29%. If we could gather reliable details on the WS, PPC, and gyro fleet, we might add another 25% or so. Based on the greater EAB community in the USA, kit LSA aircraft may begin to add significant numbers and if we can tally them accurately we will continue to reference them.

As we consider Searey’s strong performance in 2014, we again note that this is a company that cut its teeth with kit production. Over 600 have been sold and more than 500 are reportedly flying. Searey kit owners make a very strong and closeknit group of seaplane pilots with one of the largest amphibious populations anywhere.

As most readers will know, we can expect several other interesting seaplanes in the years ahead, from companies like Icon, MVP, and Vickers plus others. We are also aware of several other landplane LSA designs in the works and then will come electric aircraft (assuming FAA can find a way to invite these aircraft into the LSA fleet, which unfortunately is far from certain at this time).

Yet all we present above is only the American market. The USA may be the largest single market but the rest of the world invites comparison to the famous 80/20 rule. The USA has roughly 20% of all recreational aircraft but other countries are excellent markets for lower-cost, fuel efficient, and modern airplanes. When we add them all, using powerplant production as a measuring stick, we believe the total market for light aircraft exceeded 3,000 airplanes in 2014. With GAMA reporting 986 single engine piston general aviation aircraft for the same year, it is clear the light aircraft segment is substantially larger and for these aircraft, we believe the global future is bright.

Dan, I have Emeralds cp30 in my barn. The specs for the airplane are close to the LSA specs. Can I adjust the weight to fit and the correct prop to keep the air speed in parameters? It’s powered by a 100 horsepower Lycoming O-235. The Emeralds is a great airplane with no bad bones at all. I have just recovered the fuselage and now have a new sliding canopy now would be a great time to make some small changes. I plan on keeping it in the family and with the hope to make flying affordable for my son and grand kids Thanks for the Info

Ron Bassett, 4894e Chalmers Rd,

Monticello, IN 47960. 574-870-0898

Hi Ron: I do not believe I know this aircraft. Regardless, if you can make it fit the parameters of a LSA, yes, it could be operated by someone with a Sport Pilot certificate. It will remain in its current classification, which I imagine is Experimental Amateur Built. Good luck and blue skies!