Our annual review of LSA Market Share brings our updated fleet chart and a second chart showing prior-year registrations. While sales of new SLSA remains below par, the market appears to be experiencing spotty but regular recovery from earlier low points. The first half the year foretold a better recovery but the last half of the year stalled somewhat. Regardless, based on traffic to this website, LSA interest is higher than ever. For January 2013, ByDanJohnson.com set all-time records in Unique Visitors and all other measuring criteria Thank you for your support!

Our annual review of LSA Market Share brings our updated fleet chart and a second chart showing prior-year registrations. While sales of new SLSA remains below par, the market appears to be experiencing spotty but regular recovery from earlier low points. The first half the year foretold a better recovery but the last half of the year stalled somewhat. Regardless, based on traffic to this website, LSA interest is higher than ever. For January 2013, ByDanJohnson.com set all-time records in Unique Visitors and all other measuring criteria Thank you for your support!

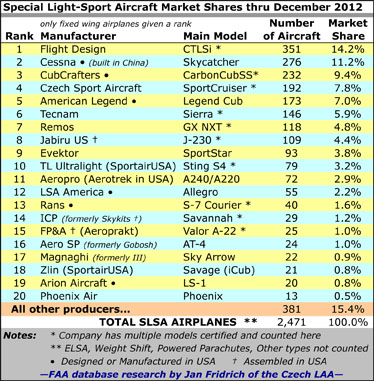

2012 Market Share report — Nearby, we present our standard market share numbers. Our original chart remains consistent, illustrating the “installed base,” or “fleet size.” Because we know many of you seek recent-year information we are repeating the Calendar Year chart that debuted last year.

For the second year in a row Cessna lead in 2012 with an impressive 94 registrations though this is down 30% from 134 in 2011. While Cessna looked to set a new record with 76 registrations (152 annualized) in the first half of 2012, their pace slowed sharply in the second half, adding only 23, perhaps a result of their announcement about switching to Primary Category as a means of entering the European market. The Wichita giant is singlehandedly restarting Primary Category with the first such application in nearly 20 years, a decision that may inspire other companies to go this route.

For the second year in a row Cessna lead in 2012 with an impressive 94 registrations though this is down 30% from 134 in 2011. While Cessna looked to set a new record with 76 registrations (152 annualized) in the first half of 2012, their pace slowed sharply in the second half, adding only 23, perhaps a result of their announcement about switching to Primary Category as a means of entering the European market. The Wichita giant is singlehandedly restarting Primary Category with the first such application in nearly 20 years, a decision that may inspire other companies to go this route.

Perhaps the most noteworthy story in 2012 registrations is an even better performance by CubCrafters. The Washington State company added 48 new registrations, up 33% from 36 in 2011. Company marketing boss John Whitish reported 52 SLSA sales, which prompts us to ask that you read the notice at the end of this article. Congratulations to CubCrafters, clearly a company to keep watching.

Perhaps the most noteworthy story in 2012 registrations is an even better performance by CubCrafters. The Washington State company added 48 new registrations, up 33% from 36 in 2011. Company marketing boss John Whitish reported 52 SLSA sales, which prompts us to ask that you read the notice at the end of this article. Congratulations to CubCrafters, clearly a company to keep watching.

We are watching a few companies not on our fleet chart. One new entry to the SLSA scene is Bristell, in a new partnership with fractional ownership provider, AAP. They join some other companies that have not been active long enough to get on the fleet chart, but nonetheless deserve attention. These companies include World Aircraft Co., which is bringing all production to their Paris, Tennessee facility. Breezer is now established on the Sun ‘n Fun campus and more is expected from them. Sky Arrow producer Magnaghi has new life and may resurge. Aero’s AT-4 (formerly known as Gobosh) is back with new representation. Just Aircraft got rave reviews on their SuperSTOL model and this mostly kit company is enjoying a solid run of business something like 100% kit producers Zenith Aircraft and Sonex. While mentioning kit builders (not on our SLSA list), we must include Van’s Aircraft, which has seen registration of 203 RV-12 kits.

This brief look at the LSA market is not complete. One observation is that the “All other producers” category is now the largest percentage, indicating small producers continue to develop sales. Some companies not reflected in our Top-20 and Top-10 charts may emerge into these lists in the future. Others that have been in the Top-20 but which are no longer producing new aircraft were omitted. However, all SLSA models are covered in our SPLOG reports and you may also examine our Featured Aircraft (right column of most pages) for more exciting Light-Sport Aircraft and other aircraft Sport Pilots can fly.

UPDATE 2/13/13: GAMA held a press conference today where they released their industry numbers. Get more on GAMA here, but this is where their figures relate to the Light-Sport market. Piston aircraft, singles and twins, suffered a minor drop, only 1.9% down; GAMA did list some LSA in their report but did not use them in summary tables. Turbines were up and GAMA added agricultural crop-spraying planes to their membership; many ag planes are turbine powered. Jets were down slightly more at minus 3.4%. Like the Light-Sport industry, GAMA is hoping for improvement in 2013 and they announced some interesting initiatives to this end.

Te escribo desde Colombia. Estoy interesado por el precio del Aerotrek A220.

[computer translation] I’m writing to you from Colombia. I’m interested in the price of the Aerotrek A220.

Ludwing: You are fortunate because the man who owns Aerotrek is married to a woman from Columbia so he may be able to help you more easily. Please contact Aerotrek directly. Good luck!

[traducción por computadora] Es afortunado porque el dueño de Aerotrek está casado con una mujer de Columbia, por lo que puede ayudarlo más fácilmente. Por favor, contacto con Aerotrek directamente. ¡Buena suerte!

Ludwing: [computer translation] You are fortunate because the man who owns Aerotrek is married to a woman from Columbia so he may be able to help you more easily. Please contact Aerotrek directly. Good luck!

[traducción por computadora] Es afortunado porque el dueño de Aerotrek está casado con una mujer de Columbia, por lo que puede ayudarlo más fácilmente. Por favor, en contacto con Aerotrek directamente. ¡Buena suerte!