On the “The Pulse of Aviation” (sign up here; it’s free) you can read my article that generated a large number of reader comments, some of which were quite colorful. •A technical glitch that took down the comments has been fixed and you can again peruse the many comments.•

GA News is published 26 times a year (subscribe here) and the article was just released in the print version. Online, a few responders apparently didn’t think much of LSA with some relying on outdated information. Several others were very supportive. That’s the value of free speech and comment sections that permit such open exchanges in the Internet Age.

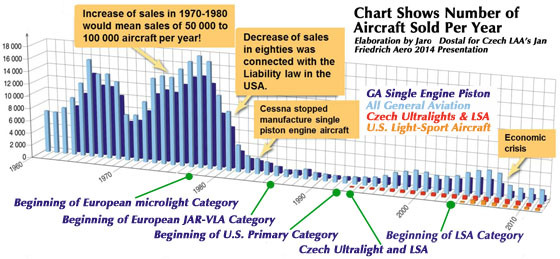

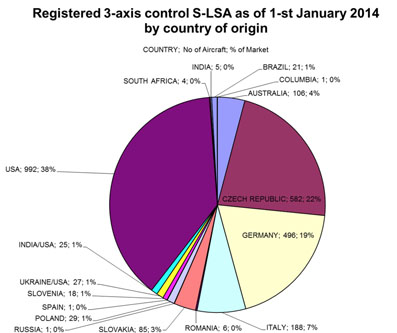

As detailed in the GA News article, I reported a market for very light aircraft and Light-Sport-type aircraft that substantially exceeds 3,000 units per year worldwide. Many American pilots remain unaware that the rest of the world flies a large number of light aircraft in the recreational or sporting categories. Overseas, these are commonly referred to as Ultralights or Microlights, Very Light Aircraft, or Light-Sport Aircraft. As you probably know Euro Ultralights are quite different from the U.S. version.

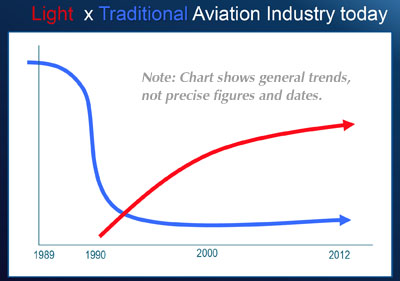

Most pilots in the USA focus on what are sometimes called “traditional” general aviation aircraft for which GAMA has reported delivery numbers for many years. Regular tallies of FAA’s N-number registration database show that in the USA the ratio is approximately 80/20, traditional GA airplanes to recreational aircraft. In Europe and most other countries that ratio is reversed with GA representing approximately 20% of all civilian aircraft with 80% recreational, according to people who try to assess such figures. This large percentage includes gliders (very big in Europe) but even omitting sailplanes the ratio is quite lopsided in favor of powered recreational aircraft. For most international pilots, GA aircraft are too expensive to buy and operate outside the USA.

These deliveries show Rotax is surely the most prolific producer of engines, but Continental, Jabiru, and Lycoming add powerplants used on recreational aircraft. Assuming their output is about 600 units per year — likely a conservative estimate and only considering production for the light aircraft sector — we calculate the UL/LSA/VLA sector probably reaches beyond 3,500 airframes per year.

Thus, when you include shipments to all countries, the light recreational aircraft market represents a large portion of all civilian, non-commercial airplanes being delivered.

With the American LSA and light kit market taking less than 1,000 of the Rotax’s annual 3,000-plus aircraft engine production, where are all the others going?

“Averaging over a long term our main engine market, including two- and four-stroke powerplants, Europe has around half of the share,” reported Mundigler. “The Americas, including North, Central, and South, has about a third of the total.”

“Growing markets are Russia and China with double digit increase rates in recent years,” said Mundigler.

Rotax engines run fine on auto gasoline or 100LL aviation fuel; operators can mix mogas and avgas in any proportion without concern. Jabiru also works fine with mogas and Continental has engine models that do as well. Around the world, aviation fuel is not widely available and, as American pilots know, avgas carries a substantial price premium though much less than the $10-12 per gallon in Europe.

From the figures used in this article, we can see the light, recreational aircraft industry is alive and well and makes up the largest unit volume share of all aircraft delivered each year.

Leave a Reply